- •Otto Group in Retailing (World)

- •SCOPE OF THE REPORT

- •INTRODUCTION

- •STRATEGIC EVALUATION COMPETITIVE POSITIONING GLOBAL RETAIL STRATEGY PRODUCT STRATEGY OPERATIONS

- •STRATEGIC EVALUATION

- •STRATEGIC EVALUATION

- •STRATEGIC EVALUATION

- •STRATEGIC EVALUATION COMPETITIVE POSITIONING GLOBAL RETAIL STRATEGY PRODUCT STRATEGY OPERATIONS

- •COMPETITIVE POSITIONING

- •COMPETITIVE POSITIONING

- •STRATEGIC EVALUATION COMPETITIVE POSITIONING GLOBAL RETAIL STRATEGY PRODUCT STRATEGY OPERATIONS

- •GLOBAL RETAIL STRATEGY

- •GLOBAL RETAIL STRATEGY

- •GLOBAL RETAIL STRATEGY

- •GLOBAL RETAIL STRATEGY

- •GLOBAL RETAIL STRATEGY

- •GLOBAL RETAIL STRATEGY

- •GLOBAL RETAIL STRATEGY

- •GLOBAL RETAIL STRATEGY

- •GLOBAL RETAIL STRATEGY

- •GLOBAL RETAIL STRATEGY

- •STRATEGIC EVALUATION COMPETITIVE POSITIONING GLOBAL RETAIL STRATEGY PRODUCT STRATEGY OPERATIONS

- •PRODUCT STRATEGY

- •PRODUCT STRATEGY

- •PRODUCT STRATEGY

- •PRODUCT STRATEGY

- •STRATEGIC EVALUATION COMPETITIVE POSITIONING GLOBAL RETAIL STRATEGY PRODUCT STRATEGY OPERATIONS

- •OPERATIONS

- •OPERATIONS

- •STRATEGIC EVALUATION COMPETITIVE POSITIONING GLOBAL RETAIL STRATEGY PRODUCT STRATEGY OPERATIONS

- •OPPORTUNITIES AND RECOMMENDATIONS

- •Experience more...

Otto Group in Retailing (World)

MARCH 2012

SCOPE OF THE REPORT

Scope

ll values expressed in this report are in US dollar terms, using a fixed exchange rate (2011).

011 figures are based on part-year estimates.

ll forecast data are expressed in constant terms; inflationary effects are discounted. Conversely, all historical data are expressed in current terms; inflationary effects are taken into account.

Disclaimer

Much of the information in this briefing is of a statistical nature and, while every attempt has been made to ensure accuracy and reliability, Euromonitor International cannot be held responsible for omissions or errors.

Figures in tables and analyses are calculated from unrounded data and may not sum. Analyses found in the briefings may not totally reflect the companies’ opinions, reader discretion is advised.

The Otto Group global company profile looks at Europe's second largest non-store retailer.

Founded in 1949, Otto has evolved from a handmade catalogue company to one of Europe's largest multi-channel retailers. The profile analyses the performance of Otto during 2011 both in its domestic market, Germany, and in international markets. The profile also examines product and geographic expansion opportunities within non-store channels that the Group could undertake in the short to medium term.

© Euromonitor International |

RETAILING: OTTO GROUP |

PASSPORT 2 |

INTRODUCTION

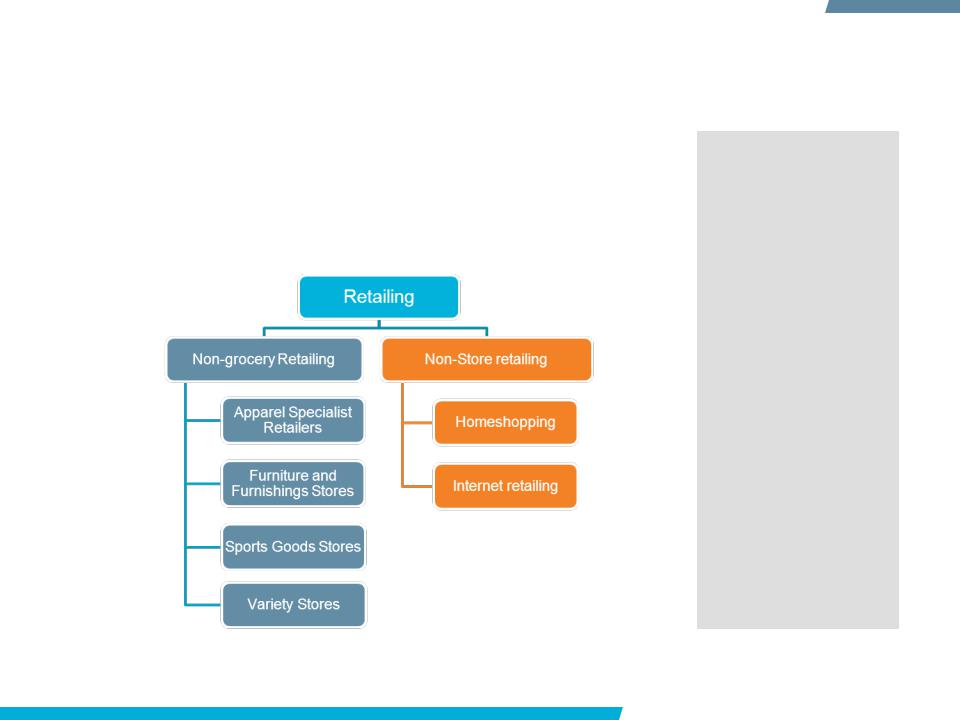

Definitions

Distance selling

In parts of this profile, the term ‘distance selling’ is used. This refers to the sale of products where the consumer is not present. It includes mail order sales, phone or telesales or physical and digital goods ordered over the internet. The numbers used in reference to this term are the aggregation of sales through the internet retailing and homeshopping channels.

© Euromonitor International |

RETAILING: OTTO GROUP |

PASSPORT 3 |

STRATEGIC EVALUATION COMPETITIVE POSITIONING GLOBAL RETAIL STRATEGY PRODUCT STRATEGY OPERATIONS

OPPORTUNITIES AND RECOMMENDATIONS

STRATEGIC EVALUATION

Key company facts

Otto Group |

|

|

Headquarters |

Hamburg, Germany |

|

Regional involvement |

Europe, North America, Asia |

|

Pacific |

||

Major channel |

Store-Based Retailing, |

|

Internet Retailing, |

||

involvement |

||

Homeshopping |

||

|

||

World retailing value |

0.1% (2010) – 0.1% (2011) |

|

share |

||

|

||

World retailing sales |

8.8% (2010) – 8.8% (2011) |

|

value growth |

||

|

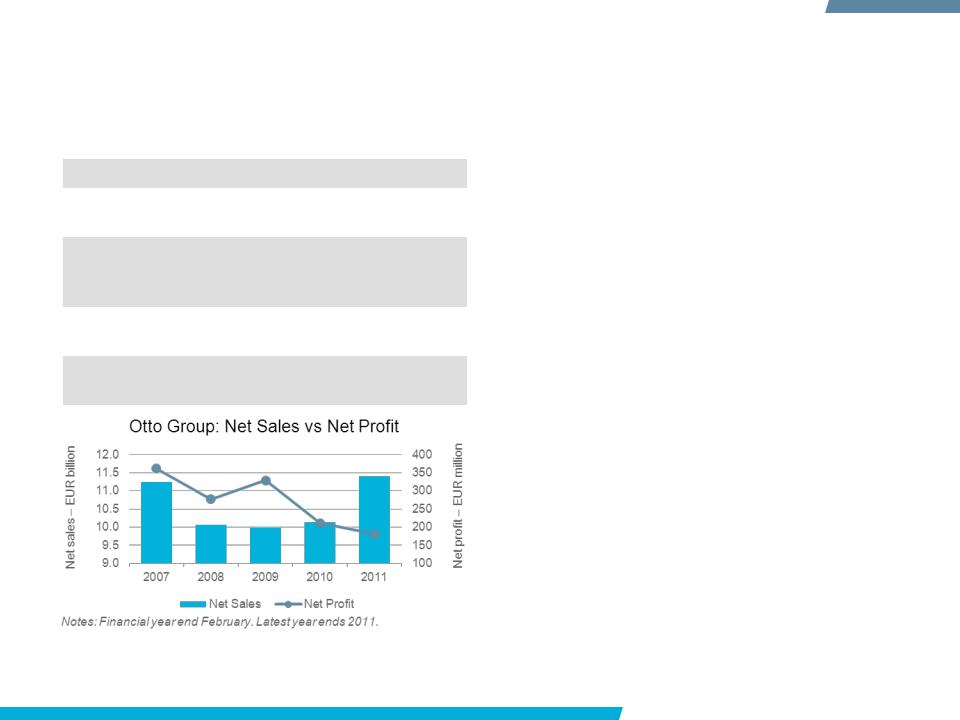

Otto Group to focus on core operations as profits continue to tumble

Despite a significant sales boost, 2011 yielded lower profits for the Otto Group as the non-store specialist continued to struggle to turn around its business.

The 12% increase in sales was attributed to organic growth as a result of improving conditions in several retail markets, most notably in Germany. However, inorganic growth from the acquisition of Quelle also aided 2011 sales growth.

Otto Group grew from a non-store retailer to a conglomerate with sizeable operations in consumer credit and logistics. Otto Group operates through 123 major subsidiaries including several brands that compete against each other in the same market.

In a bid to streamline its operations, Otto Group has vowed to return to its core business. Consequently, over time the company has sold a number of its non- retail subsidiaries. 2011 saw the completion of the sale of Cofidis group, the consumer credit side of the business. Otto Group is likely to continue to divest businesses not essential to retail.

© Euromonitor International |

RETAILING: OTTO GROUP |

PASSPORT 5 |

STRATEGIC EVALUATION

SWOT: Otto Group

STRENGTHS |

|

B2B2C business model |

Well-developed logistics |

drives traffic and growth |

business keeps costs low |

y allowing third party retailers to sell through its sites, Otto’s product portfolio has widened and helped it to become the second largest internet retailer in Western Europe.

OPPORTUNITIES

nitially started as an in- house delivery service in 1972, Hermes Europe grew to become a major delivery partner for third party retailers, lowering the central costs for Otto Group.

US and Japan prove key non-store markets

onsumers from US and Japan have the highest proportion of retail spend through non-store channels.

hese markets could be key geographic opportunities for Otto.

Shift to internet retailing to create cost savings

tto Group makes most of its retail revenue from internet sales. However, homeshopping is still an important channel for older consumers. Phasing out catalogues will lower Otto’s costs.

WEAKNESSES

Reliance on apparel products creates risks

tto Group’s product focus is on apparel. However, dependence on one product area is a risk given fluctuations in cotton prices. Beauty and personal care could complement apparel sales.

Multitude of brands prove expensive to maintain

tto Group operates under a wide variety of brand names which can be costly to maintain.

treamlining operations by consolidating brands could yield much needed cost savings.

THREATS |

|

Amazon’s growth in the |

Risk of cannibalisation |

European market |

looms for Otto Group |

n 2011, Amazon overtook Otto Group to become the biggest non-store retailer in Western Europe.

Continued growth by the US retailer could impact on Otto’s sales in future.

ith a vast number of apparel retail brands, some of Otto Group’s businesses could compete for the same consumer leading to a cannibalisation of sales and inefficiency.

© Euromonitor International |

RETAILING: OTTO GROUP |

PASSPORT 6 |

STRATEGIC EVALUATION

Key strategic objectives and challenges

Leveraging the Crate & Barrel store network to break into the US non-store retailing market

rate & Barrel operates 90 stores in the US and a further five in Canada.

ith such an extensive store network and supply chain, Otto could introduce further non-store retail brands into the North American market without the same costs associated with a market entry.

he key challenge for Otto will be standing out in a very saturated and competitive internet retailing market.

Expanding its product scope to cover other fast- growing non-grocery areas

C tto operates a number of non-store retail brands such as Bon Prix and Freemans. However, the majority of these focus almost exclusively on apparel as the primary W product area.

ith such strong penetration in the non-store market across

T

Europe, Otto has a number of opportunities to widen its product scope and cross-sell further non-grocery products such as beauty and personal care and homewares.

Improve profitability by continuing its disposal or divestment of non-core businesses

ince 2006, Otto has divested a 49% stake in OFT, a major travel agency chain in Germany, and 2011 saw the completion of the disposal of its former consumer credit supplier, Cofidis. The sale of the subsidiary helped Otto turn a profit in the financial year 2010/2011.

espite these disposals, Otto owns a number of horizontally-linked subsidiaries in 2012 which could be sold, including Hanseatic Bank.

Streamlining its brand portfolio by rationalising the number of apparel brands on offer

tto maintains separate websites for apparel retailers including Otto, Schwab and Bon Prix. Invariably, many of these retailers target the same audience leading to unnecessary competition.

hasing out some of the less successful brands and focusing on the stronger ones would create cost savings. This, in turn, could be used to invest in other areas of the business such as expanding its m-commerce offering.

© Euromonitor International |

RETAILING: OTTO GROUP |

PASSPORT 7 |

STRATEGIC EVALUATION COMPETITIVE POSITIONING GLOBAL RETAIL STRATEGY PRODUCT STRATEGY OPERATIONS

OPPORTUNITIES AND RECOMMENDATIONS

COMPETITIVE POSITIONING

Saturation in Europe and homeshopping holds Otto Group back

Strong sales growth from Otto Group but pure-play internet retailers outpace

With the exception of 2009, Otto Group’s year-on-year sales growth has ranged between 6% and 12%, far better than most large European retailers. However, given the growth of the internet retailing channel, Otto’s non-store performance has been below expectations and lags behind the likes of Amazon.

B

A C

A: Otto Group forms a joint venture, Baumarkt Direct, with store-based DIY retailer, Hagebau. The new operations take Otto into a new territory in terms of product mix and marks a clear move away from apparel.

B: Otto expands its internet presence with the acquisition of private shopping club, Limango. The acquisition takes Otto into new markets, including Turkey.

C: Milestone year for Amazon as it overtakes Otto to become the largest non-store retailer in Western Europe. Despite strong growth, reliance on the German market sees Otto lag Amazon’s sales growth.

© Euromonitor International |

RETAILING: OTTO GROUP |

PASSPORT 9 |

COMPETITIVE POSITIONING

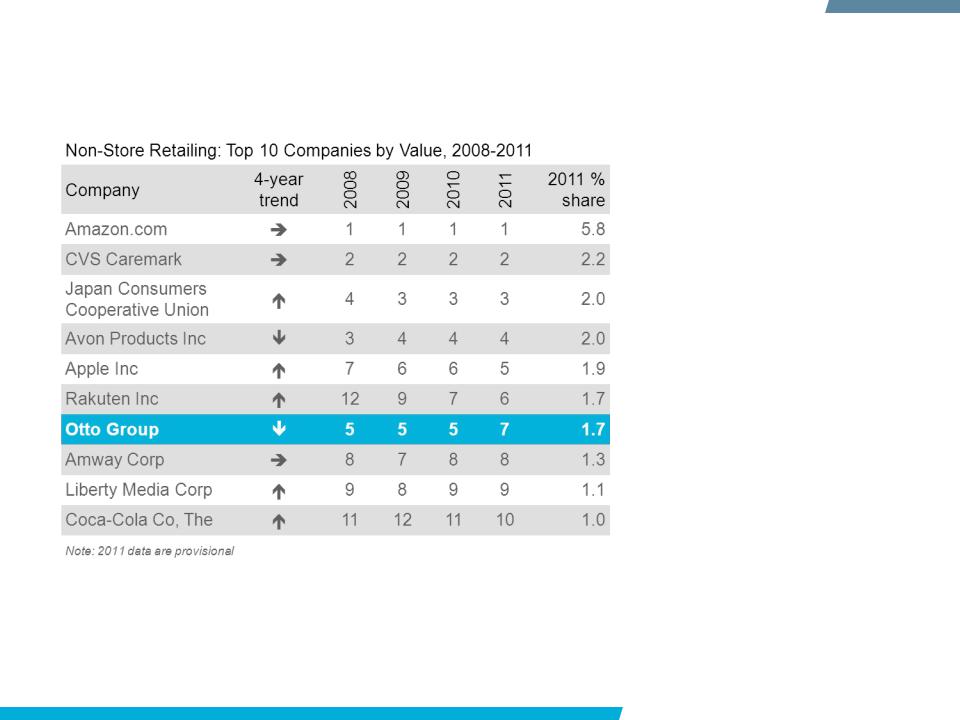

Otto drops down the list as rivals’ sales growth outstrips it

Homeshopping and market focus hamstring Otto’s growth

Despite overall sales growth of 9%, Otto slipped two places in 2011 to seventh.

One of the primary reasons behind Otto’s fall in the non-store rankings is that the company’s geographic focus is on mature markets which performed poorly in 2011, while it has significant operations in homeshopping, a much more saturated channel.

By comparison, many of its competitors have switched their attentions to emerging markets and concentrated their channel focus on internet retailing, which has proved to be a more successful strategy for growing sales.

© Euromonitor International |

RETAILING: OTTO GROUP |

PASSPORT 10 |