кейси для індивідуальної роботи 2014 н.р. / L'OrщalGroupein Beauty and Personal Care

.pdf

Opportunities in Key Categories |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

Expand retail coverage in Indonesia skin care

•Indonesia is an upcoming market, with skin care projected value growth exceeding that of the UK and matching that of Russia over the forecast period. Unilever has a 45% share of skin care in Indonesia, while L'Oréal ranks third, with nearly 6% in 2010. Unilever plans to further expand its personal care business in Asia Pacific and launched

Pond’s under different pricing tiers. Competition from

Unilever is formidable, but L'Oréal has opportunities to further expand its sales. L'Oréal’s key competitive edge is that it has a greater variety of skin care products – i.e. pharmaceutical and naturally/organically placed brands. In addition, it has been investing in research and development and has a range of sophisticated products.

•L'Oréal has already identified the potential in Indonesia’s skin care market. In 2010, it introduced sachets helping the company to increase its market share by 0.3 percentage points. However, to challenge the market leaders, L'Oréal needs to introduce its more sophisticated product range, as well as expand its retail coverage. It can consider introducing Youth Code – touted to be a breakthrough in skin care technology - La Roche-Posay, Vichy and The Body Shop in Indonesia. The pharmaceutical line is projected to grow above the regular retail channels and neither Unilever nor Procter & Gamble have any significant presence therein. Competition from multinationals is relatively low in the natural/organic segment, as well as being a fairly new market. It is a good time to introduce The Body Shop line in this market.

|

Indonesia - Retailing Channels Growth |

|||||||||||

|

|

|

Prospects 2010/2015 |

|||||||||

mn |

1,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

800 |

|

|

|

|

|

|

|

|

|

|

|

|

US$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indonesia – Skin Care Top Players by % Market Share 2010

Unilever |

|

|

Group |

|

|

45.0% |

Procter & |

|

|

||

|

Gamble |

|

|

Co, The |

|

|

11.9% |

|

Others |

L'Oréal |

|

Groupe |

||

37.6% |

||

5.5% |

||

|

21

Opportunities in Key Categories |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

Garnier has more growth potential in China

•China is set to lead the absolute value growth in skin care and L'Oréal is rightly tapping into this market having overtaken Procter & Gamble as the market leader in 2008. L'Oréal has established a regional R&D centre in China, to help it develop a better understanding of consumer needs in the market.

However, L'Oréal’s market leadership comes from controlling a number of brands including premium ones, while Procter & Gamble’s Olay continues to lead skin care benefitting from its long presence in the country with an infrastructure including 31 manufacturing plants facilitating deeper penetration there. The next step for L'Oréal is to knock Olay off the top spot. L'Oréal Paris gained 70 basis points in market share with Youth Code contributing to its growth, while Olay lost 90 basis points in market share.

•L'Oréal has more growth potential in this market – it can further popularise Garnier in mass skin care. Customising product types and format according to the market needs combines with heavy investment in marketing will help expand the brand’s domain.

•Heightened health awareness is developing greater scope for natural products. L'Oréal is taking advantage of this opportunity through its brand

Kiehl’s, but there are also opportunities for The Body

Shop, which has more accessible price points within the premium segment. In addition, the company can take advantage of the growth in the pharmacy channel through its brands La Roche-Posay and Vichy.

China: Top Three Skin Care

Manufacturers

|

20 |

|

|

|

|

|

share |

15 |

|

|

|

|

|

|

|

|

|

|

|

|

value |

10 |

|

|

|

|

|

5 |

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

|

L'Oréal Groupe |

|

|

Procter & Gamble Co, The |

||

|

Shiseido Co Ltd |

|

|

|

|

|

China: Retailing Growth Prospects by

Channel 2010/2015

|

100,000 |

|

mn |

80,000 |

|

|

||

US$ |

60,000 |

|

40,000 |

||

|

||

|

20,000 |

|

|

0 |

Supermarkets |

Internet retailing |

Hypermarkets |

Department stores |

Chemists/ pharmacies Other healthcare specialist retailers |

Direct selling |

Parapharmacies/ drugstores Beauty specialist retailers |

Discounters |

22

Opportunities in Key Categories |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

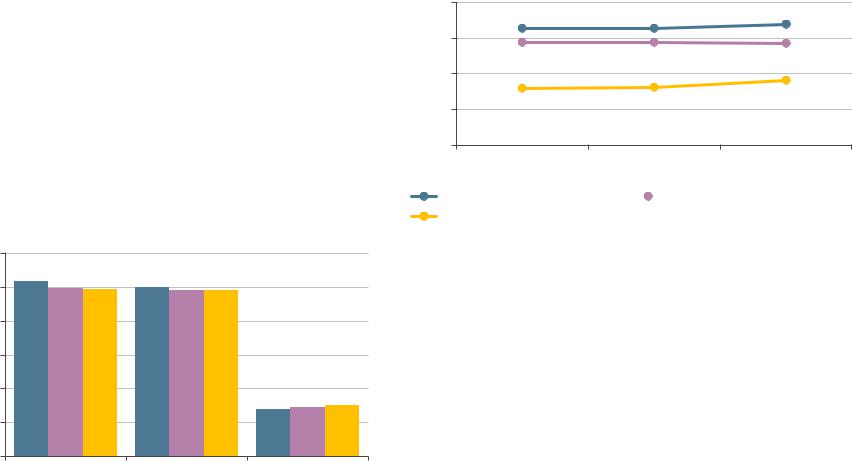

Internet to drive growth in Russia non-store retailing

•L'Oréal is the market leader in skin care in Russia and further increased its market share in

2010. The company’s new product range such as Genifique continued to perform well. In addition, L'Oréal is expanding its presence in the pharmaceutical channels through Vichy.

•If L'Oréal acquired Avon it would benefit it in skin care in Russia. Avon is the second leading player in the market and not too far behind L'Oréal – combined, L'Oréal’s share would double, increasing from approximately 11% to 20%. However, while L'Oréal experienced an increase in market share, both Avon and Oriflame saw a decline.

•Non-store retailing is projected to grow at over 9% CAGR (compound annual growth rate), but direct selling will not be a major part of it although direct selling is still projected to grow at a higher rate than retailing as a whole. Most of the non-store retailing growth will be driven by the internet – an area L'Oréal could consider to drive future growth in this market.

•Despite L'Oréal’s increase in market share, it needs to be wary of its rivals. Russia’s per capita expenditure on skin care is projected to increase by 6% CAGR compared to 2% CAGR for global per capita over 2010-2015, with competitors gearing up their activities in this market.

% value share

12

10

8

6

4

2

0

% CAGR 2010-2015

Russia: Top 3 Skin Care Manufacturers

L'Oréal Groupe

L'Oréal Groupe

Avon Products Inc

Avon Products Inc

Oriflame

Oriflame

Cosmetics SA

2008 |

2009 |

2010 |

Russia: Retailing Growth Prospects by Channel 2010-2015

16

14

12

10

8

6

4

2

0

23

Opportunities in Key Categories |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

Mass skin care to drive growth in the UK

•L'Oréal has performed well in skin care in the UK, increasing its share by 20 basis points in

2010. L'Oréal’s sales grew across all its brands, but L'Oréal Paris and Garnier also expanded their market shares – reflecting L'Oréal’s strategy to target the mass market. L'Oréal’s strategy has been to tap into the value for money trend, transferring more sophisticated product technology from premium to mass brands – an example of which is Youth Code. In addition, it has made a number of new launches under its mass ranges, helping it to drive its market share up. This is a strategy L'Oréal needs to continue with in this market to drive future growth.

•Growth in skin care in the UK is set to be driven by mass skin care. Sales of skin care overall are predicted to grow at a CAGR of 3.5% over 20102015, mainly driven by mass skin care with a projected CAGR of 3.7% versus a CAGR of 3.1% for premium skin care.

•This is further reflected in the growth forecast for retailing channels with discounters and hypermarkets outperforming health and beauty specialists as well as mixed retailers, which includes department stores.

•L'Oréal would thus benefit more by focusing on its mass range and could consider tapping into internet retailing, which is projected to be a key driver of retailing growth in the UK.

L'Oréal – UK Skin Care by Brand 2009/2010

|

|

Sales |

% value share |

|

|

2009 |

2010 |

2009 |

2010 |

L'Oréal Paris |

181.6 |

199.3 |

5.9 |

6.2 |

Lancôme |

98.6 |

103.0 |

3.2 |

3.2 |

Garnier |

88.9 |

95.9 |

2.9 |

3.0 |

The Body Shop |

29.3 |

29.5 |

1.0 |

0.9 |

Vichy |

24.7 |

25.2 |

0.8 |

0.8 |

La Roche-Posay |

13 |

13.5 |

0.4 |

0.4 |

UK - Retailing Growth Prospects by Channel 2010-2015

Absolute value growth |

2010/2015 US$ mn |

30,000 |

14 |

% CAGR 2010-2015 |

|

25,000 |

12 |

||||

20,000 |

10 |

||||

8 |

|||||

15,000 |

|||||

6 |

|||||

10,000 |

|||||

4 |

|||||

5,000 |

|||||

2 |

|||||

|

|||||

0 |

0 |

||||

-5,000 |

-2 |

||||

|

|

|

Absolute value growth 2010/2015 US$ mn

Absolute value growth 2010/2015 US$ mn  % CAGR 2010-2015

% CAGR 2010-2015

24

Opportunities in Key Categories |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

More growth opportunities for hair care

•L'Oréal ranks amongst the top three players in three of the countries projected to drive value growth in hair care. It ranks number one in the US, second in both Brazil and Mexico, number five in India and sixth in China.

•L'Oréal drove sales growth in all these markets through product innovations and marketing drives. The key question going forward is what are its growth scopes here.

•In the US it is the market leader, but needs to be wary of Procter & Gamble and Unilever gearing up their activities. The US will continue to be the largest market in the world and a small market share gain can translate into substantial value sales for a company. Unilever’s recent bid to take over Alberto

Culver gives it access to a wider brand variety particularly in the salon retail channel, which has performed well. Therefore, despite its market leading position, L'Oréal cannot afford to be complacent and needs to carry on with its marketing activities.

•L'Oréal has further growth opportunities in India, which is clearly led by Unilever, while other leading hair care companies are local players specialising in indigenous hair care products.

•In Mexico and China, L'Oréal stands to benefit from the growth in hair colourants. China, however, will pose a stronger challenge, with major multinationals competing in the market.

Hair Care - Top Five Markets by Absolute Value Growth & L'Oréal Share 2009-2015

|

12,000 |

|

|

|

|

|

10,000 |

|

|

|

|

mn |

8,000 |

|

|

|

|

6,000 |

|

|

|

|

|

US$ |

|

|

|

|

|

|

|

|

|

|

|

|

4,000 |

|

|

|

|

|

2,000 |

|

|

|

|

|

0 |

|

|

|

|

|

Brazil |

China |

India |

US |

Mexico |

Market size 2010

Market size 2010

Absolute value growth 2010/2015 US$ mn

Absolute value growth 2010/2015 US$ mn

% Market share 2009

% Market share 2009  % Market share 2010

% Market share 2010

L'Oréal - Hair Care Ranking 2010 |

|

|

Rank |

Brazil |

2 |

China |

6 |

India |

5 |

US |

1 |

Mexico |

2 |

30 |

|

|

25 |

share |

|

20 |

||

|

||

15 |

value |

|

10 |

||

% |

||

|

||

5 |

|

|

0 |

|

25

Opportunities in Key Categories |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

L'Oréal can see more growth on back of colourants in Mexico

•L'Oréal ranks second in hair care in Mexico. The company is present across a number of categories, but colourants accounts for a large proportion of its total hair care portfolio in the market.

•Colourants is set to lead value growth in hair care over the forecast period, placing L'Oréal in a strong position to take advantage of market growth.

•In shampoos, L'Oréal faces competition from Procter & Gamble and Colgate-Palmolive, but L'Oréal is a dedicated beauty company which gives it a competitive advantage particularly over Colgate-Palmolive. Product launches and a strong marketing drive could potentially see L'Oréal beat the competition in shampoos.

Mexico: Top 3 Players in Hair Care by Value Share 2006-2010

Procter & Gamble Co, The

Procter & Gamble Co, The

L'Oréal Groupe

L'Oréal Groupe

Colgate-Palmolive Co

Colgate-Palmolive Co

Others

Others

2006

2008

2010

US$ mn

Mexico: Absolute Growth Prospects in Hair Care by Category 2010/2015

250

200

150

100

50

0

value growth 2010/2015 |

US$ mn |

Absolute |

|

Hair Care Portfolio Breakdown 2010

600 |

|

|

|

|

|

|

|

|

|

Styling agents |

|

|

|

|

|

|

|

|

|

||

500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Shampoos |

|

|

|

|

|

|

|

|

|

|

||

400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Salon hair care |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Perms and |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

relaxants |

200 |

|

|

|

|

|

|

|

|

|

Conditioners |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||

100 |

|

|

|

|

|

|

|

|

|

Colourants |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

2-in-1 products |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

|

Colgate |

|

L'Oréal |

|

P&G |

|||||

|

|

|

|

|||||||

26

Opportunities in Key Categories |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

More scope for hair care growth in India

•L'Oréal held an almost 8% share in hair care in India in 2010 and has further scope for growth, primarily in shampoos, which will experience good growth. Unilever is the top player in shampoos, with a 47% value share in 2010, followed by Procter & Gamble with 22%. Unilever’s strength comes from its deep market penetration, but through product innovation and a strong marketing drive, L'Oréal should be able to beat its market rivals. It enjoys strong brand credibility, which gives it a competitive edge. Moreover, it has been working towards building its distributive network in the country. In addition to shampoos, L'Oréal could focus on colourants, which is dominated by the local players. The colourants market in India is more geared towards grey hair than fashion-related purposes as in Western markets. L'Oréal is in a strong position to beat its rivals by offering high-quality hair colourants with a more convenient application mode.

India: Top 3 Hair Care Players

by Value Sales 2010

|

400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mn |

300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

US$ |

200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

Unilever |

|

Dabur |

|

Marico |

||

|

|

|

|

|

||||

Conditioners

Conditioners  Shampoos

Shampoos  Styling agents

Styling agents

Absolute value growth 2010/2015 US$ mn

India: Absolute Growth Prospects in Hair

Care by Category 2010/2015

300

250

200

150

100

50

0

India: Top 3 Hair Care Players

2010

Unilever Group

Unilever Group

Dabur India Ltd

Dabur India Ltd

Marico Ltd

Marico Ltd

Others

Others

2006

2008

2010

27

Opportunities in Key Categories |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

L'Oréal well set to benefit from Brazil and US hair care

•L'Oréal ranks second in Brazil’s hair care market.

L'Oréal is well positioned to beat its rivals. Salon hair care is expected to record the second highest % CAGR growth over 2010-2015 and L'Oréal is well placed to benefit from this due to its wide exposure to salon hair care. This is a trend L'Oréal plans with nail care through its acquisition of Essie, but can implement a similar strategy in other categories across the world – including hair care in Brazil. In addition, L'Oréal can be expected to benefit from setting up a fifth laboratory in Brazil to determine the hair structure of the Brazilian consumers.

US: Top 3 Hair Care Manufacturers by Value Share 2008-2010

|

30 |

|

share |

25 |

|

20 |

||

|

||

value |

15 |

|

10 |

||

% |

||

|

||

|

5 |

|

|

0 |

L'Oréal Groupe |

|

Procter & |

Unilever Group |

||||

|

|

|

Gamble Co, The |

|

|||

|

|

2008 |

|

|

2009 |

|

2010 |

|

|

|

|||||

|

|

|

|||||

Brazil: Top 3 Hair Care Manufacturers by Value Share 2008-2010

share |

20 |

|

15 |

||

value% |

||

5 |

||

|

10 |

|

|

0 |

2008 |

2009 |

2010 |

|

Unilever Group |

|

L'Oréal Groupe |

|

|

|||

Procter & Gamble Co, The |

|

|

|

•L'Oréal’s share of hair care in the US has remained largely steady, with the L'Oréal Paris and Garnier brands. It launched a number of different products under its various brands which helped drive sales in 2010. It launched a sulphate-free line of shampoos, conditioners, an overnight repair treatment and a deep replenishing masque under L'Oréal EverStrong. Under Garnier, it launched a product that promises to eliminate frizz more effectively at less than salon cost. Under Redken, it introduced a new trend, borrowing skin care ingredients such as CoQ10 and antioxidants to combat density loss, dryness, dullness and other hair problems. With a large ethnic population in the US, L'Oréal could further benefit

by catering to their specific needs as well.

28

Opportunities in Key Categories |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

China less feasible growth option for L'Oréal in hair care

•Amongst the countries projected to lead growth in hair care, China is more likely to be a market where L'Oréal faces a stronger challenge. China’s hair care market is dominated by key multinationals – Procter & Gamble, Unilever and Beiersdorf. Procter & Gamble dominates with a 36% share, operating a number of different brands.

•Unilever has stated that China is a market it intends to increase its focus on - hair care and bath and shower are more likely categories as it has brand portfolios which can match those of its competitors.

•Beiersdorf entered the market in 2007 with the acquisition of a local hair care brand C-Bons, which allowed it to develop a better understanding of the market and achieve a stronger foothold in terms of distribution. Beiersdorf too has been citing China as a priority market.

•L'Oréal has been focusing on skin care, in which it has been successful in overtaking Procter & Gamble as the market leader. Projected value growth for skin care in China is much greater than that of hair care and L'Oréal will benefit more by focusing on skin care. L'Oréal, however, has been investing in salons and may consider introducing a salon range in the regular retail channels – giving consumers better value for money. This could potentially be a novel trend in the market and help beat its rivals.

•Colourants is expected to be the third leading category to drive value growth in hair care and given that L'Oréal is the leader, it stands to benefit from this growth opportunity.

China: Top 3 Hair Care Players

2006-2010

2006

2008

2010

Procter & Gamble Co, The

Procter & Gamble Co, The

Unilever Group

Unilever Group

Beiersdorf AG

Beiersdorf AG

Others

Others

29

Opportunities in Key Categories |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

Well positioned in prospective colour cosmetics markets

•L'Oréal is the global leader in colour cosmetics with a range of brands at different price points, giving it the flexibility to access a wider range of consumers. At the same time, all its brands enjoy strong credibility resulting from products based on sophisticated technology and marketing campaigns using well-known celebrities across the world. Consequently, the brands have developed a strong following and are regarded as high-quality products at accessible price points.

•L'Oréal has a clear understanding of colour cosmetics, helping it to launch the right kind of products to keep its sales growing. Its recent innovations have been longer stay lipsticks and foundations, as well as mascara leading to more prominent lashes. It is also tapping into nail care by offering professional range Essie, which it has recently acquired, in regular retail channels. During the economic downturn, L'Oréal’s strategy has been to tap into the value for money trend by mostly launching products based on new technology under its mass brands – Maybelline New York and L'Oréal Paris.

•Also, its colour cosmetics are designed according to the indigenous needs of the consumers – for example, multipurpose B.B Cream in Asia Pacific, which serves as a skin lightening, hydrating cream as well as a foundation.

•With the exception of India, L'Oréal gained market shares in the countries projected to lead value growth. In India, it is in a position to lead growth and can consider Iran for more growth potential.

Colour Cosmetics - Top Five Markets

by Absolute Value Growth & L'Oréal

Share 2009-2015

|

12,000 |

|

40 |

|

|

10,000 |

|

|

|

mn |

|

|

30 |

share |

8,000 |

|

|

||

|

|

|

|

|

US$ |

6,000 |

|

20 |

value |

4,000 |

|

|

||

|

|

|

% |

|

|

|

|

10 |

|

|

|

|

|

|

|

2,000 |

|

|

|

|

0 |

|

0 |

|

|

Brazil China US |

India |

Iran |

|

Market size 2010

Market size 2010

Absolute value growth 2010/2015 US$ mn

Absolute value growth 2010/2015 US$ mn

% Market share L'Oreal Colour Cosmetics 2009

% Market share L'Oreal Colour Cosmetics 2009  % Market share L'Oreal Colour Cosmetics 2010

% Market share L'Oreal Colour Cosmetics 2010

L'Oréal - Colour Cosmetics by Rank 2010

|

Rank |

|

|

Brazil |

3 |

|

|

China |

1 |

US |

1 |

|

|

India |

3 |

Iran |

14 |

30