кейси для індивідуальної роботи 2014 н.р. / L'OrщalGroupein Beauty and Personal Care

.pdf

L'Oréal Groupe in Beauty and

Personal Care (World)

June 2011

Scope of the Report |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

Scope

BEAUTY AND

PERSONAL CARE

Baby Care |

Bath and |

Deodorants |

Hair Care |

Colour |

Men's |

|

Shower |

Cosmetics |

Grooming |

||||

|

|

|

||||

Oral Care |

Fragrances |

Skin Care |

Depilatories |

Sun Care |

Premium |

|

Cosmetics |

||||||

|

|

|

|

|

Sets/kits

Disclaimer

Much of the information in this briefing is of a statistical nature and, while every attempt has been made to ensure accuracy and reliability, Euromonitor International cannot be held responsible for omissions or errors

Figures in tables and analyses are calculated from unrounded data and may not sum. Analyses found in the briefings may not totally reflect the companies’ opinions, reader discretion is advised

Learn More

To find out more about Euromonitor International's complete range of business intelligence on industries, countries and consumers please visit www.euromonitor.com or contact your local Euromonitor International office:

London +44 (0)20 7251 8024 |

Dubai +971 4 372 4363 |

Chicago +1 312 922 1115 |

Cape Town +27 21 552 0037 |

Singapore +65 6429 0590 |

Santiago +56 2 915 7200 |

Shanghai +86 21 6372 6288 |

Sydney +61 2 9275 8869 |

Vilnius +370 5 243 1577 |

Tokyo +81 3 5403 4790 |

2

|

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

Strategic Evaluation

Strategic Evaluation

Competitive Positioning

Competitive Positioning

Geographic and Category Opportunities

Geographic and Category Opportunities

Opportunities in Key Categories

Opportunities in Key Categories

Brand Strategy

Brand Strategy

Operations

Operations

Recommendations

Recommendations

3

Strategic Evaluation |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

Key company facts

L'Oréal Groupe

Headquarters

Regional involvement

Category involvement

World BPC share 2010

Value growth 2010 (US$ fixed exchange rate)

France

WE, EE, LA, AP, ME&A, AUS, NA

Skin care, Colour cosmetics, Hair care, Fragrances,

Men’s grooming, Sun care

9.8%

4.7%

|

|

|

L'Oréal Global BPC Sales vs Market |

|

|

||||||||||||||

rate) |

|

|

|

|

|

|

Share 2006-2010 |

|

|

|

|

|

|||||||

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

exchange |

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(fixedbn |

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

US$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2006 |

2007 |

|

|

2008 |

|

|

2009 |

|

|

2010 |

|

||||||||

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

Asia Pacific (less Japan) |

|

|

Japan |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

Eastern Europe2 |

|

|

Latin America |

|

|

|||||||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

|

North America |

|

|

Western Europe |

|

|

|||||||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

•L'Oréal’s market share in beauty and personal care

(BPC) remained largely stable in 2010, with 5% year-on- year growth in both fixed and year-on-year exchange rates. L'Oréal has performed well in 2010, returning to growth following a difficult economic period in 2009, although some markets in Western Europe proved to be challenging particularly for premium fragrances.

•L'Oréal’s key strategy involves reaching one billion new consumers primarily in developing markets. Steps to achieve this include the decentralisation of research and development centres, whilst also setting up regional factories. One of the objectives for L'Oréal was to make its products more accessible across the world. To this end, the company has used a combination of strategies depending on the regions - e.g large value packs in markets such as China and Brazil and sachets in Indonesia, India and Philippines. Going forward, L'Oréal has further growth opportunity, although it faces strong competition from other leading players, which control a significant share of these market. To L'Oréal’s advantage is its exclusive focus on beauty and the ability to offer sophisticated products within accessible price points.

•In the Western market, the company has done well by tapping into the value-seeking consumer trend and increasing its focus on sustainability, but it will benefit more by making greater use of interactive media channels and launching “green” cosmetics within the mass range.

4

Strategic Evaluation |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

2010 and 2011 L'Oréal returns to growth

Annual result 2010

•L'Oréal’s performance in the 2010 improved, as the economy began to show signs of recovery, although some parts of Europe continued to be challenging.

•In 2009, L'Oréal’s overall performance was affected by the premium division, which took the brunt of the economic downturn with a -0.4% decline in reported terms. The like-for-like growth was -9% for the division during the same period. In 2010, the premium division reported growth of 12% and in like-for-like terms, 7%. The premium division was boosted by new innovation such as Genifique and new product launches under Yves Saint Laurent and Armani. Some parts of Europe continued to be difficult for the division.

•L'Oréal has aptly tapped into the value-seeking consumer trend – offering sophisticated product technology within the mass range. This helped drive growth particularly in North America, where like-for- like sales increased 4.1% compared to -3.4 the year before. Like-for-like growth in Western Europe was 1.7% in 2010, up from -6.1% the year before.

First quarter 2011

•L'Oréal’s strong growth continued into Q1 2010, driven by all divisions and regions, although Western Europe continues to be somewhat challenging.

Revenue versus Profit 2006-2010

|

25,000 |

|

|

|

3,500 |

|

|

20,000 |

|

|

|

3,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2,500 |

|

€ mn |

15,000 |

|

|

|

2,000 |

€ mn |

|

|

|

|

|||

|

|

|

|

1,500 |

||

|

10,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,000 |

|

|

5,000 |

|

|

|

500 |

|

|

|

|

|

|

|

|

|

0 |

|

|

|

0 |

|

|

2006 |

2007 |

2008 |

2009 |

2010 |

|

|

Revenue |

Operating profit |

|

|||

Sales Growth Q1 2011

|

3,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2,500 |

|

|

|

|

1st Quarter 2010 |

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

1st Quarter 2011 |

|

€ mn |

2,000 |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

||

|

|

|

|

|

||

1,500 |

|

|

|

|

|

|

|

|

|

|

|

1,000

500

0

Professional Consumer |

Luxury |

Active |

Products Products Products Cosmetics

Note: The figures shown in both charts are the reported figures in the company’s financial documents

5

Strategic Evaluation |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

SWOT – L'Oréal Groupe

Dedicated focus on BPC |

|

Products across |

|

different pricing tiers |

|

|

|

|

|

|

|

•Unlike its key competitors,

L'Oréal’s sole portfolio comprises beauty and personal care, which means it has greater resources to invest in the development of more advanced technology.

•L'Oréal has a wide spectrum of brands that gives it the flexibility to market across different channels as well as to different income groups – an important element for emerging markets where consumers have limited affordability.

Not utilising The Body |

|

Website could be more |

Shop opportunity |

|

interactive |

|

|

|

•Despite the growing health and awareness trend, L'Oréal has not been able to make the most of The Body Shop, which not only is naturally positioned, but a pioneer in this field.

•Companies are increasingly looking to drive internet traffic by making their websites more interactive. L'Oréal’s website offers product information, but could benefit from being more interactive.

|

|

Strengths |

Weaknesses |

|

|||

|

|

Opportunities |

Threats |

|

|||

|

|

|

|

|

|

|

|

Naturally-positioned |

|

Value-seeking |

|

|

Growing competition in |

|

Political instability |

cosmetics |

|

consumers |

|

|

the emerging countries |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

•With a growing health and wellness trend, L'Oréal can benefit from naturallypositioned cosmetics. It is doing so with Kiehl’s, but can also use the opportunity to expand The Body Shop particularly in China, India and Brazil.

•L'Oréal is rightly tapping into the value-seeking consumer trend, offering sophisticated products in its mass range. This is more evident in developed markets, but this trend will help in emerging markets as well.

•L'Oréal is targeting emerging countries to drive growth, but so are other companies – thus intensifying competition in these markets.

•In 2009, L'Oréal opened subsidiaries in Egypt and Pakistan, but these countries have been politically volatile.

6

Strategic Evaluation |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

Strategic objectives and challenges

Doubling of consumer base |

Regional expansion |

|

|

L'Oréal's key objective is to increase its consumer base from 1 billion to 2 billion by 2020/2025. The company is targeting emerging markets, but there are challenges.

Competition is intensifying as other companies target the same. In addition, consumption pattern and distribution coverage are different to the Western markets. L'Oréal has made impressive strides in global expansion, customising its products to suit regional preferences, but coverage of modern retail infrastructure is limited. An issue to consider is if a potential acquisition of a direct seller can facilitate further expansion - in line with recent rumours of a potential Avon acquisition by L'Oréal.

In expanding global coverage, L'Oréal’s greater focus are the BRIMC markets, but does not confine itself to them, opening subsidiaries in Egypt and Pakistan in 2009. In total it has identified an additional15 growth markets including Philippines, Vietnam, Columbia, Argentina. According to L'Oréal, consumers in emerging countries on average consume 10 times fewer cosmetics than those in developed markets, but GDP in developing markets is increasing. By setting up operations now in Egypt and Pakistan, L'Oréal could potentially benefit from first-mover advantage. However, the challenge is that these markets can be politically volatile.

Category expansion

L'Oréal stated its plan to expand into new categories – deodorants, men's grooming and body care. L'Oréal made good progress in expanding its deodorant operation across the world, but faces mounting competition from Unilever. Beiersdorf too has been growing its deodorants business. L'Oréal introduced men’s grooming in Asia Pacific, which it continued to expand in 2010. Some men could potentially judge L'Oréal to be too feminine, but this is not so much a case in the Asian markets, and L'Oréal’s strong brand credibility can override these challenges.

Sustainable development

L'Oréal's sustainable development programme includes eco-responsible strategies and is ranked amongst the top100 most sustainable companies. In 2009, the company announced three environmental goals – to cut by half its greenhouse gas emissions, water consumption and waste generated in its factories and distribution centres. While L'Oréal has made good technological strides to help it meet its environmental goals, the next challenge is to manufacture products which are both naturally/ organically placed and effective. The company has good scope to make better use of its The Body Shop brand.

7

Strategic Evaluation |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

Detailed strategies to expand consumer base

Core strategy synopsis

Launch products with wider regional potential

Develop market infrastructure

Target younger consumers in emerging markets

Reach 1 billion new consumers by 2020

Reach one billion new consumers

•At the heart of L'Oréal’s strategies is to reach one billion new consumers by 2020, reaching out to young consumers whose beauty practices are at formative stages in the emerging markets.

•To L'Oréal’s advantage are its highly recognisable brands. Its growing distribution infrastructure is increasingly facilitating the sale of its brands in the emerging markets. In addition, it has set up regional research and development centres, customising its products to suit regional preferences. One of the challenges was to make its products more accessible to the lower income group in markets such as India, Philippines and Indonesia. In 2010, the company made greater use of sachets in these markets, thus making it accessible to a wider consumer group. For markets such as China and Brazil, L'Oréal offers large value packs as consumers are able to pay more in absolute terms but prefer to save on scale.

•Going forward, L'Oréal will be facing greater competitive challenges in the emerging markets as other companies target these markets to drive growth. A key issue to consider is if any form of acquisition can help facilitate its expansion.

•There have been rumours that L'Oréal is interested in acquiring Avon to help facilitate growth in emerging markets. While there are a few benefits to this potential acquisition, increased market coverage in emerging markets, particularly Brazil, a key challenge is that of integrating two different operating models, which can override any potential gain.

8

Strategic Evaluation |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

Key Points to consider in Avon Acquisition

Background:

•There have been rumours that L'Oréal may bid for Avon as this would develop L'Oréal’s presence in direct selling and help to further expand in markets such Latin America and Eastern Europe.

•The most significant challenge in an acquisition of this kind would be the integration of two different operating models, which could override any potential gain. For a price of US$ 19 billion, this endeavour could prove to be very risky and the investment is worthwhile only if the benefits far outweigh the costs.

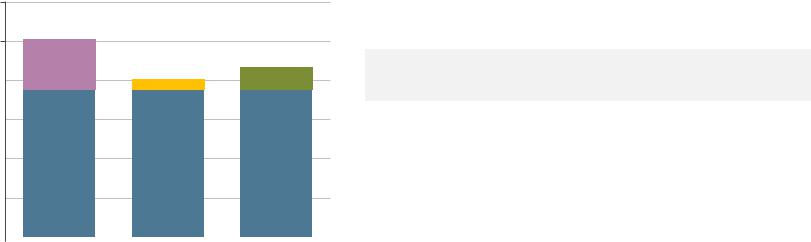

L'Oréal and Key Direct Seller

Combined Sales 2010

60,000

50,000

mn |

40,000 |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US$ |

30,000 |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

20,000 |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

10,000 |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

0 |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

2010 |

2010 |

2010 |

||||||||||

|

|

|

L'Oreal |

|

Avon |

|

|

Oriflame |

|

Natura |

|||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

||||||||

Key points:

•The key issue to consider is if L'Oréal needs to acquire a direct selling company to boost growth in emerging markets or can it grow organically.

•In terms of global year-on-year growth rate L'Oréal exceeded that of Avon, but other direct sellers such as Natura and Oriflame have outpaced L'Oréal in terms of year-on-year growth.

•This leads to the following issues –

•Did Avon outperform L'Oréal in any regional market

•If Natura or Oriflame can become potential targets for L'Oréal as these companies too can help L'Oréal develop presence in the direct retailing channels and at the same time cost less than Avon.

Comparison between L'Oréal and Key Direct

Sellers’ Global Growth Rates

% y-o-y growth rate % CAGR 2005-2010 2010

L'Oréal |

5 |

6.3 |

|

|

|

Avon |

4 |

6.9 |

|

|

|

Natura |

20 |

17.5 |

|

|

|

Oriflame |

7 |

16.6 |

|

|

|

9

Strategic Evaluation |

|

Beauty/Personal Care: L'Oréal Groupe |

|

© Euromonitor International |

|

|

|

|

|

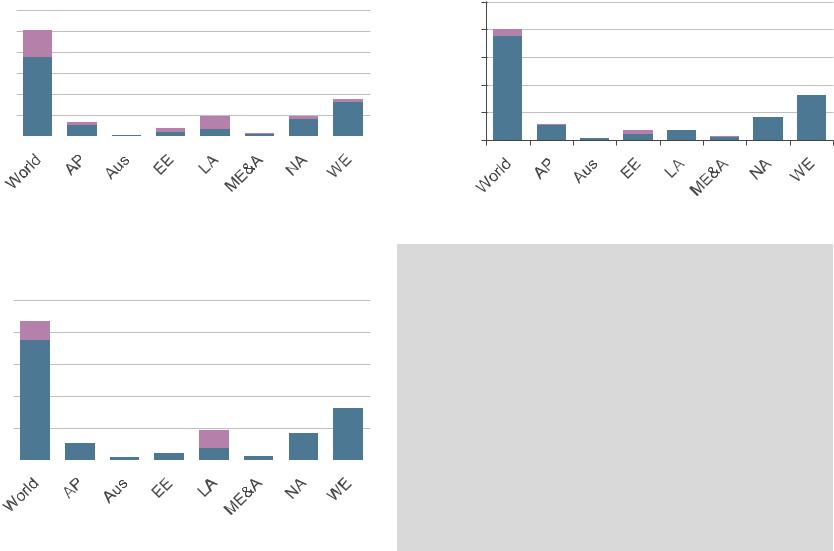

Potential regional impact of acquiring a direct seller

|

L'Oréal & Avon Combined Regional |

|||||||||||||||||

|

|

|

|

|

Sales 2010 |

|||||||||||||

|

60,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mn |

50,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

40,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

US$ |

30,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

L'Oreal

L'Oreal  Avon

Avon

|

L'Oréal & Natura Combined Sales 2010 |

|||||||||

|

50,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mn |

40,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

30,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

US$ |

|

|

|

|

|

|

|

|

|

|

20,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

10,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

L'Oreal

L'Oreal  Natura

Natura

L'Oréal & Avon Combined Sales 2010

|

50,000 |

|

US$mn |

40,000 |

|

30,000 |

||

|

||

|

20,000 |

|

|

10,000 |

|

|

0 |

L'Oreal

L'Oreal  Oriflame

Oriflame

Key Point:

•To consider the feasibility of a potential acquisition of Avon, Oriflame or Natura it is also necessary to determine the benefits L'Oréal will derive from such an acquisition.

•Avon will increase L'Oréal’s exposure globally with the largest sales boost coming from Latin America.

•Most of Natura’s operation is based in Latin America, thus giving L'Oréal a potential boost only in Latin America.

•Oriflame is mostly concentrated in Eastern Europe, thus helping L'Oréal lift its profile in the region.

•The next step is to compare L'Oréal’s growth rate

with these companies in their region of dominance.

10