- •APPLE INC IN CONSUMER ELECTRONICS (WORLD)

- •SCOPE OF THE REPORT

- •STRATEGIC EVALUATION COMPETITIVE POSITIONING MARKET ASSESSMENT CATEGORY OPPORTUNITIES BRAND STRATEGY OPERATIONS RECOMMENDATIONS

- •STRATEGIC EVALUATION

- •STRATEGIC EVALUATION

- •STRATEGIC EVALUATION

- •STRATEGIC EVALUATION

- •STRATEGIC EVALUATION COMPETITIVE POSITIONING MARKET ASSESSMENT CATEGORY OPPORTUNITIES BRAND STRATEGY OPERATIONS RECOMMENDATIONS

- •COMPETITIVE POSITIONING

- •COMPETITIVE POSITIONING

- •COMPETITIVE POSITIONING

- •COMPETITIVE POSITIONING

- •STRATEGIC EVALUATION COMPETITIVE POSITIONING MARKET ASSESSMENT CATEGORY OPPORTUNITIES BRAND STRATEGY OPERATIONS RECOMMENDATIONS

- •MARKET ASSESSMENT

- •MARKET ASSESSMENT

- •MARKET ASSESSMENT

- •STRATEGIC EVALUATION COMPETITIVE POSITIONING MARKET ASSESSMENT CATEGORY OPPORTUNITIES BRAND STRATEGY OPERATIONS RECOMMENDATIONS

- •CATEGORY OPPORTUNITIES

- •CATEGORY OPPORTUNITIES

- •CATEGORY OPPORTUNITIES

- •STRATEGIC EVALUATION COMPETITIVE POSITIONING MARKET ASSESSMENT CATEGORY OPPORTUNITIES BRAND STRATEGY OPERATIONS RECOMMENDATIONS

- •BRAND STRATEGY

- •BRAND STRATEGY

- •BRAND STRATEGY

- •STRATEGIC EVALUATION COMPETITIVE POSITIONING MARKET ASSESSMENT CATEGORY OPPORTUNITIES BRAND STRATEGY OPERATIONS RECOMMENDATIONS

- •OPERATIONS

- •STRATEGIC EVALUATION COMPETITIVE POSITIONING MARKET ASSESSMENT CATEGORY OPPORTUNITIES BRAND STRATEGY OPERATIONS RECOMMENDATIONS

- •RECOMMENDATIONS

- •RECOMMENDATIONS

- •REPORT DEFINITIONS

- •Experience more...

APPLE INC IN CONSUMER ELECTRONICS (WORLD)

December 2011

SCOPE OF THE REPORT

Scope

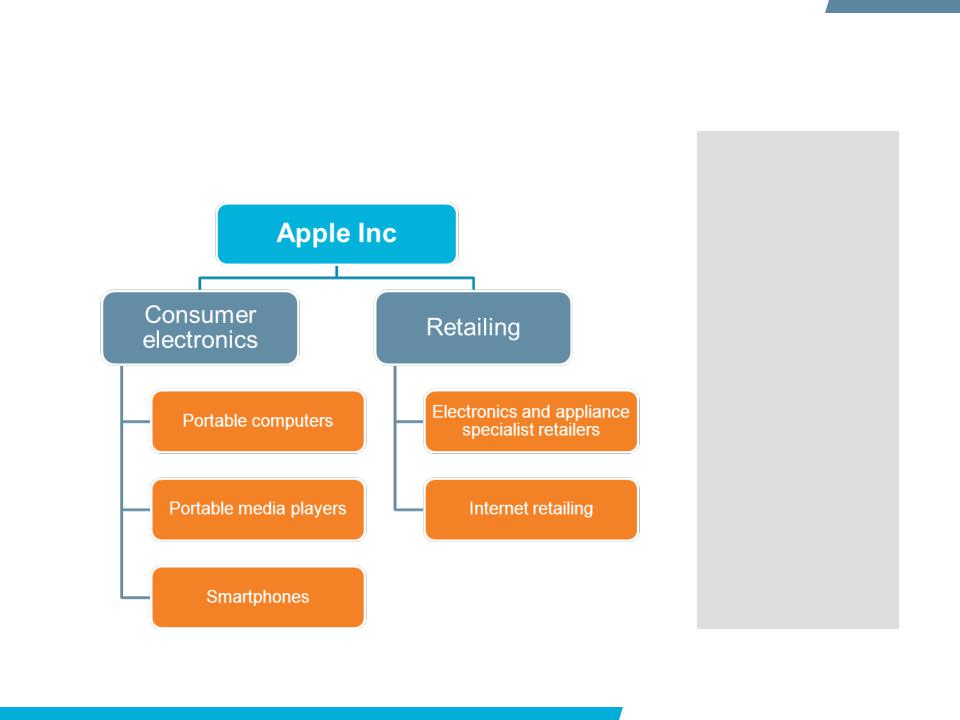

This profile of Apple Inc focuses on its operations in consumer electronics as well as its product distribution lines, and examines future opportunities and challenges for the company globally.

Disclaimer

Much of the information in this briefing is of a statistical nature and, while every attempt has been made to ensure accuracy and reliability, Euromonitor International cannot be held responsible for omissions or errors.

Figures in tables and analyses are calculated from unrounded data and may not sum. Analyses found in the briefings may not totally reflect the companies’ opinions, reader discretion is advised.

This profile of Apple Inc examines the company’s operations in consumer electronics and retailing, with a focus on forward looking analysis of its prospects in computers and portable consumer electronics. A brief overview of Apple Inc’s content retailing and operational specifics is provided to supplement the core analysis.

© Euromonitor International |

CONSUMER ELECTRONICS: APPLE INC |

PASSPORT 2 |

STRATEGIC EVALUATION COMPETITIVE POSITIONING MARKET ASSESSMENT CATEGORY OPPORTUNITIES BRAND STRATEGY OPERATIONS RECOMMENDATIONS

STRATEGIC EVALUATION

Key company facts

Apple Inc |

|

|

Headquarters |

Cupertino, CA |

|

Regional Involvement |

Worldwide |

|

Category Involvement |

Smartphones, computers, |

|

portable media players |

||

|

||

World smartphone |

16.1% |

|

share (2010) |

||

|

pple`s performance in 2010 improved significantly with sales increasing by 52%, to US$65,225 million. The main factor of the increase in growth was the continued success of the iPhone.

010 followed a more moderate performance in 2009, when the company was transitioning from sales of desktops, laptops and media players to focusing on the iPhone and iPad as its core products.

sia Pacific emerged as the fastest growth area for Apple with sales rising by 160%. However, growth was from a low base as the region was traditionally dominated by Japanese, Korean, and Taiwanese brands like Sony, Samsung and Acer.

n actual terms, Europe contributed most to growth, with sales rising by 58%. Japan grew faster at 75%. The Americas remained the most important market for Apple, with US$24.5 billion (excluding retail). The iPhone continued to be Apple’s strongest performer in FY2009; in actual value terms, it accounted for over 50% of Apple’s net sales growth, with sales rising by 93%.

© Euromonitor International |

CONSUMER ELECTRONICS: APPLE INC |

PASSPORT 4 |

STRATEGIC EVALUATION

Financial assessment

Quarterly Performance |

|

|

US$ million |

Q1 2011 |

Q1 2010 |

Net sales |

28,571 |

15,700 |

Operating profit |

9,379 |

4,234 |

Operating margin |

32.8% |

27% |

Source: Apple Inc |

|

|

he success of the iPhone 4 and iPad 2 models was instrumental in driving revenues and growing profitability in 2011.

side from revenue from hardware sales both products serve as important content delivery devices through which third party providers sell content and applications from which Apple Inc derives an increasing revenue stream.

n Q2 2011, Apple Inc introduced its iCloud cloud storage service, which allows users to store and access media via the internet on the company’s devices. The move follows similar product launches from companies like Amazon Inc.

% Y-o-Y |

FY 2010 |

FY 2009 |

2010 on 2009 |

||

Growth |

% growth |

||||

|

|

|

|||

82 |

|

65,225 |

42,905 |

52 |

|

122 |

|

14,013 |

8,235 |

70 |

|

+5.8pp |

|

21.5% |

19.2% |

+2.3pp |

|

Yearly Performance by Product Line |

T |

||||

|

|

|

|

||

US$ million |

|

2010 |

2009 |

2010 on 2009 |

|

|

|

|

|

% growth |

|

iPad |

|

4.948 |

n/a |

A |

|

|

n/m |

||||

iPhone |

|

25,179 |

13,033 |

93 |

|

Mac (total) |

|

17,479 |

13,859 |

26 |

|

Music (iTunes) |

4,948 |

4,036 |

I |

||

23 |

|||||

Peripherals |

|

1,814 |

1,475 |

13 |

|

Software |

|

2,573 |

2,411 |

7 |

|

iPod |

|

8,274 |

8,091 |

2 |

|

Source: Apple Inc |

|

|

|

|

|

© Euromonitor International |

CONSUMER ELECTRONICS: APPLE INC |

PASSPORT 5 |

STRATEGIC EVALUATION

SWOT: Apple Inc

STRENGTHS |

|

WEAKNESSES |

Strong brand image |

Cross-industry presence |

Narrow product portfolio Developing markets |

leek, easy-to-use products and a vast ecosystem of content and applications have made Apple a desirable brand in portable electronics and computers with exceptional brand loyalty.

pple is present in consumer electronics with a strong ecosystem of products and services in addition to the Apple retail operations, Apple Stores iOS App Store and iTunes Store.

pple Inc has been reliant on the iPhone and iPad to drive revenues, but while successful so far this strategy carries a significant risk of lost market share as growth shifts to new markets.

pple Inc has left itself under-exposed to key growth markets such as Brazil, India, and China largely due to the high price point of its core product ranges.

OPPORTUNITIES |

|

Economy range |

In-home entertainment |

o capitalise on opportunities in developing markets and late adopters in developed ones, Apple needs to develop low price ranges in computers and smartphones.

s integration of content on in-home and portable devices increases in importance, the company needs a stronger presence in in-home electronics, than Apple TV.

THREATS

Hardware price erosion

n the increasingly crowded smartphone and tablet markets, Apple Inc’s main competitors are quickly cutting prices and accelerating price erosion.

Lack of IP in telecommunications

pple Inc started out as a computer manufacturer which resulted in a very narrow IP portfolio in telecommunications bringing about numerous law suits.

© Euromonitor International |

CONSUMER ELECTRONICS: APPLE INC |

PASSPORT 6 |

STRATEGIC EVALUATION

Key strategic objectives and challenges

Expanded price range |

In-home electronics |

Cloud-based services |

n order to continue growing Apple will need to increase its presence in emerging markets, which in turn makes it less dependent on the US market.

t is taking steps in the right direction, with Asia Pacific sales rising by 160% in FY2010. Although impressive, the growth is from a low base and the region still only accounts for 15% of sales.

ales of the iPhone were the main component of the strong growth, but having exhausted demand from early adopters and wealthier consumers, Apple Inc needs to create an affordable smartphone to gain access to a vast base of consumers who use pre-paid mobile service.

n the developed world, Apple Inc must work to develop a presence in in-home consumer electronics. This is particularly important as consumers want a platform that allows them to easily access their content on a variety of in- home electronics, computers, and portable devices. While Apple Inc has been successful in both computers and smartphones it has not been able to make significant inroads into in-home electronics. This makes it vulnerable to competition from Google Inc whose Android 4.0 platform will likely be installed on internet-enabled TVs and set- top-boxes in addition to tablets and smartphones.

key component of creating a unified experience across different types of devices is cloud computing. Apple Inc is very well positioned with all the necessary ground work in place: wide install- base of iOS in computers and portable consumer electronics, strong services portfolio and a wide distribution network.

he iCloud service is a follow-on to Apple Inc’s previous cloud services iTools and MobileMe, and allows users to store and download data to their devices.

crucial missing component is in- home entertainment as at the time of writing the service was not available on internet-enabled televisions.

© Euromonitor International |

CONSUMER ELECTRONICS: APPLE INC |

PASSPORT 7 |

STRATEGIC EVALUATION COMPETITIVE POSITIONING MARKET ASSESSMENT CATEGORY OPPORTUNITIES BRAND STRATEGY OPERATIONS RECOMMENDATIONS

COMPETITIVE POSITIONING

Changing the product mix paves way to current success

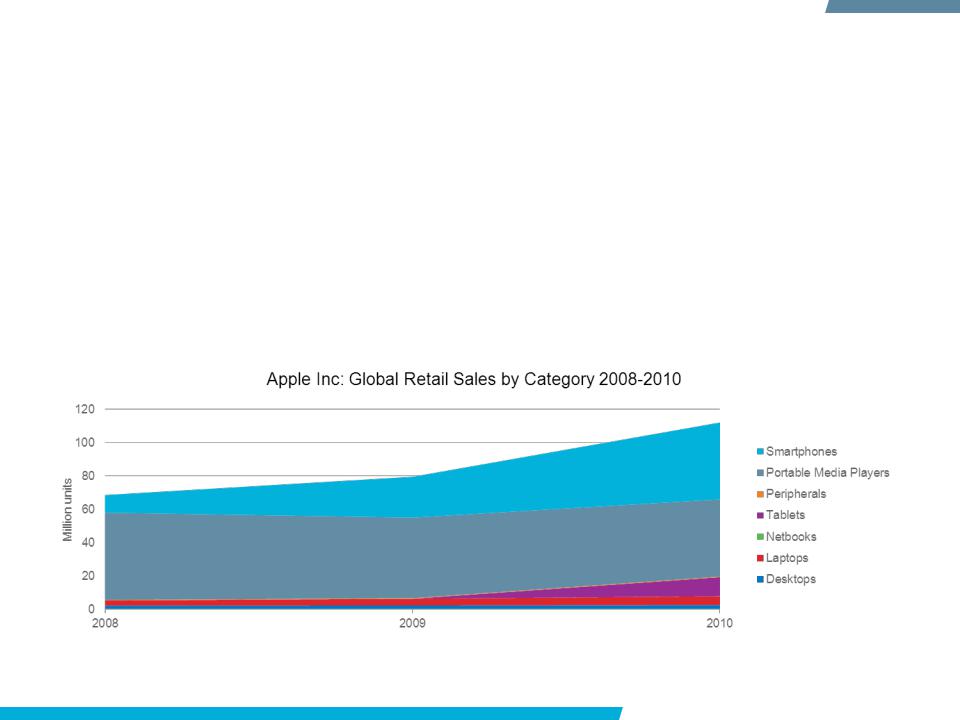

pple Inc’s line of iPod music players was instrumental in bringing it out of obscurity that it found itself in in the late 1990s and early 2000s. Hoping to build on the success of the media players Apple Inc released the iPhone in 2007, which was a significant departure from the smartphones of the time. The key difference was that the iPhone was media and consumer centric, while smartphones running on BlackBerry, Windows and Palm OS were mainly tailored for productivity-related tasks and the corporate customer.

his departure proved to be a successful gamble and the iPhone along with the iOS App Store emerged as key revenue growth drivers as demand for computers and media players stagnated since 2008. Demand for the iPhone has increased with every refresh cycle, and in 2010 Apple Inc released the iPad which has enjoyed a virtual monopoly through most of 2010 and into 2011 when Samsung Corp and Motorola Mobility Inc among others released competing products.

© Euromonitor International |

CONSUMER ELECTRONICS: APPLE INC |

PASSPORT 9 |

COMPETITIVE POSITIONING

Apple Inc has limited penetration within desktops and laptops

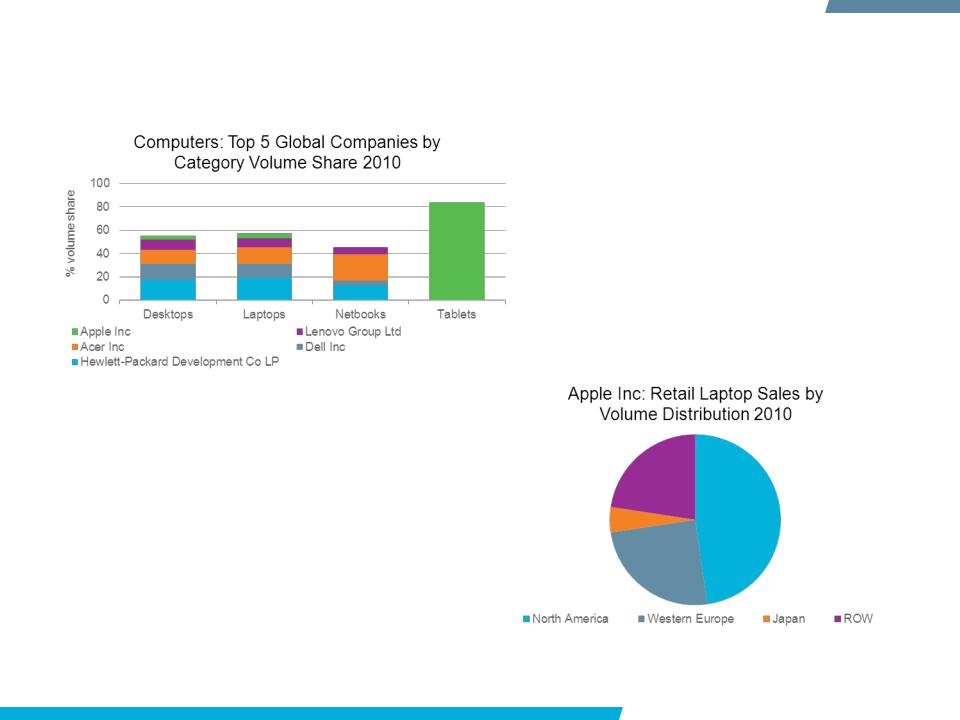

emand for Mac computers is mostly confined to the developed markets, with nearly half of 2010 laptop volume sales accounted for by North America.

lthough the brand is widely known, its computers are not price competitive, which makes penetrating mass markets in developing countries very difficult.

similar pattern has been observed in the sales of the iPad with 74% of iPad volume sales accounted for by North America. The iPad distribution picture in 2010 is heavily skewed by the fact that the iPad was launched much earlier in the US, with a global roll-out lasting through 2010.

pple Inc remained far behind it main competitors in computers, in desktops and laptops, and had a negligible presence in netbooks in 2010. Although Mac computers have gained popularity they remain priced higher than most of the Windows-based competition with a narrower software portfolio and therefore remains a niche brand.

he situation is reversed in tablets, where Apple Inc operated as a virtual monopoly through most of 2010 as competing products did not enter the market until late 2010 and early 2011.

D

A

A

© Euromonitor International |

CONSUMER ELECTRONICS: APPLE INC |

PASSPORT 10 |