Content

Introduction

Initial Data

Construction of econometric model

Testing the econometric model

F-test

T-test

Goldfeld-Quandt test

Durbin-Watson test

Testing new econometric model (data is divided by the variance of the disturbance term)

Adequacy of the model

Conclusion

Introduction

To understand, what I am going to do in this creative work, it is better to start with the definition of the term “econometrics”. Econometrics consists of the application of mathematical statistics to economic data to lend empirical support to the models constructed by mathematical economics and to obtain numerical results.

Econometrics may be defined as the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference. Any work should have the aim. The main purpose of mine is rather simple: I’m planning to construct the econometric model, which will meet the requirements of estimations of b0 and b1 and, of course, after all performed calculations and conclusions it should even remotely resemble on models which are implemented in practice.

So, let me say a few words, including Keynes point of view, about my econometric model that I will analyze and why I chose it.

Consumption function or propensity to consume is first and important component of effective demand. Effective demand represents the actual expenditure on consumption and investment at any equilibrium level of employment. This shows the total demand for goods and services in the economy.

The concept of consumption function is illustrated by Keynes with the heading, Keynes Psychological Law of Consumption. The concept of consumption function in general theory is based on the psychological tendency with regard to consumption.

According to Keynes, the volume of consumption depends upon the size of income. There is a stable functional relationship between total income and consumption, this relationship is called Propensity to Consume or Consumption function, and Shown as: C = f(Y) It shows there is a functional relationship between the total consumption and total income.

Thus, the propensity to consume refers to the actual expenditure on consumption at various levels of income. It demonstrates that when income increases, consumption also increases but not to the same extent as the increase in income.

According to Keynes: ³The psychology of the community is such that when aggregate real income is increased, aggregate consumption is increased, but not by so much as income´

Initial Data

Before construction and analyzing the model we need initial data that will help us. So, if we want to analyze model on the example of USA, then we go to U.S. Department of Commerce Bureau of Economic Analysis: http://www.bea.gov/ and search the information we need: http://www.bea.gov/national/xls/tab107.xls. I took data from 1991 up to 2010.

Year |

Net national disposable income |

Final consumption expenditures |

1991 |

5 222 800 000 000 |

5 004 000 000 000 |

1992 |

5 475 200 000 000 |

5 291 900 000 000 |

1993 |

5 739 400 000 000 |

5 555 600 000 000 |

1994 |

6 135 200 000 000 |

5 852 100 000 000 |

1995 |

6 478 300 000 000 |

6 117 800 000 000 |

1996 |

6 882 200 000 000 |

6 439 800 000 000 |

1997 |

7 354 500 000 000 |

6 776 000 000 000 |

1998 |

7 815 600 000 000 |

7 165 900 000 000 |

1999 |

8 300 300 000 000 |

7 673 000 000 000 |

2000 |

8 872 800 000 000 |

8 244 100 000 000 |

2001 |

9 112 600 000 000 |

8 661 500 000 000 |

2002 |

9 335 000 000 000 |

9 072 400 000 000 |

2003 |

9 759 500 000 000 |

9 558 700 000 000 |

2004 |

10 436 900 000 000 |

10 133 000 000 000 |

2005 |

11 158 900 000 000 |

10 784 900 000 000 |

2006 |

11 929 700 000 000 |

11 400 900 000 000 |

2007 |

12 270 200 000 000 |

11 998 100 000 000 |

2008 |

12 470 600 000 000 |

12 435 300 000 000 |

2009 |

12 009 400 000 000 |

12 299 400 000 000 |

2010 |

12 688 500 000 000 |

12 768 300 000 000 |

Construction of econometric model

The second step after data collected is construction the structural form of the model.

We have linear model.

Then, we can start estimating our model by using Excel’s useful option pack for data analysis, where we can find regression option.

The specification of the estimated model is:

The results of the regression statistics are shown in the Table 1 containing:

Multiple R – correlation coefficient of R;

R2 - coefficient of determination R2;

Adjusted R2

Standard error

Observations

Table 1:

Regression Statistics |

|

Multiple R |

0,995963339 |

R Square |

0,991942973 |

Adjusted R Square |

0,99146903 |

Standard Error |

231927041853,95 |

Observations |

19 |

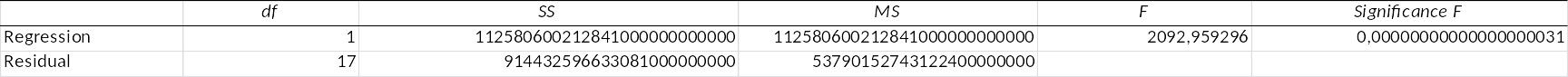

Table 2 contains the results of the dispersion analysis which is used for the control of R2 significance:

df column – the number of degrees of freedom. For Regression row, the number of the degrees of freedom is equal to the number of factor indications of the regression equation; for Residuals row, this number equals the number of observations minus the number of variables in the regression equation (m+1).

SS column – the sum of squared errors. For the Regression row this is the sum of squared deviations of theoretical data from the average - RSS; for the Residuals row this is the sum of squared deviations of empirical data from the theoretical – ESS.

MS column is calculated as SS/df.

F column is the calculated value of Fisher’s criterion.

F significance is the value of significance corresponding to the calculated value of F.

Table 2:

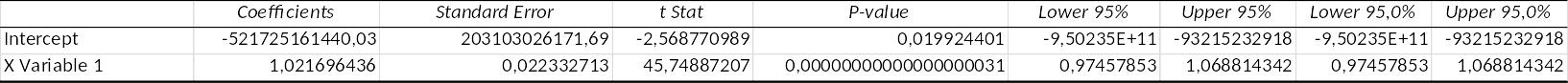

Table 3 contains the values of regression coefficients bi and their statistical estimations. The columns have the following interpretation:

Coefficients – the values of bi coefficients;

Standard error - Sbi standard errors of the coefficients bi;

t-statistics – the values of t-criterion calculated as bi/Sbi;

P-value – the levels of significance corresponding to the calculated value of t-statistics;

Lower 95% and upper 95% - lower and upper bounds of confidence intervals for the regression coefficients bi.

Table 3:

Testing the econometric model

In order to check whether our model is appropriate, good or bad, we must make some tests.

R Square is almost 1 => as the value of R square lies between 0 and 1 and is closer to 1, then our model is well explained and our regressors are chosen correctly and they explain regressants well enough.

F-test

Femp > Fcrit => R square formed not under the influence of random factors. Significance F < 0.05 => Model has a good explanatory ability.

T-Test

|

Coefficients |

Standard Error |

t Stat |

Intercept |

-521725161440,03 |

203103026171,69 |

-2,568770989 |

X Variable 1 |

1,021696436 |

0,022332713 |

45,74887207 |

Tcrit is equal to 2,10981557783332 . Absolute values of t Stat of β1 and β2 > tcrit, then our coefficients are significant.