- •In Partial Fulfillment of the Requirements

- •Chapter ----1

- •Introduction........................................................................................................09

- •Chapter----2

- •Chapter----3

- •Chapter ---------4

- •Influence the marble cluster in Afghanistan.......................................................13

- •Integration of suppliers in the actual marble business........................................17

- •Importance of marble industry to the block suppliers.........................................17

- •Chapter ---------5

- •Acknowledgment

- •General introduction to marbles

- •To investigate the current approach to the afghan marbles productivity:

- •To understanding the current literature of the afghan marble industry:

- •Overview to afghan domestic marbles product by provinces percentage

- •The five year projection of Afghans marbles industry

- •An overview of world marbles industry

- •The regional market

- •Afghanistan Marble and Granite survey by usaid

- •Amgpa(Afghanistan marbles processor association )

- •Recommendations:

- •Marble companies:

- •Market structure

- •Market opportunity

- •Ballistic brown marbles slab brecciate brown marbles slab

- •Demand in Local and Foreign Markets

- •Problems question

- •The Market and the Actual Production:

- •Recommendations:

- •Role of government

- •Factors of production :

- •Role of Private Sector

- •Role of donors

- •The method(s) used for analyzing the information:

- •The analysis:

- •Swot analysis

- •The national demand for Afghanistan

- •Factor conditions:

- •Demand conditions:

- •Related and Supporting Industries Advantages:

- •Related and Supporting Industries Disadvantages:

- •Context for Firm Strategy, Structure and Rivalry Advantages:

- •Context for Firm Strategy, Structure and Rivalry Disadvantages:

- •Influence the marble cluster in Afghanistan:

- •Second Afghanistan International Marble Conference

- •New Marble-Processing Facility Inaugurated at Marble Conference Opening

- •Websites

- •Appendix

- •Bibliography

- •I | Page

Demand conditions:

100% of processed marble is sold and consumed in the domestic market for local

construction. The nature of demand inside the country is not so complicated. The

finished products are organized around tiles for construction in different sizes. Size is an important factor in tiles. Unless consumers order for an unusual size, the standard sizes for tiles in the Afghan domestic market are limited to the followings:

a) Square tile: 30 cm x 30 cm x 1 cm and 30 cm x 30 cm x 2 cm;

b) Rectangular tile: 15 cm x 60 cm x 1 cm and 15 cm x 30 cm x 1 cm;

c)

Rectangular tile big size: 30 cm x 120 cm x 2 cm and 60 cm x 120 cm

to 250 cm x 2cm. The problem is that not all of the volume that is

quarried is processed in the country. A big portion of quarried

marble is shipped to the neighbor country, Pakistan for processing

purposes; much of this shipping happens illegally. These are often

re-imported as higher value-added polished marble product (Mitchell,

2008). The fact that continuous shipments of unprocessed marble to

Pakistan is happening and many European and other foreign buyers are

asking for Afghan marble indicate a strong export potential. However,

what is processed by the domestic processors, are not acceptable for

the international buyers in terms of quality of the finished

products. This partially explains that the nature of foreign markets

for marble seems to be more complicated than the domestic market.

Afghan processors cannot meet the standards of foreign markets in

terms of quality that comes out of value adding activities such as

polishing and finishing. The reason for low quality finished

goods/products is influenced by several factors such as lack of

technical knowledge, lack of standard and modern equipments and the

machineries, lack of energy resources, etc. The other important

challenge in demand conditions that exists, is lack of understanding

of the requirements of the international buyers. What helps the

Afghan producers in this area is to know marketing techniques in one

hand and on the other, be equipped with up to date knowledge about

the world markets and the nature of their demand and continue to meet

those demands/standards. Context

of firm strategy, structure and rivalry: In terms of legislation, the

minerals law of Afghanistan exists that governs the “the ownership,

control, prospecting, exploration, exploitation, extraction,

concentration, processing, transformation, transportation, marketing,

sale and export of mineral substances in the territory of

Afghanistan” (Minerals Law of Afghanistan, 2005). The law supports

development of mineral activities “through or in association with

the private sector,” which provides the opportunity for the marble

private companies to invest in the industry. Based on this law, clear

procedures exist that outlines the duties and responsibilities of the

Ministry of Mines and Minerals in regard to the minerals including

marble. In addition to the Minerals Law, there exists the

“Partnership Law of Afghanistan” that facilitates and “regulates

the affairs related to activities and creation of Partnerships”

between the private sector and the government of Afghanistan.

Literally there is a will to develop the sector through the private

sector, but actually when it comes to the real world, the practices

are not that promising. First of all, the ministry’s capacity is

limited in terms of initiating policies, strategies and tactics that

could further facilitate and enforce development of the sector as

well as the cluster. Expertise at the ministry is very focused around

the geological aspect of the minerals rather than the business side

of it. Most of the personnel at the ministry consist of geology

engineers at all levels, e.g., the minister, his deputy, directors of

major departments are all geologists whose knowledge remain limited

to the technical geological aspects of the minerals. They rarely

think about the economy and business part of these god-given gifts in

which the nation has comparative advantage. There is a big gap to be

filled by new policies and new strategies/tactics that could

practically enforce development of businesses, foreign and domestic

direct investments in the cluster. E.g., the ministry could initiate

penetration pricing policy for couple of years in order to attract

investment in the cluster. Currently the Ministry’s pricing policy

is in no way competitive in compare with the neighboring countries

especially Pakistan. for comparison of the prices of tiles for

Afghan marble versus Pakistan, the neighboring country. Looking at

the graph, Pakistan marble prices are more competitive against the

Afghan marble in terms of price; value added quality, and

diversification in types despite the transportation cost for import.

In comparison, the Afghan marble is less competitive in terms of

price; value added quality; and diversification in type despite being

produced within the country and without extra transportation charges.

Based on interviews with the marble processing companies, a big

portion of the cost—through the value chain—is going to the

royalty fee imposed by the Ministry of Mines and Industries, which

increases the cost of production. Other factors also play a major

role such as lack of power and production efficiency as a result of

modern equipments and technology. The Ministry’s knowledge about

the marble market and the prices remains very little and insufficient

i.e. when the deputy Minster was asked about the prices of marble in

the neighboring countries and how his ministry was acting in terms of

competitiveness; the answer was simply “I don’t know.” In

summary, the ministry is not thinking economically and competitively

about the natural resources that it holds, which by itself is a major

barrier against development of the sector as well as the cluster.

In addition to the low capacity, lack of knowledge in management and competitiveness, there exist a kind of negative attitude and mentality amongst employees of the government at different levels against the private sector. For example, they don’t seem to be enthusiastically cooperative and helpful with the private sector companies as well as other customers e.g. when the author of this paper was dealing with them to collect the relevant data at some departments of the Ministry of Mines, this was very obvious in several occasions. This negative attitude seems to be the most dangerous phenomenon for development of the sector. To overcome this challenge a lot of awareness building and capacity development activities need to be initiated and sustainably followed in the medium and long term. In terms of technical capacity personnel of the Ministry looks to have geological knowledge, but lack the capacity – in terms of finances – to conduct the required surveys and feasibility studies for the benefit of the private sector investments. The Ministry has put in place standard provisions for contracting the quarrying operations of marble to the private companies. However, some of the provisions don’t seem to be realistic given the current capacity of the private sector in the country as well as the overall context for business development. Please see Exhibit number three for the translated copy of the standard provisions. Marble companies have problems with several articles such as article number 5, 6, 7, and 9. The rate of royalty fee in Article 5 comes out of the initial price set by the Ministry based on one of the categories in the Table presented at the Exhibit four and a subsequent bidding process, which imposes high royalty fee over the companies on marble extraction in compare with the neighboring countries. Other challenges as a result of the standard provisions are advance payment, mandatory volume of marble to be quarried in each year without consideration of seasonal barriers as a result of weather and week infrastructure such as muddy roads that gets blocked easily in rainy seasons. On top of these, expenses of the geological engineer such as purdiam, transportation cost, and other privileges linked to the regular travels for the purpose of monitoring fall over the shoulders of the contracting company doing the quarrying operation.

The

business community for marble production is 100% comprised of

domestic companies. Foreign Investment has not taken place yet. Much

of knowledge of the domestic companies is focused on production and

the relevant approaches. “Little capacity exists in the business

community for business plan writing,” etc. (the OTF group,2006).

“Credit is difficult to access and expensive.” One in fond of

access to credit must be equipped with modern business knowledge of

proposal writing, budget planning, business plan writing, etc, which

is lacking amongst the business community for marble production in

Afghanistan. Rivalry remains limited to the domestic companies although the size

of the afghan marble industry is not well known the association of

marbles and Granite processor of Afghanistan AMGPA indicated that

there are around 130 factories producing ,marbles across the country

most of these company are small scale producing the overall context

for rivalry is not impressive and therefore, the growth of companies

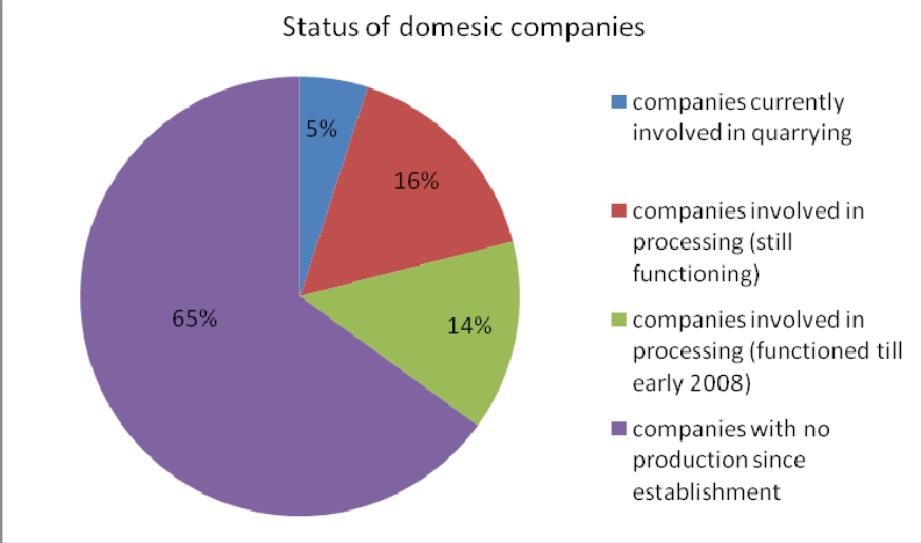

has been going through a declining trend. Based on information

provided by Mr. Besmella Ebrahimi – Director General for Khaled

Omid Marble company and a key member of the Afghanistan Marble and

Granite Processors Association (AMGPA) – 65% of companies that were

established with the mandate to work in marble industry have not been

productive at all. 14% of companies could only continue to produce

till early 2008 and went bankrupt afterwards. Only 16% of companies

are functioning at the moment and can continue to produce. Five

percent of companies are involved in quarrying operations only. The

pie chart shows that clearly: For the purpose of analyzing the

productivity of the cluster, the author selected top four leading

companies out of 16 that are currently functioning and producing

marble tiles. The aggregate amount of production for the four

companies seems to be impressive till 2005 and not so well

afterwards. The affecting factors for the decline in the production

trend generally are those identified in the diamond for the cluster.

But the problem mainly stems from the inappropriate context that

cannot facilitate healthy and proper development of the cluster.

Rivalry remains limited to the domestic companies although the size

of the afghan marble industry is not well known the association of

marbles and Granite processor of Afghanistan AMGPA indicated that

there are around 130 factories producing ,marbles across the country

most of these company are small scale producing the overall context

for rivalry is not impressive and therefore, the growth of companies

has been going through a declining trend. Based on information

provided by Mr. Besmella Ebrahimi – Director General for Khaled

Omid Marble company and a key member of the Afghanistan Marble and

Granite Processors Association (AMGPA) – 65% of companies that were

established with the mandate to work in marble industry have not been

productive at all. 14% of companies could only continue to produce

till early 2008 and went bankrupt afterwards. Only 16% of companies

are functioning at the moment and can continue to produce. Five

percent of companies are involved in quarrying operations only. The

pie chart shows that clearly: For the purpose of analyzing the

productivity of the cluster, the author selected top four leading

companies out of 16 that are currently functioning and producing

marble tiles. The aggregate amount of production for the four

companies seems to be impressive till 2005 and not so well

afterwards. The affecting factors for the decline in the production

trend generally are those identified in the diamond for the cluster.

But the problem mainly stems from the inappropriate context that

cannot facilitate healthy and proper development of the cluster.

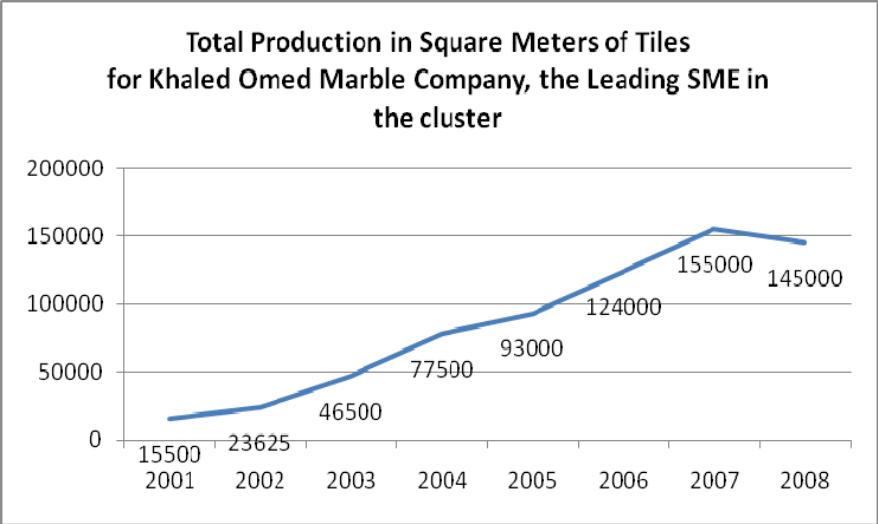

In

general, 2008 has not been a productive year for the cluster at all. Even the top

performing company that could maintain a gradual growth rate

throughout the years failed in 2008 to meet its previous year level

of production.

not been a productive year for the cluster at all. Even the top

performing company that could maintain a gradual growth rate

throughout the years failed in 2008 to meet its previous year level

of production.

Related and supporting industries and institutes:

Afghanistan’s Marble and Granite Processors Association (AMGPA) as a supporting

association was created in 2006 by the Afghan marble companies to carry out lobbying and advocacy activities for the benefit of the marble industry in Afghanistan (AMGPA quarterly, 2007). The Association has taken some initiatives to establish relationship with donors, buyers and other supporting agencies on the ground and in the region. As an example, “the efforts of marble promotional events such as ‘the big five’ exhibition and the Afghan Marble Showcase, both held in Dubai in 2007” (Mitchell, 2008) can be noted down as few of the successes for the Association. However, “the Association does not have cohesive focus on the industry” (the OTF Group, 2006). Based on interviews with members of the Association, the Author found out that there is not adequate transparency in terms of procedures and official relationship in place for the members of the Association. This results very “little knowledge sharing between the cluster members” (the OTF Group, 2006). This little knowledge and information sharing has been declining trust among the members. A major challenge is financial support. The companies are small scale and therefore, lack capital cost to buy modern quarrying and processing equipments. Supporting financial institutions e.g. banks provide loans with high interest rates that is not affordable by the marble processors. “Overall, financial sector constrains development with limited

investment and working capital. Few donors are looking at marble industry” (the OTF Group, 2006) and so far none has really taken practical step into some kind of investment in the marble cluster. “Lack of proper equipment and knowledge leads to extraction methods that ruin the value of the marble.” Afghanistan Small and Medium Enterprises Development (ASMED) is a program financed by USAID, which provides some minor support to the marble companies. E.g., they have facilitated arrangement of couple of marble exhibition shows in the region such as the “big 5 event” in Dubai in 2007. Institutional support from the relevant ministries is very poor. In addition to lack of surveying capabilities there exist “murky procedures for quarrying rights, land titling issues, etc.” (the OTF Group, 2006). Manufacturing companies for equipments and machineries do not exist in country and therefore, all these has to be imported from outside mainly China and Pakistan.

CONTEXT OF FIRM STRATEGY, STRUCTURE AND RIVALRY: • Legislatively minerals law of Afghanistan exists to govern marble quarrying and processing. • Partnership law exists to facilitate FDI and DDI. • MMI capacity is limited to initiate policies and strategies to create a better environment for marble business. • MMI leadership does not think like an economist rather thinks like a geologist. • Ministry pricing policy for quarrying is uncompetitive. • Negative attitude of government employees. • MMI’s standard provisions for quarrying is not realistic. • Business community lack marketing and business planning knowledge. • Rivalry is limited to domestic companies. |

FACTOR CONDITIONS: • Afghan marble is of best quality and huge quantity. • Strategic location geographically accessible to Middle East and central Asian markets. • Some Afghan returnees from Iran are skilled in marble processing. • Infrastructure i.e. roads, power plants, systems, and procedures in place is very week and almost inexistent. • Security profile is poor in certain parts of the country and good in other areas. |

DEMAND CONDITIONS: • 100% of processed marble is liquidated in country. • Less sophisticated nature of domestic demand (only some standard sizes). • Not all of the quarried marble is processed in country. Some goes to Pakistan. • Quality of finished marble products are low and not meeting the international demand. • Marble producers lack understanding of the requirements of international buyers. |

RELATED AND SUPPORTING INDUSTRIES & INSTITUTES: • AMGPA Association as a support agency exist that lobbies and advocates for the cluster. • Information sharing lacks amongst the members of the cluster. • Loans are available with high interest rates. • Institutional support from relevant ministries is poor. • Manufacturing companies for equipments and machineries don’t exist in country. • ASMED provides some minor supports to the marble companies through the AMGPA. Marketing exhibitions is an example of the kind of support they provide to the cluster members. |

Cluster Diamond Advantages and Disadvantages:

Based on the above discussion, the advantages and disadvantages under each of the four attributes in the cluster diamond can be noted as follows:

Factor Conditions Advantages:

• Afghanistan marble is of best quality and is available in huge quantities that can supply the regional as well as the Europe and U.S. markets.

• Afghanistan has a strategic location that is geographically accessible to Middle East and central Asian markets.

• Some Afghan returnees from Iran are skilled in marble processing techniques.

Factor Conditions Disadvantages:

• Infrastructure i.e., roads, power plants, systems, and procedures in place are very week and almost inexistent.

• Security profile is poor in certain parts of the country, especially at the quarry sites.

Demand Conditions Advantages:

• There is high demand for marble in the domestic market. Currently 100% of

processed marble is liquidated in country.

• The nature of demand in the domestic market is less sophisticated at the moment,

which does not give a hard time for the processing companies in production. This can be an advantage especially at this time since the marble companies are not well

developed yet.

Demand Conditions Disadvantages:

• Not all of the quarried marble is processed within the country. Unknown quantities

are illegally quarried and exported to Pakistan for processing.

• Lack of sophisticated nature of domestic demand would cause less initiative and

competition amongst the marble processing companies.

• Quality of finished marble products are low and not meeting the international demand standards.

• Marble producers lack understanding of the requirements of international buyers.