- •1.The role of Microeconomics

- •2. T he Subject Matter of Microeconomics

- •3. The use and limitation of Microeconomic theory

- •4. Economic methodology and microeconomic models

- •5. Equilibrium analysis

- •6. Positive and normative analysis

- •7. Demand Function(df): Individual df vs Market df

- •8. Change in Quantity Demanded, Change in Demand

- •9.Inferior, Normal and Superior Goods

- •10. Supply Function. Change in quantity supplied and Change in supply

- •11. Market equilibrium

- •12 Market Adjustment to Change: shifts of Demand and shift of Supply

- •Shifts of Demand

- •13. Changes in Both Supply and Demand

- •14. Cobweb theorem as an illustration of stable and unstable equilibrium

- •Unstable cobweb

- •Constant cobweb

- •15. Government regulation of a market

- •1. Price ceiling and Price floor

- •2. Impact of a tax on price and quantity

- •16. Price ceiling and Price floor

- •Impact of a tax on price and quantity

- •18. Demand elasticity. Price Elasticity Coefficient and Factors affecting price elasticity of demand

- •Table of price elasticity kinds of demand

- •19. Impact of demand elasticity on price and total revenue

- •20. Income elasticity of demand(yed)and Cross elasticity of demand

- •Categories of income elasticity:

- •21. The price elasticity of supply

- •22. Market adaptation to Demand and Supply changes in long-run and in short-run

- •24.Consumer Choice and Utility

- •25. Total Utility (tu) and Marginal Utility (mu)

- •26. Indifference curves.

- •28. The effects of changes in income and prices

- •29 Equimarginal Principle and Consumer equilibrium

- •30.Income Consumption Curve. Engel Curves

- •32. Income and Substitution Effects

- •The slutsky method

- •34. Production Function

- •35. Time and Production. Production in the Short-Run

- •36.Average, Marginal and Total Product. Law of diminishing returns

- •37. Producer’s behavior

- •38 Isoquant

- •39. Isocost

- •40. Cost minimization (Producer’s choice optimisation)

- •41.The treatment of costs in Accounting and Economic theory

- •Average costs. Marginal Cost

- •Long run average cost. Returns to Scale.

- •45Different market forms

- •48 The Competitive Firm and Industry Demand

- •49.Economic strategies of the firm in p-competitive m arket

- •50.Long run equilibrium

- •51.Definition of Monopoly Market. Causes of monopoly.

- •Patents and Other Forms of Intellectual Property

- •Control of an Input Resource

- •Capital-consuming technologies

- •Decreasing Costs

- •Government Grants of Monopoly

- •52.Monopoly Demand and Marginal Revenue

- •54. Monopoly Inefficiency

- •Negative consequences of Monopoly

- •55. "Natural" Monopoly

- •Government Ownership

- •56. Imperfect competition and Monopolistic competition

- •57. Profit Maximization in Monopolistic Competition

- •58. Oligopoly

- •59. Firms behavior in Oligopoly

- •60 Kinked Demand Model

- •61 Competitive factor markets

- •62 The Demand for Inputs

- •63 Supply of Inputs

- •64. Equilibrium in a Market for Inputs

- •Labour market

- •Land market

- •Capital market

- •65. Labor market: labor demand and supply of labor.

- •66.The Marginal productivity approach to demand for labor.

- •Equilibrium and disequilibrium on labor market.

- •68. Particularities of Land market. Differential rent. Marginal productivity of land.

- •69 Main characteristics of Asset market. Demand for capital. Interest rate.

- •70. Discounted value. Conceptions of Net present value (npv) and future present value (fv).

- •The role of Microeconomics

- •T he Subject Matter of Microeconomics

10. Supply Function. Change in quantity supplied and Change in supply

A supply function is a model that represents the behavior of the producers and/or sellers in a market.

Q XS

= fS(PX,

PINPUTS,

technology, number of sellers, laws, taxes, expectations . . . NS)

XS

= fS(PX,

PINPUTS,

technology, number of sellers, laws, taxes, expectations . . . NS)

PX = price of the good,

PINPUTS = prices of the inputs (factors of production used)

Technology is the method of production (a production function),

laws and regulations may impose more costly methods of production

taxes and subsidies alter the costs of production

NS represents the number of sellers in the market.

Like the demand function, supply can be viewed from two perspectives:

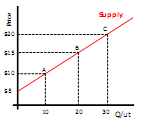

Supply is a schedule of quantities that will be produced and offered for sale at a schedule of prices in a given time period, ceteris paribus. A supply function can be viewed as the minimum prices sellers are willing to accept for given quantities of output, ceteris paribus. Generally, it is assumed that there is a positive relationship between the price of the good and the quantity offered for sale.

A change in the price of the good (PX) will be reflected as a move along a upply function. A “change in quantity supplied is a movement along a supply function.” A shift of the supply function to the right will be called an increase in supply. This means that at each possible price, a greater quantity will be offered for sale. In an equation form, an increase in supply can be shown by an increase in the quantity intercept. A decrease in supply is a shift to the left; at each possible price a smaller quantity is offered for sale.

11. Market equilibrium

Equilibrium is “a state of rest or balance due to the equal action of opposing forces,” and “equal balance between any powers, influences, etc.”

T he

New Palgrave: A Dictionary or Economics identifies 3 concepts of

equilibrium:

he

New Palgrave: A Dictionary or Economics identifies 3 concepts of

equilibrium:

– Equilibrium as a “balance of forces”

– Equilibrium as “a point from which there is no endogenous ‘tendency to change’”

– Equilibrium as an “outcome which any given economic process might be said to be ‘tending towards’, as in the idea that competitive processes tend to produce determinant outcomes”.

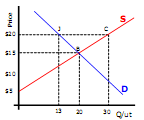

“equilibrium” is perceived as the condition where the quantity demanded is equal to the quantity supplied; the behavior of all potential buyers is coordinated with the behavior of all potential sellers. Graphically, economists represent a market equilibrium as the intersection of the demand and supply functions. At the equilibrium price the quantity that buyers are willing and able to buy is exactly the same as sellers are willing to produce and offer for sale.

There is an equilibrium price that equates or balances the amount that agents want to buy with the amount that is produced and offered for sale (at that price). There are no forces (from buyers or sellers) that will alter the equilibrium price or equilibrium quantity.

The process of achieving a state of equilibrium is based on buyers and sellers adjusting their behavior in response to prices, shortages and surpluses. If the price is “too high” – the market is not in equilibrium. The amount of the good that agents are willing and able to buy at this price (quantity demanded) is less than sellers would like to sell (quantity supplied). This is a surplus. In order to sell the surplus units, sellers lower their price. As the price falls the quantity supplied decreases and the quantity demanded increases. (Neither demand nor supply are changed.) As the price falls, the quantity supplied falls and the quantity demanded increases.

When the market price is below the equilibrium price the quantity demanded exceeds the quantity supplied. At the price below equilibrium, buyers are willing and able to purchase an amount that is greater than the suppliers produce and offer for sale. This is a shortage. The buyers will “bid up” the price by offering a higher price to get the quantity they want. The quantity demanded will fall while the quantity supplied rises in response to the higher price.

I

Р n

economic system has many agents who interact in many markets. General

equilibrium is

a

condition where all agents acting in all markets are in equilibrium

at the same time.

Since the markets are all interconnected a change or disequilibrium

in one market would cause changes in all markets.

n

economic system has many agents who interact in many markets. General

equilibrium is

a

condition where all agents acting in all markets are in equilibrium

at the same time.

Since the markets are all interconnected a change or disequilibrium

in one market would cause changes in all markets.

Consumer surplus is the excess of the benefit a consumer gains from purchases of goods over the amount paid for them. Grafically it can be shown as a triangle KEC. And mathematically it can be computed as an area of the KEC triangle.

Producer’s surplus means the excess of total sales revenue going to producers over the area under the supply curve for a good. Mathematically it can be computed as an area of the FEC triangle.