- •1.The role of Microeconomics

- •2. T he Subject Matter of Microeconomics

- •3. The use and limitation of Microeconomic theory

- •4. Economic methodology and microeconomic models

- •5. Equilibrium analysis

- •6. Positive and normative analysis

- •7. Demand Function(df): Individual df vs Market df

- •8. Change in Quantity Demanded, Change in Demand

- •9.Inferior, Normal and Superior Goods

- •10. Supply Function. Change in quantity supplied and Change in supply

- •11. Market equilibrium

- •12 Market Adjustment to Change: shifts of Demand and shift of Supply

- •Shifts of Demand

- •13. Changes in Both Supply and Demand

- •14. Cobweb theorem as an illustration of stable and unstable equilibrium

- •Unstable cobweb

- •Constant cobweb

- •15. Government regulation of a market

- •1. Price ceiling and Price floor

- •2. Impact of a tax on price and quantity

- •16. Price ceiling and Price floor

- •Impact of a tax on price and quantity

- •18. Demand elasticity. Price Elasticity Coefficient and Factors affecting price elasticity of demand

- •Table of price elasticity kinds of demand

- •19. Impact of demand elasticity on price and total revenue

- •20. Income elasticity of demand(yed)and Cross elasticity of demand

- •Categories of income elasticity:

- •21. The price elasticity of supply

- •22. Market adaptation to Demand and Supply changes in long-run and in short-run

- •24.Consumer Choice and Utility

- •25. Total Utility (tu) and Marginal Utility (mu)

- •26. Indifference curves.

- •28. The effects of changes in income and prices

- •29 Equimarginal Principle and Consumer equilibrium

- •30.Income Consumption Curve. Engel Curves

- •32. Income and Substitution Effects

- •The slutsky method

- •34. Production Function

- •35. Time and Production. Production in the Short-Run

- •36.Average, Marginal and Total Product. Law of diminishing returns

- •37. Producer’s behavior

- •38 Isoquant

- •39. Isocost

- •40. Cost minimization (Producer’s choice optimisation)

- •41.The treatment of costs in Accounting and Economic theory

- •Average costs. Marginal Cost

- •Long run average cost. Returns to Scale.

- •45Different market forms

- •48 The Competitive Firm and Industry Demand

- •49.Economic strategies of the firm in p-competitive m arket

- •50.Long run equilibrium

- •51.Definition of Monopoly Market. Causes of monopoly.

- •Patents and Other Forms of Intellectual Property

- •Control of an Input Resource

- •Capital-consuming technologies

- •Decreasing Costs

- •Government Grants of Monopoly

- •52.Monopoly Demand and Marginal Revenue

- •54. Monopoly Inefficiency

- •Negative consequences of Monopoly

- •55. "Natural" Monopoly

- •Government Ownership

- •56. Imperfect competition and Monopolistic competition

- •57. Profit Maximization in Monopolistic Competition

- •58. Oligopoly

- •59. Firms behavior in Oligopoly

- •60 Kinked Demand Model

- •61 Competitive factor markets

- •62 The Demand for Inputs

- •63 Supply of Inputs

- •64. Equilibrium in a Market for Inputs

- •Labour market

- •Land market

- •Capital market

- •65. Labor market: labor demand and supply of labor.

- •66.The Marginal productivity approach to demand for labor.

- •Equilibrium and disequilibrium on labor market.

- •68. Particularities of Land market. Differential rent. Marginal productivity of land.

- •69 Main characteristics of Asset market. Demand for capital. Interest rate.

- •70. Discounted value. Conceptions of Net present value (npv) and future present value (fv).

- •The role of Microeconomics

- •T he Subject Matter of Microeconomics

57. Profit Maximization in Monopolistic Competition

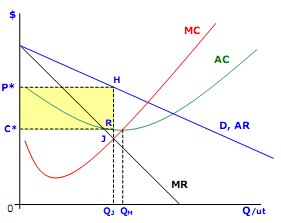

If the firm in an imperfectly competitive market has profit maximization as an objective, they will produce the output where marginal cost is equal to the marginal revenue. Short run profit maximization is shown in Figure 2.

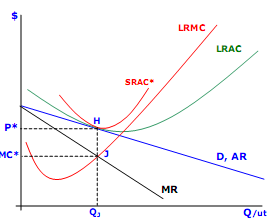

In the long run, above normal profits will attract the entry of firms into monopolistic competition. Below normal profits will encourage firms to exit. As firms enter the market demand is split among a larger number of firms which will shift the demand for each firm to the left (decrease) and probably make it more inelastic. There are more substitutes. Exit of firms will shift the demand for each firm’s output to the right (increase). Entry to and exit from the industry occur until the profits for each firm are normal, i.e. the AR = AC. The results of long run equilibrium in a monopolistically competitive market are shown in Figure 3.

The logical result of profit maximizing monopolistically competitive markets is to encourage firms to build plants that are smaller than optimal, i.e. a larger plant can produce with fewer inputs per unit of output (or costs per unit of output). Further inefficiency is expected since the inefficient plant is operated at an output level that is less than the minimum point on the SRAC. This result is due to the fact that the MR must be lower than AR when AR is negatively sloped.

Therefore MR=MC at less than the price which lies on the demand (or AR) function. Since the demand is negatively sloped and AC is usually U-shaped, the point of tangency between AR and LRAC (normal profits) will lie to the left of the minimum cost per unit of output. This is sometimes called the “excess capacity theorem;” firms build plants that are too small and operate them at less than full capacity.

58. Oligopoly

An oligopoly is a market form in which a market or industry is dominated by a small number of sellers (oligopolists). Because there are few sellers, each oligopolist is likely to be aware of the actions of the others. The decisions of one firm influence, and are influenced by, the decisions of other firms. Strategic planning by oligopolists needs to take into account the likely responses of the other market participants.

Characteristics

Profit maximisation conditions: An oligopoly maximises profits by producing where marginal revenue equals marginal costs.

Ability to set price: Oligopolies are price setters rather than price takers.

Entry and exit: Barriers to entry are high. The most important barriers are economies of scale, patents, access to expensive and complex technology, and strategic actions by incumbent firms designed to discourage or destroy nascent firms. Additional sources of barriers to entry often result from government regulation favoring existing firms making it difficult for new firms to enter the market.

Number of firms: "Few" – a "handful" of sellers.There are so few firms that the actions of one firm can influence the actions of the other firms.

Long run profits: Oligopolies can retain long run abnormal profits. High barriers of entry prevent sideline firms from entering market to capture excess profits.

Product differentiation: Product may be homogeneous (steel) or differentiated (automobiles).

Perfect knowledge: Assumptions about perfect knowledge vary but the knowledge of various economic actors can be generally described as selective. Oligopolies have perfect knowledge of their own cost and demand functions but their inter-firm information may be incomplete. Buyers have only imperfect knowledge as to price, cost and product quality.

The distinctive feature of an oligopoly is interdependence. Oligopolies are typically composed of a few large firms. Each firm is so large that its actions affect market conditions. Therefore the competing firms will be aware of a firm's market actions and will respond appropriately. This means that in contemplating a market action, a firm must take into consideration the possible reactions of all competing firms and the firm's countermoves.It is very much like a game of chess or pool in which a player must anticipate a whole sequence of moves and countermoves in determining how to achieve his objectives.