- •1.The role of Microeconomics

- •2. T he Subject Matter of Microeconomics

- •3. The use and limitation of Microeconomic theory

- •4. Economic methodology and microeconomic models

- •5. Equilibrium analysis

- •6. Positive and normative analysis

- •7. Demand Function(df): Individual df vs Market df

- •8. Change in Quantity Demanded, Change in Demand

- •9.Inferior, Normal and Superior Goods

- •10. Supply Function. Change in quantity supplied and Change in supply

- •11. Market equilibrium

- •12 Market Adjustment to Change: shifts of Demand and shift of Supply

- •Shifts of Demand

- •13. Changes in Both Supply and Demand

- •14. Cobweb theorem as an illustration of stable and unstable equilibrium

- •Unstable cobweb

- •Constant cobweb

- •15. Government regulation of a market

- •1. Price ceiling and Price floor

- •2. Impact of a tax on price and quantity

- •16. Price ceiling and Price floor

- •Impact of a tax on price and quantity

- •18. Demand elasticity. Price Elasticity Coefficient and Factors affecting price elasticity of demand

- •Table of price elasticity kinds of demand

- •19. Impact of demand elasticity on price and total revenue

- •20. Income elasticity of demand(yed)and Cross elasticity of demand

- •Categories of income elasticity:

- •21. The price elasticity of supply

- •22. Market adaptation to Demand and Supply changes in long-run and in short-run

- •24.Consumer Choice and Utility

- •25. Total Utility (tu) and Marginal Utility (mu)

- •26. Indifference curves.

- •28. The effects of changes in income and prices

- •29 Equimarginal Principle and Consumer equilibrium

- •30.Income Consumption Curve. Engel Curves

- •32. Income and Substitution Effects

- •The slutsky method

- •34. Production Function

- •35. Time and Production. Production in the Short-Run

- •36.Average, Marginal and Total Product. Law of diminishing returns

- •37. Producer’s behavior

- •38 Isoquant

- •39. Isocost

- •40. Cost minimization (Producer’s choice optimisation)

- •41.The treatment of costs in Accounting and Economic theory

- •Average costs. Marginal Cost

- •Long run average cost. Returns to Scale.

- •45Different market forms

- •48 The Competitive Firm and Industry Demand

- •49.Economic strategies of the firm in p-competitive m arket

- •50.Long run equilibrium

- •51.Definition of Monopoly Market. Causes of monopoly.

- •Patents and Other Forms of Intellectual Property

- •Control of an Input Resource

- •Capital-consuming technologies

- •Decreasing Costs

- •Government Grants of Monopoly

- •52.Monopoly Demand and Marginal Revenue

- •54. Monopoly Inefficiency

- •Negative consequences of Monopoly

- •55. "Natural" Monopoly

- •Government Ownership

- •56. Imperfect competition and Monopolistic competition

- •57. Profit Maximization in Monopolistic Competition

- •58. Oligopoly

- •59. Firms behavior in Oligopoly

- •60 Kinked Demand Model

- •61 Competitive factor markets

- •62 The Demand for Inputs

- •63 Supply of Inputs

- •64. Equilibrium in a Market for Inputs

- •Labour market

- •Land market

- •Capital market

- •65. Labor market: labor demand and supply of labor.

- •66.The Marginal productivity approach to demand for labor.

- •Equilibrium and disequilibrium on labor market.

- •68. Particularities of Land market. Differential rent. Marginal productivity of land.

- •69 Main characteristics of Asset market. Demand for capital. Interest rate.

- •70. Discounted value. Conceptions of Net present value (npv) and future present value (fv).

- •The role of Microeconomics

- •T he Subject Matter of Microeconomics

54. Monopoly Inefficiency

This loss of consumers' surplus is called the "deadweight loss" (meaning the monopoly profits are not enough to offset it) or the "welfare triangle" and is a measure of the waste due to monopoly restriction of output. In this very simplified example, it is half of the monopoly profits.

In general:

A monopoly will charge more than a competitive industry with the same cost conditions

The monopoly will sell less output

In long run equilibrium, the monopoly will receive economic profits

There will be a net loss of consumers' surplus relative to P-competitive equilibrium.

Negative consequences of Monopoly

But there are still some complications we have not taken account of. So far we have been assuming that the monopoly has the same cost conditions that a competitive industry would have. The complications arise when the monopoly and a competitive industry cannot have the same cost conditions. This could happen for two reasons.

The monopoly, lacking the spur of competition, wastes resources so that its cost curves are above those of a competitive industry. The term for this is "X-Inefficiency."

This is a deviation from the neoclassical assumption of absolute rationality, but perhaps a very important realistic deviation. A good deal of observational evidence suggests that different firms can have quite different costs, in what seem to be the same circumstances. Competition, driving prices down, will tend to eliminate this problem – by eliminating the high-cost firms. In the absence of any competition at all, we would expect costs to be higher than they would be in a competitive industry. There is some evidence that this is true.

There are economies of scale, so the monopoly, operating on a larger scale, can achieve lower costs. This is the case of natural monopoly.

55. "Natural" Monopoly

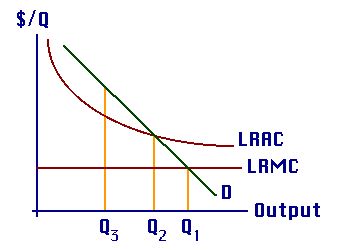

Here

is a picture-example of "natural" monopoly. The example

assumes that there is one indivisible cost, but that once it is paid,

the firm can produce an unlimited amount at a constant marginal cost.

Thus, the Long Run Marginal Cost is horizontal, but the Long run

Average Cost is downward- sloping.

Here

is a picture-example of "natural" monopoly. The example

assumes that there is one indivisible cost, but that once it is paid,

the firm can produce an unlimited amount at a constant marginal cost.

Thus, the Long Run Marginal Cost is horizontal, but the Long run

Average Cost is downward- sloping.

The dilemma is that output Q1, where MC=price, is still the efficient output. But at that output, the monopoly cannot cover its total costs. On the other hand, a profit-maximizing monopoly will produce much less, at Q3, which covers costs but it inefficient.

In different countries and at different times, governments have dealt with this problem in three primary ways:

Government Ownership

Government ownership could, in principle, solve the problem, since the government could operate the monopoly efficiently, charging a price equal to marginal cost, and cover the losses out of tax revenues.

In practice, however, government monopolies usually seem to have been operated as "cash cows" for the government, and that's not a solution to the problem of high monopoly prices! It has been quite common around the world (for example) for public telephone monopolies to raise the price of telephone service to pay the deficit of the postal system. Poor telephone service at a high price is the predictable result. Regulation

The most common response has been regulation. In this system, a private monopoly is recognized and protected as such, on the condition that it keep its price down below the profit-maximizing level. The monopoly would be allowed to earn a "fair rate of return." Over the years, this was more and more interpreted as meaning that the monopoly would operate at Q2, where the price just covers average cost. This is less efficient than Q1, but better than Q3. However, there are some other complications that led economists and regulators to question this interpretation by the 1960's. In recent years, the trend has been away from regulation.