- •1.The role of Microeconomics

- •2. T he Subject Matter of Microeconomics

- •3. The use and limitation of Microeconomic theory

- •4. Economic methodology and microeconomic models

- •5. Equilibrium analysis

- •6. Positive and normative analysis

- •7. Demand Function(df): Individual df vs Market df

- •8. Change in Quantity Demanded, Change in Demand

- •9.Inferior, Normal and Superior Goods

- •10. Supply Function. Change in quantity supplied and Change in supply

- •11. Market equilibrium

- •12 Market Adjustment to Change: shifts of Demand and shift of Supply

- •Shifts of Demand

- •13. Changes in Both Supply and Demand

- •14. Cobweb theorem as an illustration of stable and unstable equilibrium

- •Unstable cobweb

- •Constant cobweb

- •15. Government regulation of a market

- •1. Price ceiling and Price floor

- •2. Impact of a tax on price and quantity

- •16. Price ceiling and Price floor

- •Impact of a tax on price and quantity

- •18. Demand elasticity. Price Elasticity Coefficient and Factors affecting price elasticity of demand

- •Table of price elasticity kinds of demand

- •19. Impact of demand elasticity on price and total revenue

- •20. Income elasticity of demand(yed)and Cross elasticity of demand

- •Categories of income elasticity:

- •21. The price elasticity of supply

- •22. Market adaptation to Demand and Supply changes in long-run and in short-run

- •24.Consumer Choice and Utility

- •25. Total Utility (tu) and Marginal Utility (mu)

- •26. Indifference curves.

- •28. The effects of changes in income and prices

- •29 Equimarginal Principle and Consumer equilibrium

- •30.Income Consumption Curve. Engel Curves

- •32. Income and Substitution Effects

- •The slutsky method

- •34. Production Function

- •35. Time and Production. Production in the Short-Run

- •36.Average, Marginal and Total Product. Law of diminishing returns

- •37. Producer’s behavior

- •38 Isoquant

- •39. Isocost

- •40. Cost minimization (Producer’s choice optimisation)

- •41.The treatment of costs in Accounting and Economic theory

- •Average costs. Marginal Cost

- •Long run average cost. Returns to Scale.

- •45Different market forms

- •48 The Competitive Firm and Industry Demand

- •49.Economic strategies of the firm in p-competitive m arket

- •50.Long run equilibrium

- •51.Definition of Monopoly Market. Causes of monopoly.

- •Patents and Other Forms of Intellectual Property

- •Control of an Input Resource

- •Capital-consuming technologies

- •Decreasing Costs

- •Government Grants of Monopoly

- •52.Monopoly Demand and Marginal Revenue

- •54. Monopoly Inefficiency

- •Negative consequences of Monopoly

- •55. "Natural" Monopoly

- •Government Ownership

- •56. Imperfect competition and Monopolistic competition

- •57. Profit Maximization in Monopolistic Competition

- •58. Oligopoly

- •59. Firms behavior in Oligopoly

- •60 Kinked Demand Model

- •61 Competitive factor markets

- •62 The Demand for Inputs

- •63 Supply of Inputs

- •64. Equilibrium in a Market for Inputs

- •Labour market

- •Land market

- •Capital market

- •65. Labor market: labor demand and supply of labor.

- •66.The Marginal productivity approach to demand for labor.

- •Equilibrium and disequilibrium on labor market.

- •68. Particularities of Land market. Differential rent. Marginal productivity of land.

- •69 Main characteristics of Asset market. Demand for capital. Interest rate.

- •70. Discounted value. Conceptions of Net present value (npv) and future present value (fv).

- •The role of Microeconomics

- •T he Subject Matter of Microeconomics

48 The Competitive Firm and Industry Demand

The individual firm's demand curve is different from that of the industry, and is more elastic. This is because substitutes increase elasticity, and the customer of the firm has many good substitutes for that firm's output – namely, the output of other firms in the industry. As we mentioned above, the demand curve for a P-Competitive firm is infinitely elastic:

In the figure, the lower case q, s and d refer to output, supply and demand from the point of view of the individual firm, respectively, and the capital S, D, and Q are for the industry as a whole.

49.Economic strategies of the firm in p-competitive m arket

H ow

much output should firm sell, at the given price to maximize profits.

The

answer is: increase output until P=MR=MC

ow

much output should firm sell, at the given price to maximize profits.

The

answer is: increase output until P=MR=MC

Now we will use this rule as a basic rule to consider the firm economic strategies.

In the picture just shown, the firm is making an "economic profit." All costs, explicit and implicit, are included in the firm's Average Cost curve.

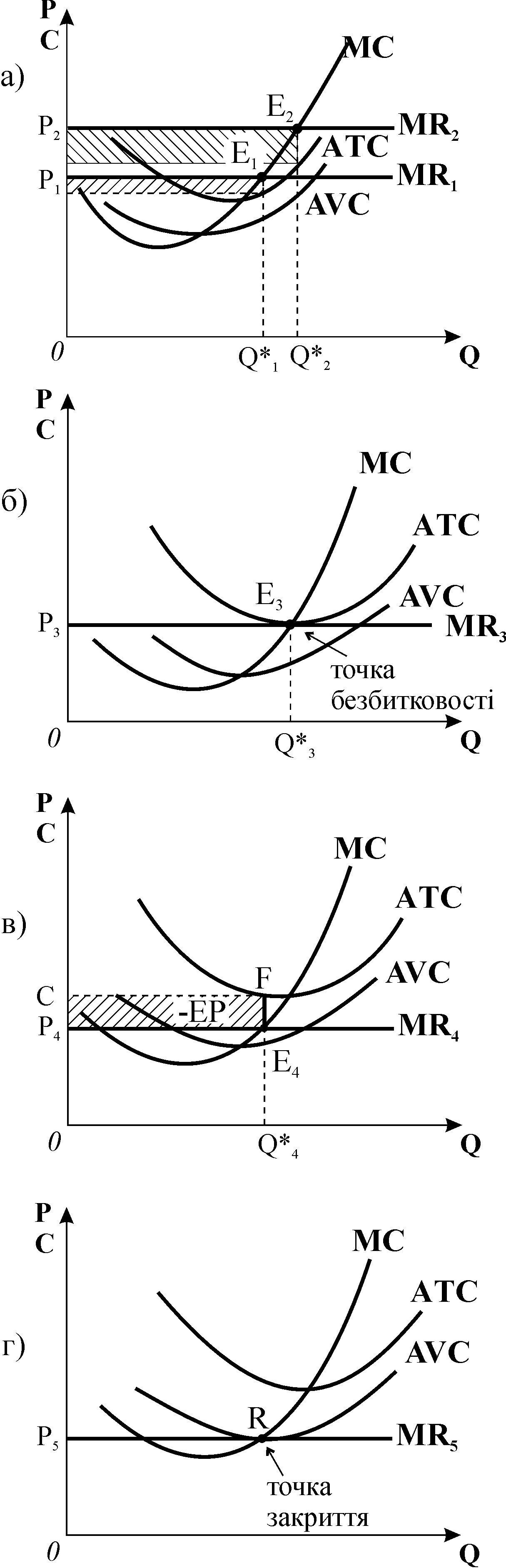

Profitableness and losses conditions for perfect competitor according to MRMC-model:

a)

a firm has profit under:

![]()

б)

break-even

condition is:

![]()

в)

losses

minimization condition through production continuance:

![]()

г![]() )losses

minimization condition through temporary dissolution of the firm:

)losses

minimization condition through temporary dissolution of the firm:

![]()

In other words if the cost of and additional unit (MC) is less than the revenue obtained from that same additional unit (MR), producing the additional units will add to profits (or reduce losses). If the cost of additional units of output (MC) cost more than they add to revenue (MR), the firm should not produce the additional units. The rules for profit maximization are simple:

• MR >MC – produce it!

• MR < MC – don’t produce it!

• When MR = MC – you are earning maximum profits!

MR=MC is the main principle of supply for the individual firm. Supply is the relation between the price and the quantity that people want to sell. For an individual firm, that is: the relation between the price and the quantity the firm wants to sell. So we ask: at a given price, how much will a (profit- maximizing) firm want to sell? The answer: enough so that the price is equal to marginal cost. In other words, the marginal cost curve is the supply curve for the individual firm.

50.Long run equilibrium

Profit opportunities will attract new firms into the industry. With "free entry," the (short run) supply curve of the industry shifts to the right, causing the price to drop until the economic profits are eliminated.

This process of entry and price change is known as the "long run equilibrium process" and it continues until "long run equilibrium" is attained. Here is a picture of the firm and industry in "long run equilibrium:"

The new price, quantity, firm demand and short run supply are indicated by primes -- p', q'. Q', d', S'. We see that, at a slightly lower price, the individual firm is lower on the MC curve and produces a little less, but since there are more firms in the industry, the industry as a whole produces more.

We notice something else about the long-run equilibrium of a P-Competitive industry: each firm chooses the plant and equipment and productive capacity that gives the lowest average cost overall. This is shown by the above figure.

To see what this means, we might ask the following hypothetical question:

If an industry is to produce a certain amount of output, how should the output it be divided up among the different firms? More specifically, how many firms should share that production assignment? If there are very many firms, then each will be producing at a very small scale. They will not be taking advantage of the economies of scale, and cost per unit will be high. On the other hand, if there are very few firms, each will be producing on a very large scale, and suffering from diseconomies of scale, so, again, unit costs would be high. It would be best to balance the disadvantages of too large scale against the disadvantages of too small scale, and have just enough firms in the industry so that each is at the bottom of its average cost curve. The total cost of producing that output is then at a minimum.

We have seen that profits will lead to the entry of new firms into a P-competitive industry. This also works in the opposite direction: if firms in the industry were taking losses, supply in the industry will decrease. Firms in the industry might continue to produce in the short run, despite the losses. Remember that a profit-maximizing firm will continue to produce, in the short run, so long as it can cover its variable costs. However, in the long run, firms will drop out of the industry, if they continue to lose money. Thus, the supply curve of the unprofitable industry will shift to the left. But that in turn means prices will rise, and the long run equilibrium comes where the price is equal to average cost.

This discussion could apply to any economic activity to which there is "free entry." Economic profits – profits over and above the opportunity cost of capital – will attract new entrants. Returns less than the opportunity cost of capital will cause firms to get out of the industry. This will continue until the return to capital in that activity is the same as the opportunity cost of invested capital, that is, until profits are zero. We might call this principle "the Entry Principle". It says that in the long run, with free entry, returns to invested capital in an industry are just enough to offset the opportunity cost. When there are economic profits or losses, entry into the industry or exit of firms from it will shift the industry supply until economic profits are zero.