- •1.The role of Microeconomics

- •2. T he Subject Matter of Microeconomics

- •3. The use and limitation of Microeconomic theory

- •4. Economic methodology and microeconomic models

- •5. Equilibrium analysis

- •6. Positive and normative analysis

- •7. Demand Function(df): Individual df vs Market df

- •8. Change in Quantity Demanded, Change in Demand

- •9.Inferior, Normal and Superior Goods

- •10. Supply Function. Change in quantity supplied and Change in supply

- •11. Market equilibrium

- •12 Market Adjustment to Change: shifts of Demand and shift of Supply

- •Shifts of Demand

- •13. Changes in Both Supply and Demand

- •14. Cobweb theorem as an illustration of stable and unstable equilibrium

- •Unstable cobweb

- •Constant cobweb

- •15. Government regulation of a market

- •1. Price ceiling and Price floor

- •2. Impact of a tax on price and quantity

- •16. Price ceiling and Price floor

- •Impact of a tax on price and quantity

- •18. Demand elasticity. Price Elasticity Coefficient and Factors affecting price elasticity of demand

- •Table of price elasticity kinds of demand

- •19. Impact of demand elasticity on price and total revenue

- •20. Income elasticity of demand(yed)and Cross elasticity of demand

- •Categories of income elasticity:

- •21. The price elasticity of supply

- •22. Market adaptation to Demand and Supply changes in long-run and in short-run

- •24.Consumer Choice and Utility

- •25. Total Utility (tu) and Marginal Utility (mu)

- •26. Indifference curves.

- •28. The effects of changes in income and prices

- •29 Equimarginal Principle and Consumer equilibrium

- •30.Income Consumption Curve. Engel Curves

- •32. Income and Substitution Effects

- •The slutsky method

- •34. Production Function

- •35. Time and Production. Production in the Short-Run

- •36.Average, Marginal and Total Product. Law of diminishing returns

- •37. Producer’s behavior

- •38 Isoquant

- •39. Isocost

- •40. Cost minimization (Producer’s choice optimisation)

- •41.The treatment of costs in Accounting and Economic theory

- •Average costs. Marginal Cost

- •Long run average cost. Returns to Scale.

- •45Different market forms

- •48 The Competitive Firm and Industry Demand

- •49.Economic strategies of the firm in p-competitive m arket

- •50.Long run equilibrium

- •51.Definition of Monopoly Market. Causes of monopoly.

- •Patents and Other Forms of Intellectual Property

- •Control of an Input Resource

- •Capital-consuming technologies

- •Decreasing Costs

- •Government Grants of Monopoly

- •52.Monopoly Demand and Marginal Revenue

- •54. Monopoly Inefficiency

- •Negative consequences of Monopoly

- •55. "Natural" Monopoly

- •Government Ownership

- •56. Imperfect competition and Monopolistic competition

- •57. Profit Maximization in Monopolistic Competition

- •58. Oligopoly

- •59. Firms behavior in Oligopoly

- •60 Kinked Demand Model

- •61 Competitive factor markets

- •62 The Demand for Inputs

- •63 Supply of Inputs

- •64. Equilibrium in a Market for Inputs

- •Labour market

- •Land market

- •Capital market

- •65. Labor market: labor demand and supply of labor.

- •66.The Marginal productivity approach to demand for labor.

- •Equilibrium and disequilibrium on labor market.

- •68. Particularities of Land market. Differential rent. Marginal productivity of land.

- •69 Main characteristics of Asset market. Demand for capital. Interest rate.

- •70. Discounted value. Conceptions of Net present value (npv) and future present value (fv).

- •The role of Microeconomics

- •T he Subject Matter of Microeconomics

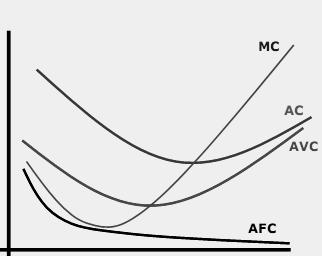

Average costs. Marginal Cost

Average fixed cost (AFC) This is the quotient of fixed cost divided by output.

Average variable cost (AVC) This is the quotient of average cost divided by output.

Average total cost (ATC or AC) This is the quotient of total cost divided by output.

The average fixed costs decline as the fixed costs are "spread over more units of output." For large outputs, however, average variable costs rise pretty steeply. ." The average total cost, dominated by fixed costs for small output, declines at first, but as output increases, fixed costs become less important for the total cost and variable costs become more important, and so, after reaching a minimum, average total cost begins to rise more and more steeply.

Marginal

cost is defined as:

![]()

As

usual, Q stands for (quantity of) output and C for cost, so

![]() Q

stands for the change in output, while

C

stands for the change in cost. As usual, marginal

cost

can be interpreted as the additional cost of producing just one more

("marginal") unit of output.

Q

stands for the change in output, while

C

stands for the change in cost. As usual, marginal

cost

can be interpreted as the additional cost of producing just one more

("marginal") unit of output.

This

is a good representative of the way that economists believe firm

costs vary in the short run:

The output produced is measured by the distance to the right on the horizontal axis. The marginal cost rises to cross average cost at its lowest point.

The point is illustrated by the following table, which extends the marginal cost table in an earlier page to show the price and the profits for the example firm.

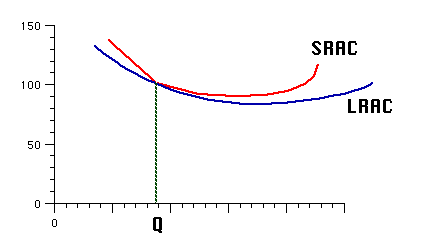

Long run average cost. Returns to Scale.

Therefore, the long run average cost (LRAC) – the lowest average cost for each output range – is described by the "lower envelope curve," shown by the thick, shaded curve that follows the lowest of the three short run curves in each range.

More realistically, an investment planner will have to choose between many different plant sizes or firm scales of operation, and so the long run average cost curve will be smooth, something like this:

As shown, each point on the LRAC corresponds to a point on the SRAC for the plant size or scale of operation that gives the lowest average cost for that scale of operation.

Returns to Scale The cost per unit changes as the scale of operation or output size changes. Here is some terminology to describe the changes:

average cost decreases as output increases in the long run = increasing returns to scale = decreasing cost

average cost is unchanged as output varies in the long run = constant returns to scale = constant costs

average cost increases as output increases in the long run =decreasing returns to scale = increasing costs

Here are pictures of the average cost curves for the three cases:

1 .

Increasing returns to scale = decreasing cost

.

Increasing returns to scale = decreasing cost

It is necessary to use less productive methods to produce the smaller amounts. Thus, costs increase less than in proportion to output – and average costs decline as output increases.

Increasing Returns to Scale is also known as "economies of scale" and as "decreasing costs."

2. Constant returns to scale = constant costs

O ne

machinist used one machine tool to do a series of operations to

produce one item of a specific kind - and to double the output you

had to double the number of machinists and machine tools.

Constant

Returns to Scale is also known as "constant costs.

ne

machinist used one machine tool to do a series of operations to

produce one item of a specific kind - and to double the output you

had to double the number of machinists and machine tools.

Constant

Returns to Scale is also known as "constant costs.

3. Decreasing returns to scale = increasing costs

Decreasing

returns to scale are associated with problems of management of large,

multi-unit firms.

. Decreasing Returns to Scale is also known as "diseconomies of scale" and as "increasing costs".