- •1.The role of Microeconomics

- •2. T he Subject Matter of Microeconomics

- •3. The use and limitation of Microeconomic theory

- •4. Economic methodology and microeconomic models

- •5. Equilibrium analysis

- •6. Positive and normative analysis

- •7. Demand Function(df): Individual df vs Market df

- •8. Change in Quantity Demanded, Change in Demand

- •9.Inferior, Normal and Superior Goods

- •10. Supply Function. Change in quantity supplied and Change in supply

- •11. Market equilibrium

- •12 Market Adjustment to Change: shifts of Demand and shift of Supply

- •Shifts of Demand

- •13. Changes in Both Supply and Demand

- •14. Cobweb theorem as an illustration of stable and unstable equilibrium

- •Unstable cobweb

- •Constant cobweb

- •15. Government regulation of a market

- •1. Price ceiling and Price floor

- •2. Impact of a tax on price and quantity

- •16. Price ceiling and Price floor

- •Impact of a tax on price and quantity

- •18. Demand elasticity. Price Elasticity Coefficient and Factors affecting price elasticity of demand

- •Table of price elasticity kinds of demand

- •19. Impact of demand elasticity on price and total revenue

- •20. Income elasticity of demand(yed)and Cross elasticity of demand

- •Categories of income elasticity:

- •21. The price elasticity of supply

- •22. Market adaptation to Demand and Supply changes in long-run and in short-run

- •24.Consumer Choice and Utility

- •25. Total Utility (tu) and Marginal Utility (mu)

- •26. Indifference curves.

- •28. The effects of changes in income and prices

- •29 Equimarginal Principle and Consumer equilibrium

- •30.Income Consumption Curve. Engel Curves

- •32. Income and Substitution Effects

- •The slutsky method

- •34. Production Function

- •35. Time and Production. Production in the Short-Run

- •36.Average, Marginal and Total Product. Law of diminishing returns

- •37. Producer’s behavior

- •38 Isoquant

- •39. Isocost

- •40. Cost minimization (Producer’s choice optimisation)

- •41.The treatment of costs in Accounting and Economic theory

- •Average costs. Marginal Cost

- •Long run average cost. Returns to Scale.

- •45Different market forms

- •48 The Competitive Firm and Industry Demand

- •49.Economic strategies of the firm in p-competitive m arket

- •50.Long run equilibrium

- •51.Definition of Monopoly Market. Causes of monopoly.

- •Patents and Other Forms of Intellectual Property

- •Control of an Input Resource

- •Capital-consuming technologies

- •Decreasing Costs

- •Government Grants of Monopoly

- •52.Monopoly Demand and Marginal Revenue

- •54. Monopoly Inefficiency

- •Negative consequences of Monopoly

- •55. "Natural" Monopoly

- •Government Ownership

- •56. Imperfect competition and Monopolistic competition

- •57. Profit Maximization in Monopolistic Competition

- •58. Oligopoly

- •59. Firms behavior in Oligopoly

- •60 Kinked Demand Model

- •61 Competitive factor markets

- •62 The Demand for Inputs

- •63 Supply of Inputs

- •64. Equilibrium in a Market for Inputs

- •Labour market

- •Land market

- •Capital market

- •65. Labor market: labor demand and supply of labor.

- •66.The Marginal productivity approach to demand for labor.

- •Equilibrium and disequilibrium on labor market.

- •68. Particularities of Land market. Differential rent. Marginal productivity of land.

- •69 Main characteristics of Asset market. Demand for capital. Interest rate.

- •70. Discounted value. Conceptions of Net present value (npv) and future present value (fv).

- •The role of Microeconomics

- •T he Subject Matter of Microeconomics

36.Average, Marginal and Total Product. Law of diminishing returns

In the short run, the relationship between the physical inputs and output can be describes from several perspectives.

T otal

product

(TP

or Q)

is the total output. Q or TP = f(L) given a fixed size of plant and

technology. Average

product

(APL)

is the output per unit of input. AP

= TP/L

(in this case the output per worker). APL is the average product of

labour. Marginal

product (MPL)

is the change in output "caused" by a change in the

variable input (L), so MPL

= ∆Q/∆L.Over

the range of inputs there are four possible relationships between Q

and L

otal

product

(TP

or Q)

is the total output. Q or TP = f(L) given a fixed size of plant and

technology. Average

product

(APL)

is the output per unit of input. AP

= TP/L

(in this case the output per worker). APL is the average product of

labour. Marginal

product (MPL)

is the change in output "caused" by a change in the

variable input (L), so MPL

= ∆Q/∆L.Over

the range of inputs there are four possible relationships between Q

and L

1) TP(Q) can increase at an increasing rate. MP will increase (from O to LA.)

2) TP in inflection point- MP max. TP may increase at a constant rate-MP will remain constant in this range.

3) TP might increase at a decreasing rate- MP fall.(from LA to LB)

4) If "too many" units of the variable input are added to the fixed input, TP can decrease, in which case MP will be negative.

The average product (AP) is related to both the TP and MP. At LH level of input, APL is a maximum and is equal to the MPL. When the MP is greater than the AP, MP "pulls" AP up. When MP is less than AP, it "pulls" AP down. MP will always intersect the AP at the maximum of the AP.

Law of diminishing returns means that as the level of a variable input rises in a production process in which other inputs are fixed, output ultimately increases by progressively smaller increments. The law of diminishing marginal product says that if we keep increasing the employment of an input, with other inputs fixed, eventually a point will be reached after which the resulting addition to output (i.e., marginal product of that input) will start falling.

A somewhat related concept with the law of diminishing marginal product is the law of variable proportions. It says that the marginal product of a factor input initially rises with its employment level. But after reaching a certain level of employment, it starts falling.

The reason behind the law of diminishing returns or the law of variable proportion is the following. As we hold one factor input fixed and keep increasing the other, the factor proportions change. Initially, as we increase the amount of the variable input, the factor proportions become more and more suitable for the production and marginal product increases. But after a certain level of employment, the production process becomes too crowded with the variable input and the factor proportions become less and less suitable for the production.

37. Producer’s behavior

Producers try to maximize profit, provides the motivation for their behavior. They must make plans while confronting uncertainty about:

-Consumer demand, -Resource availability, -Intentions of other firms in the, -Industry. For making decision producers use isoquant and isocost.

Isoquant is just an alternative way of representing the production function. Consider a production function with two inputs factor 1 and factor 2. An isoquant is the set of all possible combinations of the two inputs that yield the same maximum possible level of output. Each isoquant represents a particular level of output and is labelled with that amount of output.

Isocost line – a line that represents alternative combinations of factors of production that have the same costs. Or in other words, the combinations of inputs (K, L) that yield the producer the same level of output.

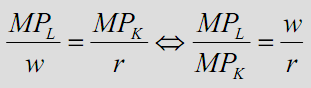

Cost minimization (Producer’s choice optimisation)

The least cost combination of inputs for a given output occurs where the isocost curve is tangent to the isoquant curve for that output.

The slopes of the two curves are equal at that point of tangency.

The firm is operating efficiently when an additional output per dollar spent on labor equals the additional output per dollar spent on machines.So that marginal product per dollar spent should be equal for all inputs: