- •1.The role of Microeconomics

- •2. T he Subject Matter of Microeconomics

- •3. The use and limitation of Microeconomic theory

- •4. Economic methodology and microeconomic models

- •5. Equilibrium analysis

- •6. Positive and normative analysis

- •7. Demand Function(df): Individual df vs Market df

- •8. Change in Quantity Demanded, Change in Demand

- •9.Inferior, Normal and Superior Goods

- •10. Supply Function. Change in quantity supplied and Change in supply

- •11. Market equilibrium

- •12 Market Adjustment to Change: shifts of Demand and shift of Supply

- •Shifts of Demand

- •13. Changes in Both Supply and Demand

- •14. Cobweb theorem as an illustration of stable and unstable equilibrium

- •Unstable cobweb

- •Constant cobweb

- •15. Government regulation of a market

- •1. Price ceiling and Price floor

- •2. Impact of a tax on price and quantity

- •16. Price ceiling and Price floor

- •Impact of a tax on price and quantity

- •18. Demand elasticity. Price Elasticity Coefficient and Factors affecting price elasticity of demand

- •Table of price elasticity kinds of demand

- •19. Impact of demand elasticity on price and total revenue

- •20. Income elasticity of demand(yed)and Cross elasticity of demand

- •Categories of income elasticity:

- •21. The price elasticity of supply

- •22. Market adaptation to Demand and Supply changes in long-run and in short-run

- •24.Consumer Choice and Utility

- •25. Total Utility (tu) and Marginal Utility (mu)

- •26. Indifference curves.

- •28. The effects of changes in income and prices

- •29 Equimarginal Principle and Consumer equilibrium

- •30.Income Consumption Curve. Engel Curves

- •32. Income and Substitution Effects

- •The slutsky method

- •34. Production Function

- •35. Time and Production. Production in the Short-Run

- •36.Average, Marginal and Total Product. Law of diminishing returns

- •37. Producer’s behavior

- •38 Isoquant

- •39. Isocost

- •40. Cost minimization (Producer’s choice optimisation)

- •41.The treatment of costs in Accounting and Economic theory

- •Average costs. Marginal Cost

- •Long run average cost. Returns to Scale.

- •45Different market forms

- •48 The Competitive Firm and Industry Demand

- •49.Economic strategies of the firm in p-competitive m arket

- •50.Long run equilibrium

- •51.Definition of Monopoly Market. Causes of monopoly.

- •Patents and Other Forms of Intellectual Property

- •Control of an Input Resource

- •Capital-consuming technologies

- •Decreasing Costs

- •Government Grants of Monopoly

- •52.Monopoly Demand and Marginal Revenue

- •54. Monopoly Inefficiency

- •Negative consequences of Monopoly

- •55. "Natural" Monopoly

- •Government Ownership

- •56. Imperfect competition and Monopolistic competition

- •57. Profit Maximization in Monopolistic Competition

- •58. Oligopoly

- •59. Firms behavior in Oligopoly

- •60 Kinked Demand Model

- •61 Competitive factor markets

- •62 The Demand for Inputs

- •63 Supply of Inputs

- •64. Equilibrium in a Market for Inputs

- •Labour market

- •Land market

- •Capital market

- •65. Labor market: labor demand and supply of labor.

- •66.The Marginal productivity approach to demand for labor.

- •Equilibrium and disequilibrium on labor market.

- •68. Particularities of Land market. Differential rent. Marginal productivity of land.

- •69 Main characteristics of Asset market. Demand for capital. Interest rate.

- •70. Discounted value. Conceptions of Net present value (npv) and future present value (fv).

- •The role of Microeconomics

- •T he Subject Matter of Microeconomics

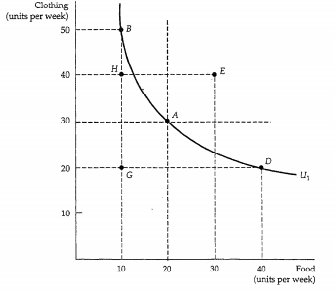

26. Indifference curves.

Indifferent curve is a curve showing the different combinations of two goods that provide the same satisfaction or total utility to a consumer.

Properties of Indifference Curves:

1. Every bundle is on some indifference curve;

2. Two indifference curves never cross;

3. Indifference curve slopes downward;

4. A bundle that has more of all goods is on a higher indifference curve.

A

different level of satisfaction or total utility can be shown in

indifference map - a selection of indifference curves.

A

different level of satisfaction or total utility can be shown in

indifference map - a selection of indifference curves.

One more characteristic of indifference curves is marginal rate of substitution (MRSxy). MRSxy is the rate at which a consumer is willing to substitute one good for another good without a change in total utility. The MRS equals the slope of an indifference curve at any point on the curve. It shows how much more of a good would a consumer require to compensate them for loss of a unit of another good. MRS measures willingness to make this substitution:

MRSxy= -ΔY/ΔX

On the graph we can see the way of MRS calculating.

The rate of MRS and therefore the form of indifferent curve depends on the relationships between examined goods.

For example, MRS for perfect substitutes is constant and hence the indifference curve looks like straight line (Picture (a)). And if goods are perfect complements MRS for them is zero, the indifference curves look like right angles(Picture (b)).

27.Budget ConstraintWhen goods are “free,” an individual should consume until the MU of a good is 0. This will insure that total utility is maximized. When goods are priced above zero and there is a finite budget, the utility derived from each expenditure must be maximized.

An individual will purchase a good when the utility derived from a unit of the good X (MUX) is greater than the utility derived from the money used to purchase the good (MU$). Let the price of a good (PX) represent the MU of money and the MUX represent the marginal benefit (MBX) of a purchase. When the PX > MBX, the individual should buy the good. If the PX < MBX, they should not buy the good. Where PX = MBX, they are in equilibrium, they should not change their purchases.

Given a finite budget (B) or income (I) and a set of prices of the goods (PX , PY, PN) that are to be purchased, a finite quantity of goods (QX, QY, QN) can be purchased. The budget constraint can be expressed,

B=PxQx + PyQy +…+ PnQn

Where B – budget, Pn – price of Nth good, Qn–quantity of Nth good

For one good the maximum amount that can be purchased is determined by the budget and the price of the good

Qx that can be perchased = Budget/Price=B/Px

The combinations of two goods that can be purchased can be shown graphically. The maximum of good X that can be purchased is B/ Px, the amount of the Y good is B/ Py. All possible combinations of good X and Y that can be purchased lie along (and inside) a line connecting the X and Y intercepts. This is shown in Figure.

The slope of the budget line equals the ratio of the price of good X on the horizontal axis divided by the price of good Y on the vertical axis.