- •Table of content

- •Introduction

- •Introduction to theoretical Background

- •1.2. Forex

- •1.2.1 Defining of Forex

- •1.2.2 History of Forex

- •1.2.3 Forex market participants

- •1.2.4 Daily turnover in Forex market

- •1.2.5 Types of exchange rate

- •Managed float regime

- •4). Free float regime

- •1.3.6 Factors, that effect to foreign exchange

- •1.3.7 Foreign exchange transactions

- •Forward transaction

- •Options

- •Futures

- •1.3 Risk management

- •1.3.1 The history of the theory of risk management

- •1.3.2 Defining of risk management

- •1.3.3 Foreign exchange risk

- •1.3.4 Types of foreign exchange risk

- •1.3.8 Foreign Exchange Risk Management

- •1.3.9 Stages and methods Foreign Exchange Risk Management

- •1.3. 10 Methods to reduce the foreign exchange risk

- •1.3.11 Methods of insurance from foreign currency risks

- •1. Балабанов и.Т. «Риск-менеджмент» – Москва.: Финансы и статистика, 1997.

- •1. Жуков е.Ф. «Банки и банковские операции» – Москва.: юнити, 1997.

- •1.3.12 Problems of foreign exchange risk management

1. Жуков е.Ф. «Банки и банковские операции» – Москва.: юнити, 1997.

In industrialized countries, specialized expert consulting firms are engaged in professional investors and exporters. Offering recommendations on the optimal hedging and investment requirements in foreign currency (when, for such period, in such currencies). In addition, the banks themselves, having a staff of analysts' forecasts and traffic courses are actively trying to offer services for the integrated management of client risk. The process of hedging a significant impact on supply and demand in the forward market, exercising pressure on the rates of certain currencies, especially during difficult to predict trends in the development of their courses.

Another method of managing foreign exchange risk is to analyze the movement of exchange rates. Such an analysis is fundamental and technical.

Fundamental analysis of the movement of exchange rates is based on the premise that the main change is occurring under the influence of macroeconomic factors for the development of the economies of the issuers of exchange. Analysts. Ranking to the fundamentalists. Closely monitor on a regular basis underlying macroeconomic performance of individual countries and predict the movement of exchange rates in the long term.

Macro-economic factors can affect only 3 4 types of currency. For the prediction of reference for the exchange rate changes are usually analyzed baseline and foreign exchange rates.

Technical analysis is based on the proposition that the macroeconomic performance in the short and medium term, little effect on the movements of exchange rates. Furthermore, exchange rates can be predicted with extreme accuracy only by the method of analysis, which is based on a mathematical system.

Technical analysis is a tendency to currency fluctuations and gives signals to buy and sell.

1.3.12 Problems of foreign exchange risk management

Bank conducting foreign exchange transactions, meets with two risks:

1) The impact of adverse movements in exchange rates or interest rates in the open position.

2) The bankruptcy of the second party before was made commitments to spot, forward or deposit liabilities. Consideration of losses incurred by a few large banks shows that these risks can be classified under two headings:

1. Operations performed with the full knowledge and authorization of the Board or the Chief Executive Officer of the bank.

2. The operations performed by dealers, department of foreign currency transactions without authorization or outside of the board of the bank.

Moreover, when opened by a large speculative positions. It was obviously a significant increase in business volume.

Since the total volume of business that the bank may conduct in the international market depends on its reputation, status, and hence ability to pay, it is virtually impossible for other market participants to establish on what suspicious transactions based standards.

Similarly, in the light of how easy it can mean large speculative positions in a relatively short period of time without causing suspicion, it would be wrong to take into account the size of individual operations as an indication of the usual number of the dealing transactions.

These aspects of dealing, which can show a second side of the transaction or the bank - the reporter that there, may be dealing operations, which have not been received credentials, can be recognized as follows:

Sudden increase in trade volumes compared to those who are accustomed to the bank or branch, however, be aware that when it comes to large banks outlined above, it may be questionable warning;

The necessary increase in turnover of the bank with the banks - correspondents on clearing accounts, especially the private provision of overdrafts. And as the turnover on clearing accounts provides a total amount over a number of transactions, which by themselves cannot be trusted by the other parties. It can be a very useful conclusion;

Changes in the normal form of the commission dealing. Open positions should be applied only when the supply of currency forwards, but can also be applied when buying / selling foreign currency at spot, which will then be exchanged every day for a short period of time. Such operations lead to an increase in their numbers in the market, as well as an increase in turnover in clearing accounts. The risk of loss may occur when the bank is in a position of fixed-term net foreign exchange transactions. Although there is no net open position, as the total amount of purchases corresponds to the total amount of sales, but there is a risk for staggered terms of forward transactions;

Do not receive confirmation of the transaction, especially on forward transactions;

Do not receive a satisfactory response to requests for confirmation of unpaid contract;

A desire to lead the transaction at a price that is deliberately set at a level that corresponds to the market. To avoid the providence of operations with certain banks, the dealer can set a bid with a large spread between the buying and the selling price. If another bank conducts transactions in particular of the swap, the more likely it is a bank, which now faces the challenges of their operations;

Chapter 2

2.1 Introduction to analysis of Forex market nature and risk management in Forex

The chapter will analyze the current condition of the currency market and its development in the post-Soviet space and Kazakhstan. The second analysis concerns directly topics of the diploma about risk management in the foreign exchange market. All analyzes were carried off only on the market traders.

In section analysis of the current condition of the currency market will analyze the results of the survey, in which participated 3,000 people. Most of them are individual traders and managers of investors’ accounts, institutional traders, and investors, present in small quantities. The survey was conducted in the famous forums, blogs and informational portals in which traders discusses and analyzes the market situation. The survey involved traders in several countries. The analysis will find out the influence of factors such as: mobile trading, how Internet and modern technology has changed availability and speed of execution of trading orders, etc. The second section will consider the development and prospects of the development of the foreign exchange market in Kazakhstan.

The third section will analyze the management of risks in the forex market. A survey among traders, which involved 47 people, determines how important it is that traders refer risk management as an emotional and capital. The survey results show how effectively acts in terms of management. And in this section, we consider the risk managing as emotional and in the form of money management. Since emotional risk is a pure human factor, which disappears with experience. We will analyze the effectiveness of money management to trade foreign exchange market, because money management specialize form of risk management. Capital risk management sole way to reduce the risks in the currency market.

2.2 Forex market survey

We know that foreign exchange market is a form of exchange for the global decentralized trading of international currencies. Financial centers around the world function as anchors of trading between a wide range of different types of buyers and sellers around the clock, with the exception of weekends. And in this market participated also individual trader, who trade at home or have internet access wherever. Forex trading with the development of the Internet has become more accessible to common people who would like to make a profit from the market. And with the increase in the number of market participants over the past 10 years has increased the liquidity of the market by almost 80%. And this factor, the factor of liquidity attracts more people into the market. But every Trader Should Know with increase in liquidity always increases the risks. Not quiet market always increases in human emotionality, and emotion is the first enemy of the profitable trades. But before analyzing risk and risk management in Forex would like to know who they are, who they are traders. How trades, whence trades, the time they spend in trading, how analyze the market, the average experience of these people, how many earn in the market, how many invest, how take risks themselves, what leverage they use, and why they are trades. By learning the answers of these questions; we learn the essence of the market, the psychology of the market, why it is so attractive. By answering these questions, we construct the image of one country of market, crowd country the market, and those who stand out from the crowd.

This figure shows that 84% of traders are trade from home, and the remaining 16% from the offices of brokerage companies, or hedge funds. This is a vivid example of what; with the development of the Internet access to trading has absolutely no restrictions.

Figure2. You trade from

From the next two figures we can see that the majority of traders (60%) trade half-time, and a smaller part of respondents is a Forex trader with a full-time job (40%). Almost 30% trade over 15 hours per week, 19% from 10 to 15 hours, 30% trade from 5 to 10 hours and only 22% less than 5 hours in a week.

Figure3. Do you trade the Forex Market?

Figure4. How many hours do you trade Forex in a week

A significant number - more than 33% of traders - use in their work mobile technologies, such as smart phones and iPads, this is quite a big rate. Considering that Mobile Trading has become available recently and its temporary inconvenience comparison with the computers.

Figure5. Whether you are tracking the situation in the Forex market and (or) are trading through mobile technology (smart phones, iPAD, and so on)?

Approximately 36% of traders say they are working with the banks to trade in the Forex market, while 64% opted for dealing broker. It shows the result of advertising from dealing centers. When choosing a platform 40% referred to the main criterion reliability, spread 29%, ease of use - 16% speed - 11%

Figure6. When trading in the Forex market you are working with

Figure7. when choosing a trading platform a major factor for you is:

Some traders spend significant amounts of money to buy books, attend seminars and purchase DVD. More than half (54%) spent on training less than $ 1,000. Almost 20% of traders spent on it over 5000 dollars, about 10% - more than 10 thousand dollars.

Figure.8 how much money have you invested in the courses, to purchase books, DVD’s on Forex?

Traders get their information from a large number of sources, financial sites on the Internet rank first place - 63% (to respondent was allowed to choose more than one answer.) The second place is taken by online forums - 38%, the information that provides the bank or brokers - 34%, blogs - 33%, traders' network - 26%. Traders also indicate news agency Bloomberg and Reuters (19%), newspapers (17%), magazines (15%).

Figure.9 where do you get information on which trade?

Traders are very loyal to Forex, as their choice for trading. 63% of respondents say that it is the sole tool which they trade.

Only 37% of respondents are traded other instruments. Of these, 71% of trades in stocks 47% of commodity futures, options 31% and 20% fixed income securities. According to the results of this survey can be wondering why the majority of Forex traders trade only in this market. Analyzing the financial markets, we can say that all beginners start from Forex trading. It is characterized by high liquidity; a minimum capital investment, easies to analyze relatively other financial markets.

Figure.10 Is a Forex the single asset class that you trade?

Figure.11 What other tools do you use in trading?

Significant part of traders (34%) believes that the profit that can be obtained in trending markets - the main reason why they chose the forex market. Thus, surprisingly, sufficiently a high percentage of respondents (16%) who argues that the fact that "forex is the most interesting and intelligent target for investment." For 15% of the determining factor for the choice of the Forex market is a work 24 hours a day, for 13% lower initial capital requirements, for the 12% liquidity, for 9% high leverage.

Figure.12 The main reason that you are trading in the Forex market

The overwhelming majority of respondents described themselves as individual traders (91%). 6% identified themselves as managers of accounts, institutional traders 2%.

Figure.13 Which type of trader are you?

Favorite pair of retail forex traders EUR / USD, more than 51% of traders are choosing this pair. As retail traders often trade GPB / USD - 18%, EUR / JPY - 6%, GBP / JPY = 5%.

Figure.14 which currency pair are you trading most often?

Most traders focus their attention on a small number of currency pairs. 66% said that trade from 1 to 5 pairs. About 24% of trades in 5-10 pairs, and only 5% of trades in 10-15 pairs. 5% of traders are trading more than 15 pairs.

Figure.15 How many currency pairs are you trading?

Traders are mostly determined as the main objective of trade speculation (83%), 8% of responder says that goal of Forex trading – hedging. In 8% of hedger include instructional traders and investing capital managers.

Figure16. What is the main purpose of your trade in the Forex market?

More than half of traders (53%) using a combination of fundamental and technical strategies, only 36% based exclusively on the technical strategy and 8% of traders are using exclusively fundamental strategy. 3% of responders use other strategies, as price action, volume spread analysis.

Figure17. How to determine your trading strategy on Forex?

Half of the traders, responding to questions, said that the use of short-term trading style. 26% defined their style as oscillatory trading; scalping is engaged in 17%, long-term trading strategies using 7% of respondents. From this graph we can know that 90% of traders are trade in intraday. Second graph confirm last words. Regarding, short-term deal concludes the majority of respondents. 49% of them say that their transactions are intraday or last a few days, 42% hold positions from several minutes to several hours. Only 4% reported that their usual deal lasts for several weeks.

Figure18. What is your trading style?

Figure19. What is the average length of your deal?

47% of respondents said that the average profit per trade is 0-5%, and 32% of traders said that the average profit from them 5-10%, a significant percentage - 22% of respondents said that earns more than 10% profit on the trade.

Figure20. What is your average profit per trade?

The majority of traders (65%) reported an average loss of 0-5% per trade, 21% of traders lose out each deal 5-10% of capital, and 14% of the traders average loss more than 10%. Traders, who loss 10% in one deal are very risky, but at the time experienced traders. If they generally have profit.

Figure21. What is your average loss?

The outcome of the most respondents the last 12 months were positive. The largest group of traders - 37% stated that during this period the net profit amounted to 0-25%, 15% of respondents claim to have received a net profit in the amount of 25-50%, 11% of respondents have made a profit of 50 to 100%. Only 27% of respondents reported a loss in the amount of 0-25%.

Figure22. What are the results of your work in the last 12 months?

Traders are widely used leverage. The most popular leverage was 1:50-1:100, about 15% use leverage more than 1:100. A minority of traders use a small leverage. Leverage from 1:1 to 1:5 using 20% of respondents, from 1:5 to 1:10 - 13% of respondents, from 1:10 to 1:20 - 10% of those surveyed responders, 10% prefer to leverage from 1:20 to 1:50. Leverage that give Forex unbillable, at the same time attractive to traders. But if use money management correctly, it is not risk to trade.

Figure23. What leverage do you use?

Whereas three-quarters of traders said that is not engaged in hedging - not open position against the open position. 74,1% traders claims that open positions against already open.

Figure24.Do you open a position against an already open?

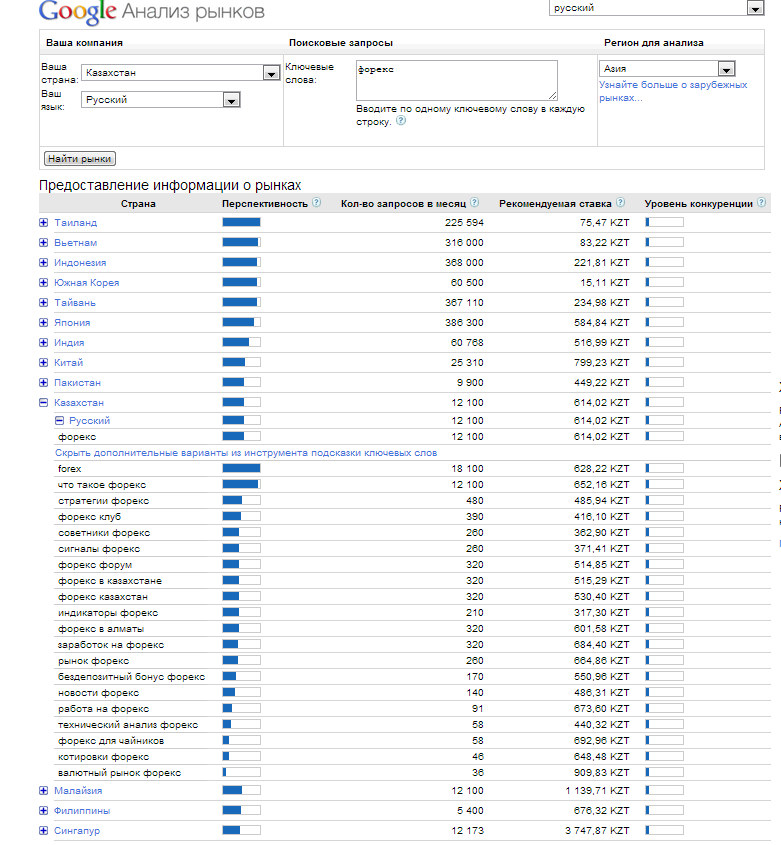

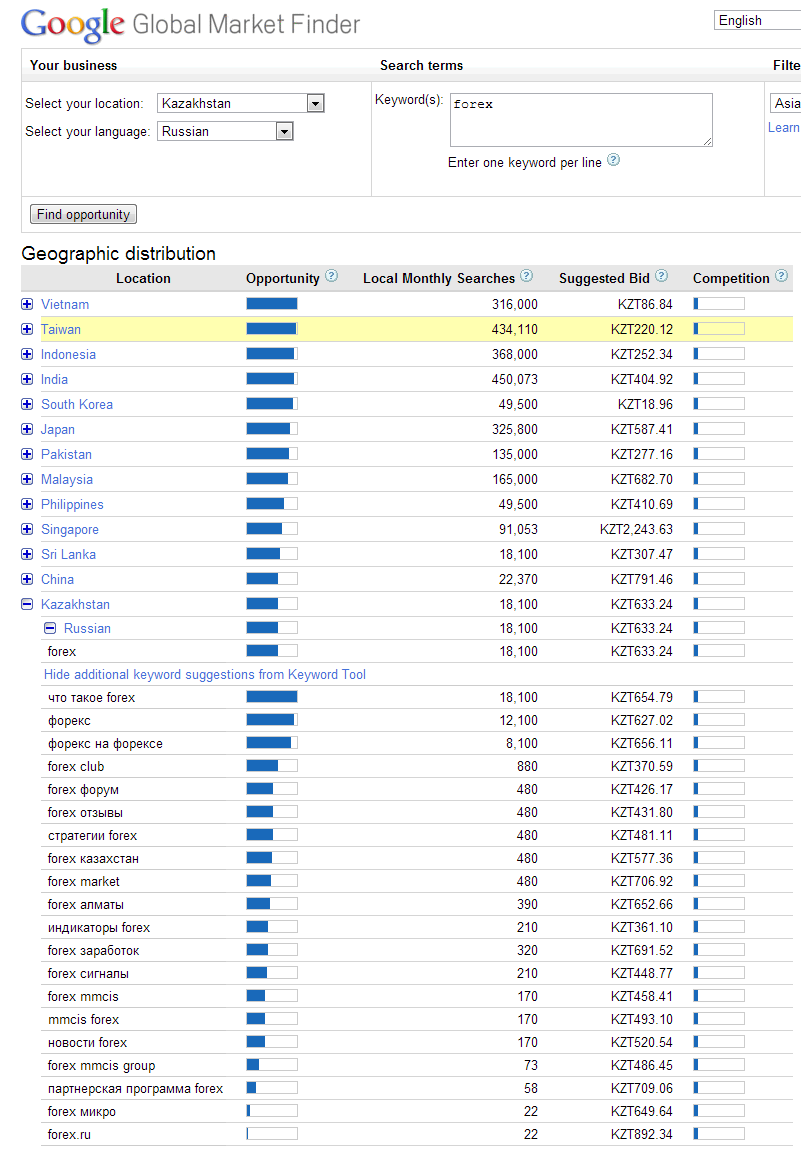

2.2.1 Forex market survey in case of Kazakhstan

2.3 Risk managing analysis in Forex market

|

|

|

1 |

Risk management major factor in the Forex market |

4,9 |

2 |

The risk in trading Forex first of all for you is |

4 |

3 |

Are you managing risk at trade? |

3,6 |

4 |

The risk of trading in the Forex market is relatively other financial markets |

3,8 |

5 |

Money management solves your problems with risks |

3,6 |

6 |

Are you set the stop loss in Forex trading? |

4,3 |

7 |

How do you define a stop loss? |

3,8 |

8 |

I do not set a stop loss, because |

3 |

9 |

Do you think that using high leverage is the risk? |

3,9 |

10 |

Do you diversify market entry? |

3,2 |

11 |

What is the main purpose of your trade in the forex market? |

3,6 |

12 |

How to determine your trading strategy on Forex? |

3,2 |

13 |

Do you open a position against an already open? |

2,9 |

|

|

3,6 |

2.3.1 Money management as key factor of profitable trade

2.4 Summary

Chapter 3 Findings and Suggestions

3.1 Introduction

3.2 Finding

3.3 Recommendation

3.4 Summary of the study

Conclusion

Implication

Future research

Summary

REFERENCES

APPENDICES