- •Unit 9 business integration tendencies

- •How companies compete with each other

- •Vocabulary tasks

- •Competition

- •Competitive forces

- •Industries and their players

- •Mergers and acquisitions

- •Business Integration

- •Types of Business Integration

- •Forward and Backward Integration

- •Which reasons for m&As result in adding shareholder value and which do not? Fill in the table below and comment on it.

- •How to protect a company against a hostile acquisition

- •Choose the Russian equivalents for the English terms in the left-hand column.

- •Takeover Defences

- •Swot analysis

- •Round-table session

Swot analysis

internal factors competitors external factors core competencies

A SWOT analysis is used by management to analyze and estimate a company’s economic situation in order to reduce a risk of being acquired. SWOT stands for strengths, weaknesses, opportunities and threats. In formulating its strategy, a company should look at its strengths and weaknesses in relation to its 1) …, which characterise the current situation of the company. For example, a good sales team is a strength and poor internal communication is a weakness. The company should also look at future opportunities and threats in its environment: the strength of competitors, government regulation, the way that society is changing etc. These are 2) … . For example, a change in a country’s legislation on broadcasting might present an opportunity for a group that wants to buy a television company there. The change would probably also pose a threat to existing broadcasters. The way that a company organises and combines its human resources, know-how, equipment and other assets are 3) … .These are 4) … .

Concept Check

1. In what terms can takeovers be described? Why?

3. What is the difference between various defensive tactics?

5. What does SWOT stand for? What is its role in protecting a company against hostile acquisitions?

Key learning points

|

Round-table session

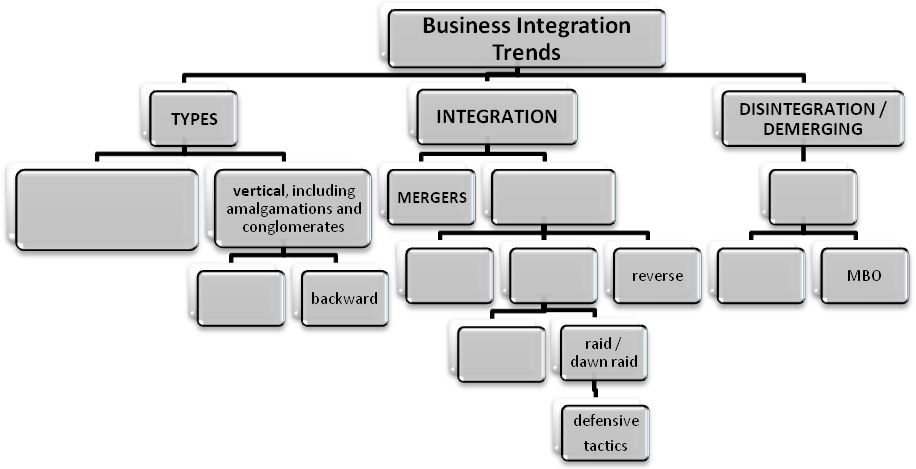

Use the texts in Readings II-III to complete the cluster diagramme below. Add boxes if necessary.

Make a Power Point presentation on business integration taking into consideration the ideas reflected in the diagramme above.

Hold a round-table session to discuss the problems of business integration. Use the presentation to support your viewpoint. Do not forget to mention such things as

possibilities of investing money, reasons for and against M&As;

types of business integration;

a merger and its consequences;

kinds of takeovers;

leveraged buyouts and management buyouts; and

defences against a hostile takeover.