- •Unit 9 business integration tendencies

- •How companies compete with each other

- •Vocabulary tasks

- •Competition

- •Competitive forces

- •Industries and their players

- •Mergers and acquisitions

- •Business Integration

- •Types of Business Integration

- •Forward and Backward Integration

- •Which reasons for m&As result in adding shareholder value and which do not? Fill in the table below and comment on it.

- •How to protect a company against a hostile acquisition

- •Choose the Russian equivalents for the English terms in the left-hand column.

- •Takeover Defences

- •Swot analysis

- •Round-table session

Types of Business Integration

|

VERTICAL INTEGRATION |

|

HORIZONTAL INTEGRATION |

|

Production

Processing

Distribution |

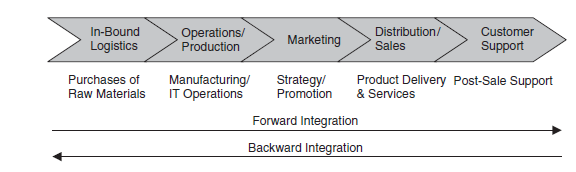

Vertical integration (a vertical merger or acquisition) in its turn can be of two types: backward and forward. Integration with the supplier is backward, and integration with the customer is regarded forward (See Figure 2).

Figure 2.

Forward and Backward Integration

Through growth, consolidations, and other means, a company can grow into a multinational company, a large organisation with branches in several countries. Multinational organisations are a major force in globalization; commerce is conducted without regard to national boundaries. When you use Google to do an Internet search, you are using the services of a multinational company. Google’s headquarters are in Mountain View, California, but it has branch offices in many other countries. Coca-Cola, McDonald’s, Nike, and Sony are just a few examples of multinational or transnational companies. Such companies have many beneficial effects. They provide new jobs, goods and services around the world and spread technological advances. When such companies open businesses in poorer countries, the jobs and the tax revenues help raise the standard of living. However, multinational companies can also create problems. Some build factories and give harmful waste products in host countries. Others operate factories where employees work long hours in unsafe working conditions and get low wages.

Takeovers

There are a variety of reasons for an acquiring company to wish to purchase another one. The target company may simply be very reasonably priced and the acquiring company may decide that in the long run it will make money by purchasing the target company now. Or an acquiring company may decide to purchase a company that has good distribution capabilities in new areas which the acquiring company can utilise for its own products. A target company might be attractive because it allows the acquiring company to enter a new market without taking on the risk, time and expense of starting up a new division.

Takeovers can be held in different forms. A friendly takeover consists of a straight buyout of a company and happens frequently. Normally, the acquirer company (the bidder) offers the target company a takeover bid – a public offer to a target company’s shareholders to buy their shares, at a particular price during a particular period. It is a popular way to purchase a majority of shares of another company. In order to induce the shareholders to sell their shares, the acquiring company typically offers a purchase price higher than market value. The shareholders receive cash or (more commonly) an agreed-upon number of shares of the acquiring company. Thus, a friendly takeover must be approved by the shareholders of the target firm and can take place with the consent of the directors of the company whose shares are being acquired.

A hostile takeover occurs when a company attempts to buy out another whether the management of the target company likes it or not and can be accomplished through a number of tactics.

The first tactics is a proxy fight. It is a technique used by an acquiring company to attempt to gain control of a takeover target. The acquirer tries to persuade the shareholders of the target company that the present management should be ousted in favour of a new list of directors preferable to the acquirer. Thus, the acquiring company through the proxy votes can gain control of the target company without paying a premium price.

A hostile takeover can also occur through publicly traded shares by purchasing the majority of a target company’s shares in the open market. An acquiring company can launch a raid – in other words, buy a large quantity of a company’s shares at the stock exchange. A raid has its own advantages for an acquirer as compared to a takeover bid. In many countries, if all the shareholders agree to sell, the acquirer making a takeover bid is obliged to buy 100% of the shares, and cannot stop at 50% plus one.

‘Dawn raid’ is another hostile tactics employed by the acquirer. A ‘dawn raid’ consists of buying shares of the target company through several brokers early in the morning, as soon as the stock markets open, before speculators notice the rising price and join in. This will immediately increase the share price, and may persuade a sufficient number of other shareholders to sell for the raider to take control of the company. By getting the brokers to conduct the buying of shares in the target company, the acquirer masks its identity and thus its intent.

One more form of acquisitions is a reverse takeover. A reverse takeover can occur in different forms. It may be the acquisition of a public company by a private entity in order to become a public limited company without costly IPO procedures. A reverse takeover is also the buying of a larger company by a smaller one.

Leveraged Buyouts

Leverage means having a large proportion of debt compared to equity capital. Leveraged buyouts (LBOs) are takeovers which involve buying a company with a lot of borrowed money. Acquirers borrow money, and choose a large, badly-managed, inefficient or under-priced corporation or conglomerate, or a company with huge cash reserves, or a company in the fields that are not sensitive to a recession (food, tobacco). They buy the company, restructure it and split the assets up, then sell the profitable bits, make a profit in the process and pay back the principle and interest to the bank or other lenders. It is called asset-stripping – selling off the assets of poorly performing or under-valued companies. But this process can go wrong. If there is a recession or a stock market crash, it is more difficult to sell the assets, and if you have less sales revenue, it becomes harder to pay the interest on the borrowed money. Where a company is bought by its existing managers, we talk of management buyout or MBO.

Demerging

Demerging is the reverse (opposite) process to integration. To demerge is to carry out the separation of a company from another. Sometimes, a corporation decides to sell a part of its existing business operations or set it up as a new and independent corporation. There may be several reasons for such a step. A firm might decide, for example, that it should focus more specifically on its core businesses. Such a sale is called a divestiture. When a firm sells part of itself to raise capital, the strategy is known as a spin-off.

Concept check