- •Subject matter and methodology of economics.

- •Concept of elasticity: notion, types, methods of calculation

- •Income elasticity of demand

- •Market mechanism: demand, supply, prices

- •Consumer behavior: the cardinal utility theory.

- •Consumer behaviour: the ordinal utility theory.

- •Income and substitution effects of a price change: Slutski and Hicks approaches.

- •Production function and scale effects.

- •Comparative analysis of profit maximization under perfect competition and under pure monopoly.

- •Models of oligopoly.

- •Alternative theories of the firm.

- •Producer’s equilibrium in the inputs markets.

- •Price determination in the monopsonic labour market.

- •Market failures and the economic role of the government.

- •Distribution and redistribution of income and wealth.

- •Social equilibrium. The Edgeworth box. Pareto efficiency.

- •Macroeconomic equilibrium in the circular flow of income model.

- •Economic growth and its sources. The phases and character of the business cycles.

- •19. Unemployment: types and costs.

- •20. Inflation: classification, causes and effects.

- •21. Measurement of national output, unemployment and price level. National income accounting and the real living standard.

- •22. Classical economics and the Keynesian revolution: the major areas of disagreement

- •23. Consumption, saving and withdrawals functions in the Keynesian analysis. Injections and their determinants.

- •24. Determination of national income equilibrium in the Keynesian analysis. The multiplier effect and multiplier coefficient.

- •25. Keynesian explanation of inflation and business fluctuations.

- •26. Fiscal policy: types and effectiveness.

- •27. Money market: demand for money and supply of money. Money multiplier. Equilibrium in the money market. Monetary transmission mechanism.

- •28. Monetary policy: subjects, aims, types, instruments and effectiveness.

- •29. Inflation-unemployment theory: the Phillips curve and its development. Phillips curve and explanation of stagflation.

22. Classical economics and the Keynesian revolution: the major areas of disagreement

The general ideas

Classical |

Keynesian |

1. There is long run equilibrium.

|

1. There might be a persistent disequilibrium in the modern market economy. |

2. Short run disequilibrium is abolished by market mechanism. |

2. This disequilibrium can't be eliminated with the existent market mechanism. |

3. There are no such long-run problems in the economy, as recession, unemployment, recession. |

3. There are such problems as there is a long-run unemployment. No inflation in this period (1936) |

4. Government should not interfere in market mechanism. Markets are people running themselves |

4. Government should interfere in the economy in order to correct disequilibrium. |

Areas of disagreement

Areas |

Classical |

Keynesian |

1 – Prices and Wages |

Prices and wages are relatively flexible. Markets tend to clear quickly.

|

Prices and wages are relatively inflexible. Impossible for prices and wages to fall down. Government price policies, final anti-monopoly laws. Because monopolies try to keep prices at high level. Wages don't tend to fall and as a result markets can't automatically restore equilibrium. |

2 - Macroeconomic Equilibrium |

W=J (Withdrawals = inJections) W=S+T+M; J=I+G+X So, Saving=Investment iMport=eXport Taxes=Government because government must balance its budget. |

W <> J So: S <> I, M <> X, T <> G

|

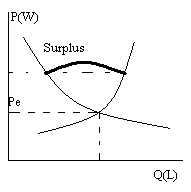

3 - Elasticity of AS curve and stability of AD

|

AS curve is inelastic, it is vertical. AS = Ypotential

Supply creates its own demand. |

AS supply curve is elastic

AS depends on AD. |

4 – Inflation (velocity of money circulation |

MS – money supply V-velocity P-price index Y-value of national output MsV=PY V is stable and depends on D for money. Y is stable too. |

1)Increase in MS does not necessary lead to inflation. V is instable. Y depends directly on MS. 2)Inflation may be caused by sufficient increase in AD. |

23. Consumption, saving and withdrawals functions in the Keynesian analysis. Injections and their determinants.

Important assumptions in the Keynisian analysis

Absence of inflation-amount of money corresponds to the change in AD and av int rate is fixed.

absence of bus fluctuations(Inj=W)

Injections-exodiness var(doesn’t depend on Y in the short run).W and Cd-endogenouss(depend on Y)

The consumption of domestically produced goods and services( Cd) – the direct flow of money payments from households to firms.

Consumption function:

The main determinant of national consumption is national income. This relationship may be illustrated with the consumption function C=f(Y) and 45* line diagram.

Description of diagram:

Y influnces directly on C

At low level of income befor point of intersection (A) consumption function lies above 45 degre line. It means that nation spends more than it earns-dissaving.

At point A cons=nat income, that is nation spend all its income corresponded to A. A is called break-even point.

After p. A cons is less than nat income (other part goes on saving)

The slope of con function depends on marginal propencity to consume (mpc-a proportion of arise in Y that goes on consumption mpc=∆C/∆Y, apc-is the proportion of total national income that goes on consumption apc=C/Y)

Withdrawals(W)(or leakages) – income of households or firms that are not passed on round the inner flow. Withdrawals equal net savings(S) plus net taxes(T) plus import expenditure(M): W=S+T+M

1.Savings

mps-proportion in the incr of Y saved=∆S/∆Y

aps-proportion of Y saved=S/Y

Non-income determ:

1.wealth and distribution of income

2.level of taxes

3interest rate

4.expectations of future prices

5.personal motivation to save.

2.Taxes

Types:

1.Lump-sum –no changes in T when Y rises

2.Proportional-T rise proportional as Y rises

3.Progressive-T rise more intensivle than Y

4.Regressive-T rise less int than Y

Mpt-proportion of rise in Y payed in tax=∆T/∆Y

Apt-proportion of Y payed in T=T/Y

Non-income detetm:

1.tax rates

2.size of underground economy

3.Imports

1. M of luxury goods 2. M of basic g&s

mpm-proportion of rise in Y that goes abroad=∆M/∆Y

apm-proportion of Y that goes abroad=M/Y

Non-income determin:

1.relative prices-if domestic prices are higher than imported than people prefer to buy imported

2.relative quality-if quality of imported is better than domestic M rises

3.Relative interest rates-if foreign int rayes rise relative to domestic,more money will flow abroad, M rises

4.exchange rate-if people expect exchange rate is about to depriciate,there will be an outflow of capital, M rises

5.preferences

6.total consumption

Injections(J) – expenditure on the production of domestic firms coming from outside the inner flow of the circular flow of income. Injections equal investment(I)plus government expenditure(G) plus expenditure on exports(X). J=I+G+X

Injections

1.Investment

a)real interest rate-the higher the interest rate the more expensive is borrowing and the less I

b)capacity and stocks-the more capacity the less I

c)expected rate of net profit-I depends on firms expectations about future marker conditions.

2.Gov expenditure-the higher level of Y, the higher amount of Trevenue,the more it can afford to spend in the long run.

3Exports-the same determinants as import.