- •2. Intertemporal choice problem as foundation of the modern theory of finance.

- •3. Basic economic theory of risk. Expected utility function, risk premium and risk aversion measures.

- •4. Technology, profit maximization and theory of firm and industry supply

- •5. Production costs in short run vs long run and cost minimization problem.

- •Variable Costs

- •Isocost Lines

- •6. Types of industrial markets. The model of perfect competition.

- •7. The theory of monopoly. State regulation of monopoly markets.

- •8. (И.К.)Models of oligopoly and game theory applications

- •9. 9. Institutional foundations of economic systems. The economic theory of property rights.

- •10. Transaction costs: the origin, nature, classification, measurement problems.

- •11. Theory of information, properties, info asymmetry and methods of overcoming it

- •Information asymmetry

- •12. Gdp as an indicator of economic results of the macroeconomic system.

- •Income approach

- •13. Aggregate demand and aggregate supply. The ad-as model.

- •14. Consumption, savings and investment. “Keynesian Cross”.

- •15. Money market. The demand for money and supply, factors that determine them. Equilibrium in the money market.

- •16.Joint balance of real and monetary sectors of the economy (model is-lm).

- •17. Cycles of economic dynamics. Sources of cyclical fluctuations in economic conditions.

- •18. Inflation, its types and methods of measurement. Factors and consequences of inflation. Anti-inflationary policies.

- •19. Disequilibrium in the labor market. Unemployment and its types and methods of measurement.

- •20.Globalization and the polarization in the modern world economy.

- •21.General economic equilibrium in an open economy (model Mandell - Fleming).

- •Is components

- •22.(И.К.)Efficient Market Hypothesis (emh): Concept, Forms, Arguments for and against.

- •23. Economic Data and Econometric Analysis. Four types of Economic Data. Role of Econometrics. Main Application of Econometrics.

- •24. Financial Econometrics, it’s object. Type of equations in mathematical modeling: behavioral equations and identities.

- •25,26,27,29 Simple regression analysis. The Simple Linear Model. Least Squares Regression. Interpretation of a Regression Equation.

- •28.Ordinary Least Squares (ols). The Gauss – Markov Theorem.

- •30.Heteroscedasticity. Possible Causes of Heteroscedasticity. The Goldfeld–Quandt Test.

- •31.Autocorrelation. Possible Causes of Autocorrelation. The Durbin–Watson Test.

- •32.Multiple Regression Analysis. Derivation of the Multiple Regression Coefficients.

- •33.Properties of the Multiple Regression Coefficients: unbiasedness, efficiency, precision, consistency.

- •34.Multiple Regression Analysis. Problem of Multicollinearity.

- •35. Purchasing Power Parity Theory: Concept, Forms, Application

- •36. Fisher Effect Parity Theory: Concept, Application

- •37 International Fisher Effect Parity Theory: Concept, Application

- •38. Interest Rate Parity Theory: Concept, Application

- •39. The composition of the global financial market: instruments, participants, sources of information.

- •41. Types of banks and their role in the international financial market.

- •42. The global equities market: size, indicators, principles of organization.

- •43. The global debt securities market: composition, principles of organization.

- •44. The international debt securities: types and organization.

- •45. The government bond markets: size, composition, significance.

- •46. Mortgage-backed securities: mechanism of issuance, the role in the international financial crisis of 2007-2009.

- •47. Exchange-traded derivatives: types, functions, mechanism of trading.

- •48.Otc derivatives. Swaps.

- •49. Types of institutional investors and their role in the global financial markets.

- •50. The functions of the international financial organizations (imf, World Bank, bis).

- •International trade financing

- •52. International banking: the structure and operational function, the services offered, and measures to improve the efficiency and effectiveness of the international banking organization.

- •53. The major issues in International banking: international money laundering, international banking crisis, regulation of international banking, and offshore banking markets.

- •54. Acquisitions and Mergers in Financial Services Management.

- •55.Measuring and evaluating the performance of banks: financial ratio analysis, profitability analysis.

- •57. Bank Financial Management:

- •58.(И.Р.)Requirements for an effective audit and evaluation of evidence (Не полностью описал)

- •59. The audit process and audit report

- •60. Generally Accepted Auditing Standards and Code of Professional Conduct

- •Accounting principles;

- •Confidential client info not disclose without specific consent.

- •61. Cost concepts, classification, and allocation.

- •62. Job order costing system & cost flow

- •63. Process costing and equivalent production

- •65.(И.Р.)Cost behavior and cvp analysis

- •66. Accounting Cycle, Generally Accepted Accounting Principles, and Financial Statements

- •Accounting Cycle – Steps During the Accounting Period

- •Accounting Cycle: Steps at the end of the accounting period

- •67. Merchandising operations & inventories

- •Inventory Costing Methods

- •Perpetual fifo

- •Perpetual lifo

- •68. Internal control, cash and receivables

- •69. Current & long term Liab.

- •70.Long term Assets.

- •71. Contributed Capital & corporate statements.

- •72.(И.Р.)Cash flow statement

- •73. Accounting Rate of Return Method as an Investment Rule. Application and possible Problems

- •74. Payback Method as an Investment Rule. Application and possible Problems.

- •75. Internal Rate of Return Method as an Investment Rule. Application and possible Problems.

- •76. Profitability Index Method as an Investment Rule. Application and possible Problems.

- •1) The method requires an estimate of the cost of capital in order to calculate the profitability index

- •2) The method may not give the correct decision when used to compare mutually exclusive projects.

- •77. Net Present Value Method as an Investment Rule. Application and possible Problems.

- •78. Capital Structure Concept.

- •79. Dividend Policy

- •80. Arbitrage Pricing Theory (apt)

- •81. Capital Asset Pricing Model (capm)

- •82. Fama and French Three Factor Model of Assets Pricing

- •83. Duration concept, application, concept of convexity, and how convexity affects macalay’s duration

- •83. Duration concept, application, concept of convexity, and how convexity affects macalay’s duration

- •84. Valuation based on Price Multiples: p/e, p/bv, p/s.

- •85. (И.К.)Asset Based Valuation Model, Residual Income Valuation Model Asset-based valuation

- •86.(И.Р.)Dividend Discount Model

- •87. Discounted Cash Flow (dcf) Valuation Model

- •88. Capital Structure: Differences between Companies

- •89. Capital structure: Differences between Countries.

- •90. Exporting as a foreign market mode, merits, demerits

- •91. Collaborative Arrangements: Licensing, Franchising, Management Contracts

- •92. (И.К.)Risky assets and portfolio optimization problem.

- •Investors can use either a top-down or bottom-up approach:

- •95. Credit Risk Models

- •96. International Diversification: investing in different markets.

- •97. Translation exposure

- •98. Transaction Exposure.

- •99. Operational Exposure

- •100.(И.Р.)Foreign Direct Investments: Joint Ventures, wholly owned Subsidiaries

- •101. Securitization (s): creation of abSs, participants and functions, securitization’s impact and risks, regulators’ concerns.

- •103. Classification and comparative characteristics of derivatives.

- •1.By the relationship between the underlying asset and the derivative :

- •3.By the market in which they trade:

- •1.Call and Put options

- •2.Exchange-traded or Over-the-counter (otc) options

- •105. Swaps: concept, types, strategies for using

- •106. Futures: concept, types, strategies for using

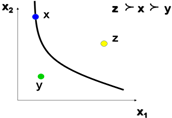

1.Preferences, utility function, problem of choice, and the theory of demand. Preferences A decisionmaker always chooses its most preferred alternative from its set of available alternatives. So to model choice we must model decisionmakers’ preferences.

Preference Relations: Comparing two different consumption bundles, x and y:

strict preference: x is more preferred than is y.

weak preference: x is as at least as preferred as is y.

indifference: x is exactly as preferred as is y.

Strict preference, weak preference and indifference are all preference relations. Particularly, they are ordinal relations; i.e. they state only the order in which bundles are preferred.

![]() denotes strict preference; x

≻

y means that bundle x is preferred strictly to bundle y.

denotes strict preference; x

≻

y means that bundle x is preferred strictly to bundle y.

~ denotes indifference; x ~ y means x and y are equally preferred.

≿ denotes weak preference; x ≿ y means x is preferred at least as much as is y.

Assumptions about Preference Relations:

Completeness: For any two bundles x and y it is always possible to make the statement that either x ≿ y or y ≿ x.

Reflexivity: Any bundle x is always at least as preferred as itself; i.e. x ≿ x.

Transitivity: If x is at least as preferred as y, and y is at least as preferred as z, then x is at least as preferred as z; i.e. x ≿ y and y ≿ z → x ≿ z.

Indifference CurvesTake: a reference bundle x’. The set of all bundles equally preferred to x’ is the indifference curve containing x’; the set of all bundles y ~ x’.Since an indifference “curve” is not always a curve a better name might be an indifference “set”.

Extreme

Cases of Indifference Curves; Perfect Substitutes:If

a consumer always regards units of commodities 1 and 2 as equivalent,

then the commodities are perfect substitutes and only the total

amount of the two commodities in bundles determines their preference

rank-order.

Extreme

Cases of Indifference Curves; Perfect Substitutes:If

a consumer always regards units of commodities 1 and 2 as equivalent,

then the commodities are perfect substitutes and only the total

amount of the two commodities in bundles determines their preference

rank-order.

Extreme Cases of Indifference Curves; Perfect Complements :If a consumer always consumes commodities 1 and 2 in fixed proportion (e.g. one-to-one), then the commodities are perfect complements and only the number of pairs of units of the two commodities determines the preference rank-order of bundles.

The slope of an indifference curve is its marginal rate-of-substitution (MRS). MRS at x’ is lim {Dx2/Dx1}= dx2/dx1 at x’

Utility Functions

A preference relation that is complete, reflexive, transitive and continuous can be represented by a continuous utility function.

Continuity means that small changes to a consumption bundle cause only small changes to the preference level.

A utility function U(x) represents a preference relation if and only if:

x’≻ x”↔ U(x’) > U(x”);x’ ≺x” ↔ U(x’) < U(x”); x’ ~ x”↔ U(x’) = U(x”).

Utility is an ordinal (i.e. ordering) concept. E.g. if U(x) = 6 and U(y) = 2 then bundle x is strictly preferred to bundle y. But x is not preferred three times as much as is y. Consider the bundles (4,1), (2,3) and (2,2). Suppose (2,3) (4,1) ~ (2,2). Assign to these bundles any numbers that preserve the preference ordering; e.g. U(2,3) = 6 > U(4,1) = U(2,2) = 4. Call these numbers utility levels.

An

indifference curve contains equally preferred bundles.

Equal

preference Þ

same utility level.

Therefore,

all bundles in an indifference curve have the same utility level.

So

the bundles (4,1) and (2,2) are in the indiff. curve with utility

level U =4.

But

the bundle (2,3) is in the indiff.

curve with utility level U=

6.

T![]() he

collection of all indifference curves for a given preference relation

is an indifference map.

An

indifference map is equivalent to a utility function; each is the

other.

A

good

is a commodity unit which increases utility (gives a more preferred

bundle).

A

bad

is a commodity unit which decreases utility (gives a less preferred

bundle).

A

neutral is

a commodity unit which does not change utility (gives an equally

preferred bundle).

The

marginal utility of commodity i is the rate-of-change of total

utility as the quantity of commodity i consumed changes; i.e.

he

collection of all indifference curves for a given preference relation

is an indifference map.

An

indifference map is equivalent to a utility function; each is the

other.

A

good

is a commodity unit which increases utility (gives a more preferred

bundle).

A

bad

is a commodity unit which decreases utility (gives a less preferred

bundle).

A

neutral is

a commodity unit which does not change utility (gives an equally

preferred bundle).

The

marginal utility of commodity i is the rate-of-change of total

utility as the quantity of commodity i consumed changes; i.e.

Marg. Rates-of-Substitution for Quasi-linear Utility Functions :MRS = - f (x1) does not depend upon x2 so the slope of indifference curves for a quasi-linear utility function is constant along any line for which x1 is constant.

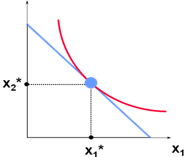

Choice. The principal behavioral postulate is that a decisionmaker chooses its most preferred alternative from those available to it. The available choices constitute the choice set.

The most preferred affordable bundle is called the consumer’s ORDINARY DEMAND at the given prices and budget. Ordinary demands will be denoted by x1*(p1,p2,m) and x2*(p1,p2,m).

Rational

Constrained Choice:x1*,x2*)

satisfies two conditions:

(a)

the budget

is exhausted;

p1x1*

+ p2x2*

= m

(b)

the slope of the budget constraint, -p1/p2,

and the slope of the indifference curve containing (x1*,x2*)

are equal at (x1*,x2*).

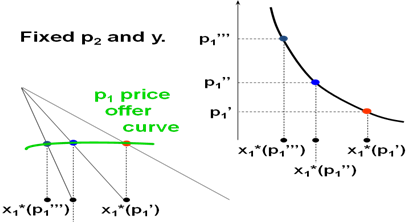

Demand.

Comparative

statics analysis of ordinary demand functions -- the study of how

ordinary demands x1*(p1,p2,y)

and x2*(p1,p2,y)

change as prices p1,

p2

and income y change.

The

curve

containing all the utility

The

curve

containing all the utility![]() -maximizing

bundles traced out as p1

changes, with p2

and y constant, is the p1-

price offer curve.

The

plot of the x1-coordinate

of the p1-

price offer curve against p1

is the ordinary demand curve for commodity 1.

-maximizing

bundles traced out as p1

changes, with p2

and y constant, is the p1-

price offer curve.

The

plot of the x1-coordinate

of the p1-

price offer curve against p1

is the ordinary demand curve for commodity 1.

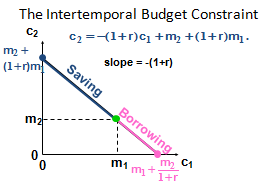

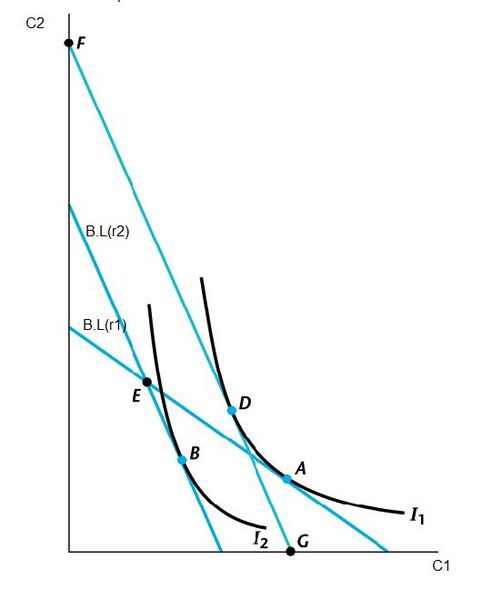

2. Intertemporal choice problem as foundation of the modern theory of finance.

Model of intertemporal choice involving consumption and investment decisions. (Named after Irving Fisher)

Irving Fisher developed the theory of Intertemporal Choice in 1930 in his book 'Theory of interest'. Contrary to Keynes, who related consumption to current income, Fisher’s model showed how rational forward looking consumers chooses consumption for the present and future to maximize their lifetime satisfaction. According to Fisher, an individual's impatience depends on four characteristics of his income stream: the size, the time shape, the composition and risk. Besides this foresight, self control, habit, expectation of life, and bequest motive (or concern for lives of others) are the five personal factors that determine a person's impatience which in turn determines his time preference. In order to understand the choice exercised by a consumer across different periods of time we take consumption in one period as a composite commodity. Suppose there is one consumer, N commodities, and two periods. Preferences are given by U (x1; x2) where xt = (xt1; :::; xtN ). Income in period t is Yt. Savings in period 1 is S1, spending in period t is Ct, and r is the interest rate.

C1 + S1 ≤Y1 ... (1)

C2 ≤ Y2 + S1 (1 + r) ... (2)

We arrive at the following equation from equation 1 and 2

=![]() =

=![]()

The left hand side shows the present value expenditure and right hand side depicts the present value income respectively. Multiplying the equation by (1+r) gives us the future value.

Now the consumer has to choose a C1 and C2 such that Max U(C1,C2) subject to C1+C2/(1+r) = Y1 + Y2/(1+r)

A consumer maybe a net saver or a net borrower. If he's initially at a level of consumption where he's neither of the above(i.e. a net borrower or net saver), an increase in income may make him a net saver or a net borrower depending on his preferences. An increase in current income or future income will increase current and future consumption(consumption smoothing motives).

Now, let us consider a scenario where the interest rates are increased. If the consumer is a net saver, he will save more in the current period due to the substitution effect and consume more in the current period due to the income effect. The net effect thus, becomes ambiguous. If the consumer is a net borrower, however, he will tend to consume less in the current period due to the substitution effect and income effect thereby reducing his overall current consumption.

If the consumer is a net saver, an increase in interest rate will have an ambiguous effect on the current consumption.

If the consumer is a net borrower, an increase in interest rate will reduce his current consumption.

Key Assumptions:

Two periods (generalizing to many future periods is straightforward); Perfect capital markets; the absence of uncertainty

What is the consumer choosing? One of the many possible “Consumption Streams”. A consumption stream is a sequence of time dated consumption. Consumers are able to choose between alternative consumption streams. Choices are consistent (transitive), they prefer more consumption to less, i.e. they prefer higher standards of living to lower. Consumers choose the most preferred consumption stream among those attainable. Let m1 and m2 be incomes received in periods 1 and 2. Let c1 and c2 be consumptions in periods 1 and 2. Let p1 and p2 be the prices of consumption in periods 1 and 2. Suppose prices are 1$. Suppose that the consumer chooses not to save or to borrow. What will be consumed in period 1? c1 = m1. What will be consumed in period 2? c2 = m2.

Now suppose that the consumer spends nothing on consumption in period 1; that is, c1 = 0 and the consumer saves s1 = m1. The interest rate is r. What now will be period 2’s consumption level?

Now suppose that the consumer spends everything possible on consumption in period 1, so c2 = 0. What is the most that the consumer can borrow in period 1 against her period 2 income of $m2? Let b1 denote the amount borrowed in period 1. Only $m2 will be available in period 2 to pay back $b1 borrowed in period 1. So b1(1 + r ) = m2. That is, b1 = m2 / (1 + r ). So the largest possible period 1 consumption level is .

The calculation of saving or borrowing amounts is the modern theory of finance. All these calculation used in calculation of investing or spending cash flows. For example, bond, securities etc.