- •2. The use and limitation of Microeconomic theory. Economic methodology

- •2.1. Microeconomic models

- •2.2. Equilibrium analysis

- •1. Demand Function

- •1.1. Individual Demand Function

- •1.2. Market Demand Function

- •1.3. Change in Quantity Demanded and Change in Demand

- •1.4. Inferior, Normal and Superior Goods

- •2. Supply Function

- •2.1. Change in quantity supplied and Change in supply

- •3. Equilibrium

- •4. Market Adjustment to Change

- •4.1 Shifts of Demand

- •If supply is constant, an increase in demand will result in an increase in both equilibrium price and quantity. A decrease in demand will cause both the equilibrium price and quantity to fall.

- •4.2. Shift of Supply

- •4.3. Changes in Both Supply and Demand

- •Lecture 3 Equilibrium and Government regulation of a market

- •Cobweb theorem as an illustration of stable and unstable equilibrium

- •Stable cobweb

- •2.2. Impact of a tax on price and quantity

- •1.2. Impact of demand elasticity on price and total revenue

- •1.3. Income elasticity of demand (yed) and Cross elasticity of demand (ced)

- •C ategories of income elasticity:

- •Persantage changes in Price of good y

- •Price elasticity of supply

- •3. Market adaptation to Demand and Supply changes in long-run and in short-run

- •Lecture 5. Consumer Behavior

- •1. Three parts and three assumptions of consumer behavior theory

- •2. Consumer Choice and Utility

- •2.1. Total Utility (tu) and Marginal Utility (mu)

- •2.2. Indifference curves

- •3. Budget Constraint

- •3.1. The effects of changes in income and prices

- •4. Equimarginal Principle and Consumer equilibrium

- •Lecture 6. Changes in consumer choice. Consumer Behavior Simulation

- •1. Income Consumption Curve. Engel Curves

- •2. Price Consumption Curve and Individual Demand curve

- •3. Income and Substitution Effects

- •1. Income Consumption Curve. Engel Curves

- •2. Price Consumption Curve and Individual Demand curve

- •3. Income and Substitution Effects

- •The slutsky method

- •Lecture 7. Production

- •1. The process of production and it’s objective

- •2. Production Function

- •3. Time and Production. Production in the Short-Run

- •3.1. Average, Marginal and Total Product

- •3.2. Law of diminishing returns

- •4. Producer’s behavior

- •4.1. Isoquant and Isocost

- •4.2. Cost minimization (Producer’s choice optimisation)

- •In addition to Lecture 7. Return to scale

- •Lecture 8. Costs and Cost Curves

- •The treatment of costs in Accounting and Economic theory

- •2. Fixed and Variable Costs

- •3. Average Costs. Marginal Cost

- •4. Long Run Cost. Returns to Scale

- •Envelope Curve

- •Long Run Average Cost in General

- •Returns to Scale

- •The lrac Curve

- •Lecture 9. Competition

- •1) Many buyers and sellers

- •2) A homogenous product

- •3) Sufficient knowledge

- •4) Free Entry

- •3. Economic profit in trtc-model and in mrmc-model

- •4. The Competitive Firm and Industry Demand

- •Figure 4

- •4.1. Economic strategies of the firm at p- Competition

- •Profitableness and losses conditions for perfect competitor according to mrmc-model:

- •4.2. Long run equilibrium

- •Lecture 10 Monopoly

- •Definition of Monopoly Market. Causes of monopoly.

- •Patents and Other Forms of Intellectual Property

- •Control of an Input Resource

- •Capital-consuming technologies

- •Decreasing Costs

- •Government Grants of Monopoly

- •2. Monopoly Demand and Marginal Revenue

- •3. Monopoly Profit Maximization

- •4. Monopoly Inefficiency

- •Negative consequences of Monopoly

- •5. "Natural" Monopoly

- •Government Ownership

- •Regulation

- •Lecture 11. Monopolistic Competition and Oligopoly

- •1. Imperfect competition and Monopolistic competition

- •2. Profit Maximization in Monopolistic Competition

- •3. Oligopoly

- •3.1. Firms behavior in Oligopoly

- •3.2. Kinked Demand Model

- •Duopolies

- •Cournot Duopoly

- •Stackelberg duopoly

- •Bertrand Duopoly

- •Collusion

- •Extension of the Cournot Model

2.2. Impact of a tax on price and quantity

Without taxes – no government. Government is necessary for certain goods – known as “public goods” – to be efficiently provided. Taxes are needed to raise revenue to pay for public goods. Examples are Justice, Defense, Public Health Services, Roads, and Education. Taxes discourage market activity. When a good is taxed, the price paid by buyers increases and the quantity sold falls. A tax on a good places a wedge between the price paid by buyers and the price received by sellers. Buyers and sellers usually share the tax burden.

The incidence of a tax refers to who bears the burden of a tax. The incidence of a tax does not depend on who actually pays the tax to the government. The incidence of the tax depends on the relative price elasticities of supply and demand in the market.

To find out the impact of a tax on price and quantity we need to compute the new price under taxation. We can do it by changing supply function in proper way:

In the case of specific tax Qs = c +dP should be transformed into Qst = c +d(P-t).

In the case of Ad Valorem tax the original functions should be transformed into Qst = c +d P (1-t).

Then we need to equal original (or constant) demand function and new (transformed) supply function to get the new characteristics of equilibrium Pet and Qet.

Tax revenue (TaxR) is the whole sum of money collected by taxation. It can be computed as TaxR=t•Qet.

The tax burden on consumers is the part of the tax paid by consumers in terms of higher prices. CB= (Pet - Pe)•Qet.

The tax burden on sellers is the part of the tax paid by firms in terms of lower receipts. SB=TaxR – CB = t•Qet - (Pet - Pe)•Qet = Qet (t - Pet + Pe)

Tax burden on each is determined by the elasticities of supply and demand.

Also we can define society tax burden – some losses of all the society because of decrease of quantity sold/bought on the market and increased price: SCB = t•( Qe - Qet).

In the case of subsidy government support supply curve shifts in opposite side and according to this action our calculation will change (Qssub = c +d(P+sub)) and market actors get benefits instead of pay burden. But the main prinsiple remains the same.

Lecture 4. Elasticity and its applications

1. Demand elasticity

1.1. Price Elasticity Coefficient and Factors affecting price elasticity of demand

![]()

Arc-elasticity:

Point-elasticity:

![]()

Factors affecting price elasticity of demand:

Substitution - The more substitutes, the higher the elasticity, as people can easily switch from one good to another if a minor price change is made.

Percentage in the consumer’ income - The higher the percentage that the product's price is of the consumers income, the higher the elasticity, as people will be careful with purchasing the goods because of its cost.

Useful or not - The more necessary a goods is, the lower the elasticity, as people will buy it no matter the price, such as insulin.

The time period under consideration - The longer a price change holds, the higher the elasticity, as more and more people will stop demanding the goods (i.e. if you go to the supermarket and find that blueberries have doubled in price, you'll buy it because you need it this time, but next time you won't, unless the price drops back down again). Elasticity will normally be different in the short term and the long term.

Breadth of definition: The broader the definition, the lower the elasticity

Table of price elasticity kinds of demand

Demand |

Coefficient |

Illustration |

Examples |

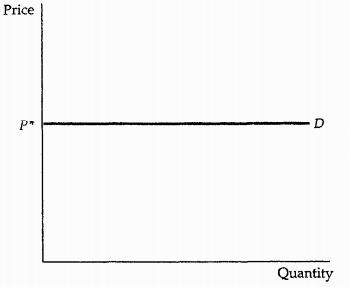

Infinitely (perfectly) elastic |

|Edp|=∞ |

|

Diamands, goods on perfect competitive market |

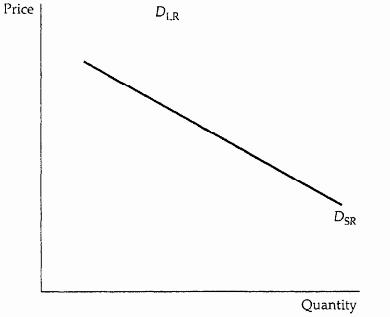

Elastic |

|Edp|>1 |

|

Most goods in long term, also durable goods (automobile, TV set, frige etc.) |

Unitary |

|Edp|=1 |

|

Any good with the same reaction of both price and quantity demanded |

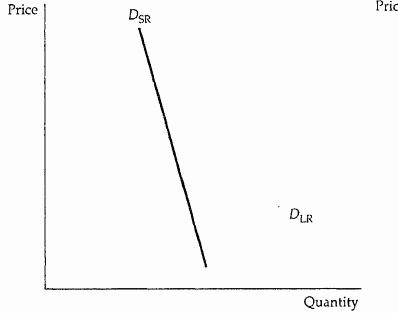

Inelastic |

0<|Edp|<1 |

|

Most goods in short term, also nondurable (food, services etc.) |

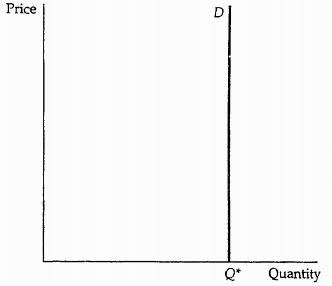

Completely Inelastic |

|Edp| =0 |

|

Water, medicine for ill person, drugs for drug taker |