- •2. The use and limitation of Microeconomic theory. Economic methodology

- •2.1. Microeconomic models

- •2.2. Equilibrium analysis

- •1. Demand Function

- •1.1. Individual Demand Function

- •1.2. Market Demand Function

- •1.3. Change in Quantity Demanded and Change in Demand

- •1.4. Inferior, Normal and Superior Goods

- •2. Supply Function

- •2.1. Change in quantity supplied and Change in supply

- •3. Equilibrium

- •4. Market Adjustment to Change

- •4.1 Shifts of Demand

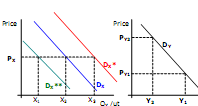

- •If supply is constant, an increase in demand will result in an increase in both equilibrium price and quantity. A decrease in demand will cause both the equilibrium price and quantity to fall.

- •4.2. Shift of Supply

- •4.3. Changes in Both Supply and Demand

- •Lecture 3 Equilibrium and Government regulation of a market

- •Cobweb theorem as an illustration of stable and unstable equilibrium

- •Stable cobweb

- •2.2. Impact of a tax on price and quantity

- •1.2. Impact of demand elasticity on price and total revenue

- •1.3. Income elasticity of demand (yed) and Cross elasticity of demand (ced)

- •C ategories of income elasticity:

- •Persantage changes in Price of good y

- •Price elasticity of supply

- •3. Market adaptation to Demand and Supply changes in long-run and in short-run

- •Lecture 5. Consumer Behavior

- •1. Three parts and three assumptions of consumer behavior theory

- •2. Consumer Choice and Utility

- •2.1. Total Utility (tu) and Marginal Utility (mu)

- •2.2. Indifference curves

- •3. Budget Constraint

- •3.1. The effects of changes in income and prices

- •4. Equimarginal Principle and Consumer equilibrium

- •Lecture 6. Changes in consumer choice. Consumer Behavior Simulation

- •1. Income Consumption Curve. Engel Curves

- •2. Price Consumption Curve and Individual Demand curve

- •3. Income and Substitution Effects

- •1. Income Consumption Curve. Engel Curves

- •2. Price Consumption Curve and Individual Demand curve

- •3. Income and Substitution Effects

- •The slutsky method

- •Lecture 7. Production

- •1. The process of production and it’s objective

- •2. Production Function

- •3. Time and Production. Production in the Short-Run

- •3.1. Average, Marginal and Total Product

- •3.2. Law of diminishing returns

- •4. Producer’s behavior

- •4.1. Isoquant and Isocost

- •4.2. Cost minimization (Producer’s choice optimisation)

- •In addition to Lecture 7. Return to scale

- •Lecture 8. Costs and Cost Curves

- •The treatment of costs in Accounting and Economic theory

- •2. Fixed and Variable Costs

- •3. Average Costs. Marginal Cost

- •4. Long Run Cost. Returns to Scale

- •Envelope Curve

- •Long Run Average Cost in General

- •Returns to Scale

- •The lrac Curve

- •Lecture 9. Competition

- •1) Many buyers and sellers

- •2) A homogenous product

- •3) Sufficient knowledge

- •4) Free Entry

- •3. Economic profit in trtc-model and in mrmc-model

- •4. The Competitive Firm and Industry Demand

- •Figure 4

- •4.1. Economic strategies of the firm at p- Competition

- •Profitableness and losses conditions for perfect competitor according to mrmc-model:

- •4.2. Long run equilibrium

- •Lecture 10 Monopoly

- •Definition of Monopoly Market. Causes of monopoly.

- •Patents and Other Forms of Intellectual Property

- •Control of an Input Resource

- •Capital-consuming technologies

- •Decreasing Costs

- •Government Grants of Monopoly

- •2. Monopoly Demand and Marginal Revenue

- •3. Monopoly Profit Maximization

- •4. Monopoly Inefficiency

- •Negative consequences of Monopoly

- •5. "Natural" Monopoly

- •Government Ownership

- •Regulation

- •Lecture 11. Monopolistic Competition and Oligopoly

- •1. Imperfect competition and Monopolistic competition

- •2. Profit Maximization in Monopolistic Competition

- •3. Oligopoly

- •3.1. Firms behavior in Oligopoly

- •3.2. Kinked Demand Model

- •Duopolies

- •Cournot Duopoly

- •Stackelberg duopoly

- •Bertrand Duopoly

- •Collusion

- •Extension of the Cournot Model

1.1. Individual Demand Function

The behavior of a buyer is influenced by many factors: the price of the good, the prices of related goods (compliments and substitutes), incomes of the buyer, the tastes and preferences of the buyer, the period of time and a variety of other possible variables. The quantity that a buyer is willing and able to purchase is a function of these variables.

An individual's demand function for a good (Good X) might be written:

QX

= f(PX,

P related

goods,

income (M), preferences, . . . )

where Q X

= the quantity of good X,

X

= the quantity of good X,

PX = the price of good X

P related goods = the prices of compliments or substitutes

Income (M) = the income of the buyers

Preferences = the preferences or tastes of the buyers

Expectations about the future prices of goods = can cause the demand in any period to shift. If buyers expect relative prices of a good will rise in future periods, the demand may increase in the present period. An expectation that the relative price of a good will fall in a future period may reduce the demand in the current period.

The demand function is a model that "explains" the change in the dependent variable (quantity of the good X purchased by the buyer) "caused" by a change in each of the independent variables. Since all the independent variable may change at the same time it is useful to isolate the effects of a change in each of the independent variables. To represent the demand relationship graphically, the effects of a change in PX on the QX are shown. The other variables, (Prelated goods, M, preferences, . . . ) are held constant.

Demand can also be perceived as the maximum prices buyers are willing and able to pay for each unit of output, ceteris paribus.

PX = f(QX), given incomes, price of related goods, preferences, etc.

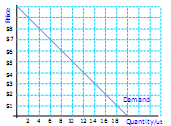

It is important to remember that the demand function is usually thought of as Q = f(P) but the graph is drawn with quantity on the X-axis and price on the Y-axis.

1.2. Market Demand Function

When property rights are nonattenuated (exclusive, enforceable and transferable) the individual's demand functions can be summed horizontally to obtain the market demand function.

For the market the demand function can be represented by adding the number of buyers (NB, or population), QX = f (PX, Prelated goods, income (M), preferences, . . . NB) Where NB represents the number of buyers. Using ceteris paribus the market demand may be stated QX = f(PX), given incomes, price of related goods, preferences, NB etc.

1.3. Change in Quantity Demanded and Change in Demand

When demand is stated Q = f(P) ceteris paribus, a change in the price of the good causes a "change in quantity demanded" The buyers respond to a higher (lower) price by purchasing a smaller (larger) quantity. Only in unusual circumstances (a highly inferior good, a Giffen good) may a demand function have a positive relationship.

A change in quantity demanded is a movement along a demand function

caused by a change in price while other variables (incomes, prices of

related goods, preferences, number of buyers, etc) are held constant.

change in quantity demanded is a movement along a demand function

caused by a change in price while other variables (incomes, prices of

related goods, preferences, number of buyers, etc) are held constant.

A change in demand is a "shift" or movement of the demand function. A shift of the demand function can be caused by a change in: incomes, the prices of related goods, preferences, the number of buyers etc.