- •2. The use and limitation of Microeconomic theory. Economic methodology

- •2.1. Microeconomic models

- •2.2. Equilibrium analysis

- •1. Demand Function

- •1.1. Individual Demand Function

- •1.2. Market Demand Function

- •1.3. Change in Quantity Demanded and Change in Demand

- •1.4. Inferior, Normal and Superior Goods

- •2. Supply Function

- •2.1. Change in quantity supplied and Change in supply

- •3. Equilibrium

- •4. Market Adjustment to Change

- •4.1 Shifts of Demand

- •If supply is constant, an increase in demand will result in an increase in both equilibrium price and quantity. A decrease in demand will cause both the equilibrium price and quantity to fall.

- •4.2. Shift of Supply

- •4.3. Changes in Both Supply and Demand

- •Lecture 3 Equilibrium and Government regulation of a market

- •Cobweb theorem as an illustration of stable and unstable equilibrium

- •Stable cobweb

- •2.2. Impact of a tax on price and quantity

- •1.2. Impact of demand elasticity on price and total revenue

- •1.3. Income elasticity of demand (yed) and Cross elasticity of demand (ced)

- •C ategories of income elasticity:

- •Persantage changes in Price of good y

- •Price elasticity of supply

- •3. Market adaptation to Demand and Supply changes in long-run and in short-run

- •Lecture 5. Consumer Behavior

- •1. Three parts and three assumptions of consumer behavior theory

- •2. Consumer Choice and Utility

- •2.1. Total Utility (tu) and Marginal Utility (mu)

- •2.2. Indifference curves

- •3. Budget Constraint

- •3.1. The effects of changes in income and prices

- •4. Equimarginal Principle and Consumer equilibrium

- •Lecture 6. Changes in consumer choice. Consumer Behavior Simulation

- •1. Income Consumption Curve. Engel Curves

- •2. Price Consumption Curve and Individual Demand curve

- •3. Income and Substitution Effects

- •1. Income Consumption Curve. Engel Curves

- •2. Price Consumption Curve and Individual Demand curve

- •3. Income and Substitution Effects

- •The slutsky method

- •Lecture 7. Production

- •1. The process of production and it’s objective

- •2. Production Function

- •3. Time and Production. Production in the Short-Run

- •3.1. Average, Marginal and Total Product

- •3.2. Law of diminishing returns

- •4. Producer’s behavior

- •4.1. Isoquant and Isocost

- •4.2. Cost minimization (Producer’s choice optimisation)

- •In addition to Lecture 7. Return to scale

- •Lecture 8. Costs and Cost Curves

- •The treatment of costs in Accounting and Economic theory

- •2. Fixed and Variable Costs

- •3. Average Costs. Marginal Cost

- •4. Long Run Cost. Returns to Scale

- •Envelope Curve

- •Long Run Average Cost in General

- •Returns to Scale

- •The lrac Curve

- •Lecture 9. Competition

- •1) Many buyers and sellers

- •2) A homogenous product

- •3) Sufficient knowledge

- •4) Free Entry

- •3. Economic profit in trtc-model and in mrmc-model

- •4. The Competitive Firm and Industry Demand

- •Figure 4

- •4.1. Economic strategies of the firm at p- Competition

- •Profitableness and losses conditions for perfect competitor according to mrmc-model:

- •4.2. Long run equilibrium

- •Lecture 10 Monopoly

- •Definition of Monopoly Market. Causes of monopoly.

- •Patents and Other Forms of Intellectual Property

- •Control of an Input Resource

- •Capital-consuming technologies

- •Decreasing Costs

- •Government Grants of Monopoly

- •2. Monopoly Demand and Marginal Revenue

- •3. Monopoly Profit Maximization

- •4. Monopoly Inefficiency

- •Negative consequences of Monopoly

- •5. "Natural" Monopoly

- •Government Ownership

- •Regulation

- •Lecture 11. Monopolistic Competition and Oligopoly

- •1. Imperfect competition and Monopolistic competition

- •2. Profit Maximization in Monopolistic Competition

- •3. Oligopoly

- •3.1. Firms behavior in Oligopoly

- •3.2. Kinked Demand Model

- •Duopolies

- •Cournot Duopoly

- •Stackelberg duopoly

- •Bertrand Duopoly

- •Collusion

- •Extension of the Cournot Model

3. Monopoly Profit Maximization

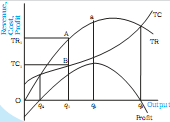

The profit received by the firm equals the total revenue minus the total cost. In the figure, we can see that if quantity q1 is produced, the total revenue is TR1 and total cost is TC1. The difference, TR1 – TC1, is the profit received. The same is depicted by the length of the line segment AB, i.e., the vertical distance between the TR and TC curves at q1 level of output. It should be clear that this vertical distance changes for diferent levels of output.

When output level is less than q2, the TC curve lies above the TR curve, i.e., TC is greater than TR, and therefore profit is negative and the firm makes losses.

The same situation exists for output levels greater than q3. Hence, the firm can make positive profits only at output levels between q2 and q3, where TR curve lies above the TC curve. The monopoly firm will choose that level of output which maximises its profit. This would be the levelof output for which the vertical distance between the TR and TC is maximum and TR is above the TC, i.e., TR – TC is maximum. This occurs at the level of output q0. If the difference TR – TC is calculated and drawn as a graph, it will look as in the curve marked ‘Profit’ in Figure 3. It should be noticed that the Profit curve has its maximum value at the level of output q0.

The analysis shown above can also be conducted using Average and Marginal Revenue and Average and Marginal Cost. Though a bit more complex, this method is able to exhibit the process in greater light.

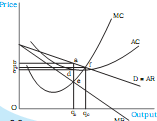

In Figure 4, the Average Cost (AC), Average Variable Cost (AVC) and Marginal Cost (MC) curves are drawn along with the Demand (Average Revenue) Curve and Marginal Revenue curve.

The rule for monopoly profit maximization will come as no surprise. It is

MR=MC

That is, the rule says that the monopoly should increase output up to the level where the marginal cost curve intersects the marginal revenue curve, in order to maximize its profits. The price charged is the corresponding price on the demand curve. Notice that this is a two-stage analysis:

at the first stage, the marginal cost, shown in red, and the marginal revenue, shown in light green determine the output. Profit maximizing output is the output at which they intersect, shown by the gold line.

at the second stage, the output and the demand curve determine the price. Trace up the vertical gold line to the dark green demand curve, and that's the profit-maximizing price. The diagram is a little more complex. Here it is:

Thus, a profit-maximizing monopoly will sell less than the supply-demand output, at a higher price.

4. Monopoly Inefficiency

This loss of consumers' surplus is called the "deadweight loss" (meaning the monopoly profits are not enough to offset it) or the "welfare triangle" and is a measure of the waste due to monopoly restriction of output. In this very simplified example, it is half of the monopoly profits.

In general:

A monopoly will charge more than a competitive industry with the same cost conditions

The monopoly will sell less output

In long run equilibrium, the monopoly will receive economic profits

There will be a net loss of consumers' surplus relative to P-competitive equilibrium