- •2. The use and limitation of Microeconomic theory. Economic methodology

- •2.1. Microeconomic models

- •2.2. Equilibrium analysis

- •1. Demand Function

- •1.1. Individual Demand Function

- •1.2. Market Demand Function

- •1.3. Change in Quantity Demanded and Change in Demand

- •1.4. Inferior, Normal and Superior Goods

- •2. Supply Function

- •2.1. Change in quantity supplied and Change in supply

- •3. Equilibrium

- •4. Market Adjustment to Change

- •4.1 Shifts of Demand

- •If supply is constant, an increase in demand will result in an increase in both equilibrium price and quantity. A decrease in demand will cause both the equilibrium price and quantity to fall.

- •4.2. Shift of Supply

- •4.3. Changes in Both Supply and Demand

- •Lecture 3 Equilibrium and Government regulation of a market

- •Cobweb theorem as an illustration of stable and unstable equilibrium

- •Stable cobweb

- •2.2. Impact of a tax on price and quantity

- •1.2. Impact of demand elasticity on price and total revenue

- •1.3. Income elasticity of demand (yed) and Cross elasticity of demand (ced)

- •C ategories of income elasticity:

- •Persantage changes in Price of good y

- •Price elasticity of supply

- •3. Market adaptation to Demand and Supply changes in long-run and in short-run

- •Lecture 5. Consumer Behavior

- •1. Three parts and three assumptions of consumer behavior theory

- •2. Consumer Choice and Utility

- •2.1. Total Utility (tu) and Marginal Utility (mu)

- •2.2. Indifference curves

- •3. Budget Constraint

- •3.1. The effects of changes in income and prices

- •4. Equimarginal Principle and Consumer equilibrium

- •Lecture 6. Changes in consumer choice. Consumer Behavior Simulation

- •1. Income Consumption Curve. Engel Curves

- •2. Price Consumption Curve and Individual Demand curve

- •3. Income and Substitution Effects

- •1. Income Consumption Curve. Engel Curves

- •2. Price Consumption Curve and Individual Demand curve

- •3. Income and Substitution Effects

- •The slutsky method

- •Lecture 7. Production

- •1. The process of production and it’s objective

- •2. Production Function

- •3. Time and Production. Production in the Short-Run

- •3.1. Average, Marginal and Total Product

- •3.2. Law of diminishing returns

- •4. Producer’s behavior

- •4.1. Isoquant and Isocost

- •4.2. Cost minimization (Producer’s choice optimisation)

- •In addition to Lecture 7. Return to scale

- •Lecture 8. Costs and Cost Curves

- •The treatment of costs in Accounting and Economic theory

- •2. Fixed and Variable Costs

- •3. Average Costs. Marginal Cost

- •4. Long Run Cost. Returns to Scale

- •Envelope Curve

- •Long Run Average Cost in General

- •Returns to Scale

- •The lrac Curve

- •Lecture 9. Competition

- •1) Many buyers and sellers

- •2) A homogenous product

- •3) Sufficient knowledge

- •4) Free Entry

- •3. Economic profit in trtc-model and in mrmc-model

- •4. The Competitive Firm and Industry Demand

- •Figure 4

- •4.1. Economic strategies of the firm at p- Competition

- •Profitableness and losses conditions for perfect competitor according to mrmc-model:

- •4.2. Long run equilibrium

- •Lecture 10 Monopoly

- •Definition of Monopoly Market. Causes of monopoly.

- •Patents and Other Forms of Intellectual Property

- •Control of an Input Resource

- •Capital-consuming technologies

- •Decreasing Costs

- •Government Grants of Monopoly

- •2. Monopoly Demand and Marginal Revenue

- •3. Monopoly Profit Maximization

- •4. Monopoly Inefficiency

- •Negative consequences of Monopoly

- •5. "Natural" Monopoly

- •Government Ownership

- •Regulation

- •Lecture 11. Monopolistic Competition and Oligopoly

- •1. Imperfect competition and Monopolistic competition

- •2. Profit Maximization in Monopolistic Competition

- •3. Oligopoly

- •3.1. Firms behavior in Oligopoly

- •3.2. Kinked Demand Model

- •Duopolies

- •Cournot Duopoly

- •Stackelberg duopoly

- •Bertrand Duopoly

- •Collusion

- •Extension of the Cournot Model

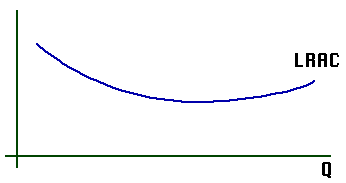

The lrac Curve

In our examples, the LRAC is (more or less roughly) u-shaped, like this:

The idea is that:

–for small outputs, indivisibilities predominate, and so long run average cost declines with increasing output

–for intermediate outputs, operations can be expanded roughly proportionately, while tendencies to increasing and decreasing costs - if any - offset one another.

–for large outputs, the problems of management predominate, and so long run average cost increases with increasing output

Lecture 9. Competition

1. Different market forms

2. P- Competition

3. Economic profit in TRTC-model and in MRMC-model

4. Firm and industry demand in P-competitive market

4.1. Economic strategies of the firm in P-competitive market

4.2. Long run equilibrium

To begin with let’s just think about just what a market is. A market consists of all the (potential) buyers and sellers of a particular good or service.

In order for a market to exist, though, these potential buyers and sellers must have some way to communicate offers to buy and sell with one another. Thus, it is natural to identify a market with the place where traders come together (as in the case of a stock market) or the means by which they communicate.

One possibility is for them to come together and yell at one another (as at the New York Stock Exchange). In traditional societies, craftsmen in a particular trade may all be located on the same street, so that customers know where to go to buy. Of course, many modern markets make use of a wide range of electronic communication methods, as do NASDAQ and the international currency markets.

To sum it up if we talk about a market we always mention the following things:

- buyers, sellers;

commodity;

price setting;

forms of competition.

All this characteristics may vary for different markets. At the same time it could be similarities for some markets. This is the ground to construct some ideal model of the market. These models are called forms of markets (other name types of market structures).

Economists in general recognize four major types of market:

"Perfect Competition"

Monopoly

Oligopoly

Monopolistic competition

1. P-Competition

What many economists call "Perfect Competition" is an idealized model of the market (structure of an industry) in which price competition is dominant – in fact the only form of competition possible. The terminology "Perfect Competition" is quite common but not quite universal. The term "Pure Competition" is also sometimes used.

A P-Competitive structure is defined by four characteristics. For an industry to have a P-competitive structure, it must have all four of these characteristics:

1) Many buyers and sellers

The idea is that the sellers and buyers are small relative to the size of the market, so that no one of them can "fix the price." If there are "many small sellers," it makes it much harder for any seller or any group of sellers to "rig the price". Similarly, if there are "many small buyers," there is little opportunity for buyers to "rig the price" in their own favor. Each seller reasons as follows: "If I try to charge a price above the market price, my customers will know that they can get a better price from my competitors. Thus, the seller treats the price as being given and determined by "the forces of the market" independently of her own output.

T his

has given us a start on understanding of the demand on the

P-competition market. From the Figure we can see, that the demand

curve for a P-Competitive firm is a

horizontal

line corresponding to the going price.

And

that makes sense, because the price in a P-Competitive market is

determined by supply and demand – not by the seller or the buyer.

his

has given us a start on understanding of the demand on the

P-competition market. From the Figure we can see, that the demand

curve for a P-Competitive firm is a

horizontal

line corresponding to the going price.

And

that makes sense, because the price in a P-Competitive market is

determined by supply and demand – not by the seller or the buyer.

The seller has no control over the price, it means that the price is given – a constant, a horizontal line – from the point of view of the seller.

The second important thing here is equality – MR=D=p. Every additional unit of production adds to total revenue the same amount of money – its price .

So, the first basic characteristics of P-Competition is many sellers. How many sellers? How small? There is no absolute answer to that question; but there must be enough sellers and they must each be small enough so that each regards the price as being determined by the market, so that none of the sellers sees any opportunity to push the price up by cutting back on his or her output.

Similarly, there must be enough buyers, and each small enough, that each one treats the price as being determined by the market, and beyond her or his own ability to influence.