- •International Business Strategy

- •Midterm essay

- •Norilsk Nickel

- •Ownership

- •Internationalization

- •Ummc – Ural Mining and Metallurgical Company

- •Ownership

- •Internationalization

- •Russian copper company - Русская медная компания

- •Ownership

- •Internationalization

- •Armz Uranium Holding Co.

- •Ownership

- •Internationalization

- •Kamensk-Uralsky Metallurgical Works j.S.Co. (kumz)

- •Ownership

- •Internationalization

- •United Co. Rusal.

- •Ownership

- •Internationalization

- •Vsmpo-avisma Corporation.

- •Ownership

- •Internationalization

- •Conclusion

- •Norilsk Nickel

- •Russian copper company - Русская медная компания

- •Armz Uranium Holding Co.

- •Kamensk-Uralsky Metallurgical Works j.S.Co. (kumz)

- •United Co. Rusal.

- •Vsmpo-avisma Corporation.

Kamensk-Uralsky Metallurgical Works j.S.Co. (kumz)

KUMZ was founded especially for supplying of aerospace industry with semi-finished products in aluminum and magnesium alloys. Currently, the plant produces aluminum alloy billets, forged and rolled plates, rods, bars, tubes, drill pipes profiles, die-forgings.

Ownership

KUMZ was founded in 1944, as state owned company in that time. In 2000 company was privatized. Nevertheless, bearing in mind sophistication of their products, and usage of it government must have at least some kind of supervision over the company at least over aero-space products. Although, there is no clear proof of that in documents we looked through.

Internationalization

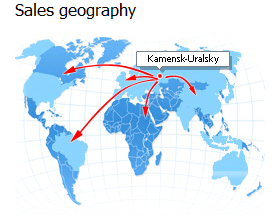

While company maintains most of its operations at home, it exports its products worldwide. KUMZ have a number of advantages:

On-site casting providing high quality ingot for further manufacturing of semi-finished products;

In-house tooling production allowing to make and maintain dies for extrusions and forgings;

On-site R&D Centre.18

The list of country where KUMZ exports its product is vast. In the near future company will probably engage into much active internationalization but at the moment it doesn’t have such aspirations.

United Co. Rusal.

United Company Rusal is another evidence of the high level of consolidation in the Russian non-ferrous metallurgy industry: it is the only considerable player in aluminum in the modern Russia. Founded in 2000 by the agreement of joint management of aluminum and alumina assets between Sibirsky Aluminum and Millhouse Capital, Rusal became the major aluminum manufacturer both in Russia and Ukraine. The next milestone in Rusal’s history was its merger with Sual and the alumina assets of a Swiss company Glencore. This deal marked the creation of United company Rusal, the biggest aluminium company in the world.

Today Rusal is one of the world’s largest alumina producers: it accounts for 9% share of the global aluminum and alumina production19. In 2013 Rusal runs its business in 19 countries of the world on 5 continents, having 40 plants and employing about 72,000 people20. Except for its aluminium and alumina assets, Rusal has such ones as bauxite and nepheline ore mines, foil mills and power-generating assets, along with some units producing alloys and packaging materials. Basically, there are 5 main business divisions in the company, namely: aluminium, alumina, packaging, engineering and construction, and energy21.

The company regards Russia, US, China, Japan and Singapore as its main markets. As for Rusal’s main clients, these are obviously automotive, construction and packaging industries. These strong relationships serve as the company’s competitive advantage in terms of stability. Moreover, developed network of smelters and plants and good supply chain management system helps Rusal to save considerably on transportation costs. Other country-specific advantages for aluminum industry include low labour costs, bargain electricity used for production.

Ownership

Rusal is listed on on MICEX-RTS, HKEx and NYSE Euronext22. From the very beginning, Rusal was owned by a number of notorious Russian oligarchs, the greatest part of whom, however, sold its shares in favor of Oleg Deripaska, which made him the principal stockholder and the only beneficiary of the company23. As for the company’s shareholders, they go as follows: controlling interest (48,13 %) belongs to En+ Group (an energy-related company controlled by Oleg Deripaska), 17,02% of shares belong to ONEXIM Group (private investment fund controlled by Mikhail Prokhorov), 15,80% goes to SUAL, 8,75% Amokenga Holdings ultimately controlled by Glencore International AG), 0,26% RUSAL's management (including 0.22% held by the CEO Deripaska), and 10,03% of shares are free-float24.

Although the state does not directly dispose of shares in Rusal, it clearly has a direct interest in the company and supports it. Thus, it’s crucial to understand that the aluminum industry is “core to Russia and figures significantly in its GDP, impelling the government to support it”25. Without this government backing it would be too costly for Rusal to compete internationally, since the rivalry for aluminium deposits and smelters is severe and global. Rusal is one of 5 so-called economy-forming companies in Russian Federation, so it is quite clear that government is vitally interested in promoting Rusal’s overseas expansion – this part will be more thoroughly examined below, in the Internationalization section.

Not only does government support Rusal’s operations directly. Here, we can cite a good example of the company’s IPO plan. Rusal planned to float about 10% of its shares, but because of its high debt, Rusal was not able to pay dividend for several years. So, such companies connected with government as Sberbank and VTB signaled their interest in the sale (with market price of US$2-US$2.6 bil.)26.

Finally, one does not have to forget about Oleg Deripaska, who is a very important figure in today’s Russia and close advocate of Mr. Putin. It comes cleat just from naming several most important affiliations of Mr. Deripaska: Chairman of ABAC Russia, Vice President of the Russian Union of Industrialists and Entrepreneurs, Chairman of the Executive Board of the Russian National Committee of the International Chamber of Commerce and a member of the Competitiveness and Entrepreneurship Council, an agency of the Russian Government27. Moreover, he sits on the board of trustees of the key Russian theatres and Universities; he is a co-founder of the National Science Support Foundation and the National Medicine Fund. All these facts do not leave any doubt in both direct and indirect participation of State in the business of Rusal.