- •International Business Strategy

- •Midterm essay

- •Norilsk Nickel

- •Ownership

- •Internationalization

- •Ummc – Ural Mining and Metallurgical Company

- •Ownership

- •Internationalization

- •Russian copper company - Русская медная компания

- •Ownership

- •Internationalization

- •Armz Uranium Holding Co.

- •Ownership

- •Internationalization

- •Kamensk-Uralsky Metallurgical Works j.S.Co. (kumz)

- •Ownership

- •Internationalization

- •United Co. Rusal.

- •Ownership

- •Internationalization

- •Vsmpo-avisma Corporation.

- •Ownership

- •Internationalization

- •Conclusion

- •Norilsk Nickel

- •Russian copper company - Русская медная компания

- •Armz Uranium Holding Co.

- •Kamensk-Uralsky Metallurgical Works j.S.Co. (kumz)

- •United Co. Rusal.

- •Vsmpo-avisma Corporation.

St. Petersburg State University

Graduate School of Management

International Business Strategy

Lecturer: Andrei Panibratov

Midterm essay

Non-ferrous metallurgy

Students Darya Plotnikova Branko Popovic

March 14, 2013 St. Petersburg

Preface

– The metallurgy sector

Preface

– The metallurgy sector

At the beginning of 21st century, metallurgy was very profitable and booming business. Recently, metallurgy has booming again. The main reason for such circumstances is rising of prices of natural resources, especially in emerging markets. Now we are witnessing some operational restructuring of metallurgy companies. However, their main businesses stayed production and refining of metals.1

Russian metallurgy companies are among leading companies in the world. In recent years they acquired a lot of foreign assets throughout the world. The most prominent strategy for Russian companies were M&A, especially cross-border M&A. Nevertheless, strategy of Russian companies in metallurgy sector and their growth were propelled by the government from time to time (import quotas, customs, tax-brakes, etc.).2 Our analysis of non-ferrous metals metallurgy sector, main companies in sector, would try to prove that issue.

Non-ferrous metallurgy companies

Norilsk Nickel

At the home market there are few strong players in the field of non-ferrous metals. We will start with analysis of one of the main players – Norilsk Nickel. Norilsk Nickel is the largest producer of nickel and palladium in the world.3 Its largest operations are located in the Norilsk–Talnakh area, in northern Russia.

Ownership

The company is listed on MICEX-RTS and the NASDAQ. The key shareholders are Vladimir Potanin's Interros and Oleg Deripaska's Rusal: each reportedly owns over 25% of shares.4 In 2012, one more oligarch entered in ownership structure of Norilsk. That was Roman Abramovich whose Millhouse Capital bought about 7.3 percent of shares. As is written in the newspapers goal of his entry intended to end Norilsk Nickel dispute between main shareholders.5 The reason for his entry and abrupt end of the dispute we could also link to the Russian president Vladimir Putin’s statement issued earlier that year in which he demanded quick end of the conflict.6 Given that we could conclude that government could influence Norilsk Nickel decision, even if it doesn’t have direct share in this company. Also, there is vast number of examples where Russian government affected decisions of Russian oligarchs, and because of that we could draw conclusions that even the richest people in Russia and owners of colossal companies should coordinate actions of their companies with governmental policy. Bearing that in mind we could say that Russian government in this case has at least indirect control over Norilsk Nickel.

Internationalization

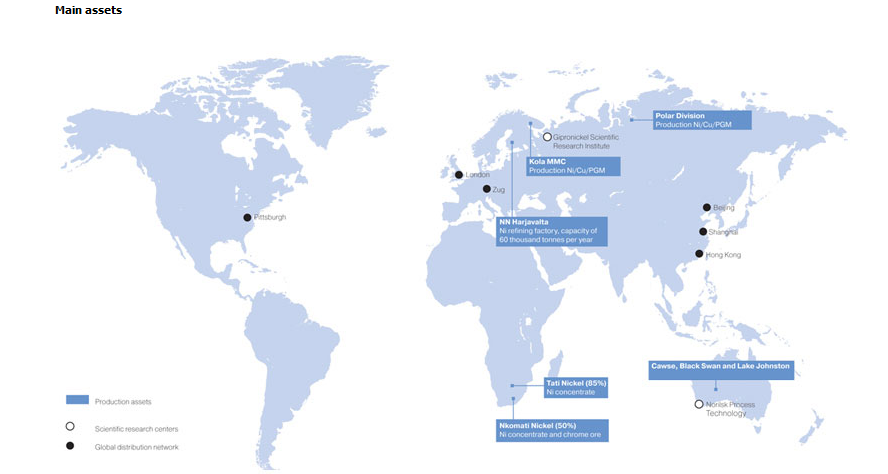

Norilsk Nickel Finland became part of Norilsk Nickel as a result of the OM Group’s nickel business acquisition on 1 March 2007. Norilsk Nickel Harjavalta is the only nickel refining plant in Finland. Norilsk Nickel Harjavalta refinery has the capacity to produce 60 thousand tonnes per year of nickel products. It employs a technique of sulfuric acid leaching of nickel products. It allows to consistently abtain nickel extraction rates above 98%, being an advanced practice for the metals and mining industry. Brownfield entry strategy was exploited in this case. By acquiring Harjavalta, Norilsk gained access to new technologies and new production facilities as well as bigger capacities. Also, it gained monopoly on the Finish nickel market, because Harjavalta was only producer of nickel in Finland. Furthermore, it gained access to raw materials, experienced and quality managers and employees, and better access at the EU market.

In the next step Norilsk Nickel acquired 85% shares of Tati Nickel as a result of the LionOre Mining International Limited acquisition on 28 June 2007. The Botswana government owns the remaining 15% in Tati Nickel. About acquiring of Lion Ore you can find out more in next paragraph.

During 2007, OJSC MMC Norilsk Nickel (Norilsk) separately acquired certain assets of OM Group Inc (OMG) and all of LionOre Mining International Limited's (LionOre) assets through the brownfield investment. In acquiring the assets of OMG and LionOre, Norilsk acquired a diverse mix of projects and growth opportunities which have a rich history in Western Australia's mining industry. The acquisition of LionOre's and OMG's Australian assets in 2007 strengthened Norilsk's internationally diversified portfolio of metal production assets in attractive mining regions. These assets have been consolidated under the management of Norilsk Nickel Australia Pty Ltd.The operations of LionOre and OMG delivered complementary technology for a "reserve rich" sulphide based nickel producer and an asset base of mining and processing operations that fit with Norilsk's refining capabilities. Importantly Norilsk has assembled a strong management team experienced in mining and processing supporting the company's operations in the southern hemisphere, and with strong capabilities in building new operations in remote areas.7

In all cases which we stressed previously there are no clear link between Norilsk Nickel acquisitions and visible governmental involvement it the process. However, as we said earlier influence of government on owners of the company could have something with Norilsk Nickel action. Nevertheless, all actions which Norilsk undertook had business motives, and as we’ve seen, Norilsk was able to acquire new resources, new capacities, and even monopoly. In the end we could conclude that all undertaken actions were in accordance with Norilsk Nickel business strategy, mostly with following statement - growth in prospecting, exploration and development of world class mineral deposits;