Unit 4 money

1. Vocabulary

Exercise 1. Read and memorize the following words and word combinations:

-

Indispensable

exchange

value

to accept

payment

to hoard

portability

durability

uniformity

divisibility

recognizability

life expectancy

denomination

measure

in terms of

price

legal tender

the latter

circulation

embodiment

a means of

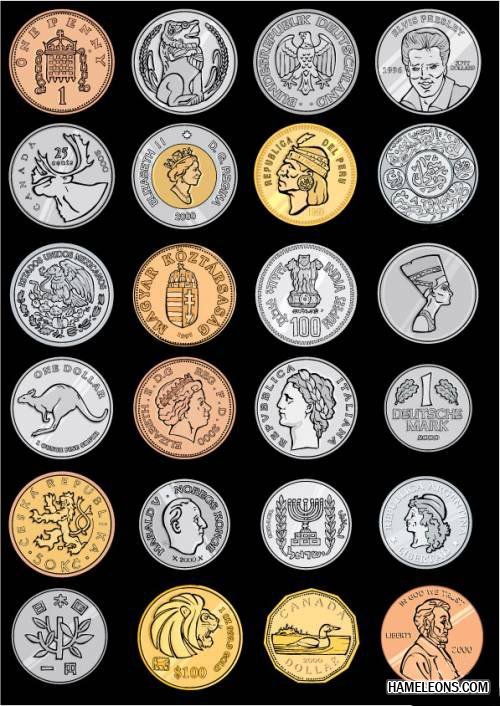

coins

orders

purchase

sale

a number of

Необхідний

обмін

цінність

приймати

платіж

накопичувати

портативність

міцність

о

днорідність,

однаковість

днорідність,

однаковістьділимість

впізнаваність

строк експлуатації

цінність грошових знаків, купюра

міра

в перекладі на, у вираженні

ціна

законний платіжний засіб

останній (з двох названих)

кругообіг

втілення

засіб

монети

ордер

покупка

продаж

низка (декілька)

Exercise 2. Guess the meaning of the following international words:

universal equivalent, role, material, barter, circulation, cheque.

Find in the text more international words and guess their meaning

Exercise 3. Find in the text derivatives containing suffixes 1. -ment; -tion/sion and 2. –al, -ly, -able of the following words, translate them and say to what part of speech they belong:

1. To pay, to circulate, to accumulate, to embody.

2. universe, general, immediate, reason, easy,

Exercise 4. Translate the following words as nouns and as verbs:

Exchange, measure, copy, function, increase.

Exercise 5. Find in the text synonyms to the following words:

goods, states, necessary.

Exercise 6. Find in the text antonyms to the following words:

disadvantages, more, easy, sales, real.

II Reading

Exercise 7. Read and translate:

Text A

Money

is indispensable in a society in which commodity exchange takes

place. In commodity exchange money plays the role of a universal

equivalent, that of a commodity expressing the value of all the other

commodities. Money can be anything that is generally accepted in

payment for goods and services. Although anything can serve as money,

the material should possess the following qualities:

Money

is indispensable in a society in which commodity exchange takes

place. In commodity exchange money plays the role of a universal

equivalent, that of a commodity expressing the value of all the other

commodities. Money can be anything that is generally accepted in

payment for goods and services. Although anything can serve as money,

the material should possess the following qualities:

Stability. The value of money should be more or less the same today as tomorrow. In societies where value of money fluctuates (goes up and down) people will hoard it in the hope that its value will increase, or spend it immediately thinking it will be worth less tomorrow.

Portability. Modern money has to be small enough and light enough for people to carry.

Durability. The material chosen has to have a reasonable life expectancy. For that reason most countries use a very high quality paper for their money.

Uniformity. Equal denomination of money should have the same value.

Divisibility. One of the principal advantages of money over barter is its ability to be divided into parts. In other words, while making change for a dollar is easy, making change for a chicken is more difficult.

Recognizability. Money should be easily recognized for what it is and hard to copy.

Money has a number of functions:

Measure of value. Money is used to measure the value of all other commodities. Each commodity is sold for a certain sum of money, which expresses its value. The value of a commodity in terms of money is called its price.

When commodities are exchanged with the aid of money the latter also serves as a means of circulation. To perform this function money has to be real, not ideal. What is important is that anyone receiving these symbols of value must be assured that they will be accepted from him too, when he pays for other commodities. That is why states declare paper money to be legal tender.

Money also serves as a means of accumulation. This function stems from the fact that money can buy any commodity. Therefore, money is a universal embodiment of wealth and a means of accumulating it. Taken out of circulation, however, money becomes treasure only if it is gold, or money converted into articles of precious metals and stones.

The main types of money in use today are:

Token coins. There are coins made from metals whose real value is less then the value of the coin.

Paper money. Printed money is more convenient than coins. They are lighter to carry and easier to handle in large quantities.

Bank money. Deposits at a bank are the same as money. These deposits can be transferred from one person to another by means of cheques. Cheques are not money but only orders to pay money. Sales and purchases are often made on credit.