- •Содержание

- •Case 1. A Year in Fashion

- •1. This story is set in a fashion house. To find out some background about the world of fashion, read this background box: Background: Fashion houses

- •2. This story looks at problems caused when borrowing money. If you’d like to think about the ethics of money lending, discuss this point:

- •Problem

- •27 May May Week No. 22

- •6 June June Week No.23

- •18 August August Week No. 33

- •11 September September Week No. 35

- •15 September September Week No. 35

- •27 May: Get the facts straight

- •6 June: Getting the money

- •18 August: Why gloomy?

- •11 September: The risks

- •15 September: a letter from the bank

- •5. When you’ve read the first paragraph of this entry, read this letter from the bank summarising the meeting, and fill in the gaps using the words underneath.

- •6. Now, read Suzanne’s four options and then move on to make your decision! Decision time

- •Paired comparisons

- •Background: Bonds

- •The Characters

- •The situation

- •The decision

- •Role play Divide into pairs with members of another group, and role play the following situations:

- •So, should Cliff try to sell the bonds to Louise? If your discussions so far haven’t produced a consensus, take a vote on it. Now decide! Case 3. Angel Investments Background

- •Case study ‘Angel Investments’ card 1

- •Key points for product presentations

- •Proposals

- •Writing

- •Case study ‘Angel Investments’ card 2

- •Case 4. Camden Football Club Background

- •Current situation

- •Writing

- •Case study ‘Camden fc’ card 1 Camden fc negotiating team

- •Case study ‘Camden fc’ card 2 United Media negotiating team

- •Case 5. Group Bon Appetit plc Background

- •Group Bon Appetit: Key facts

- •Innovia Cafes

- •Recent developments

- •1. Task

- •Speaker a Business start-up: Penguin Park

- •Speaker b The Olive Shop (established 2000)

- •Speaker c Business start-up: Sweet Sleepers

- •Speaker d Business start-up: Ingredients.Com

- •2. You have decided to approach a venture capitalist to raise finance for one of the ventures in Exercise 1. Write the covering letter to accompany a detailed business plan.

- •Information for savers and investors

- •Useful language:

- •3. When you have finished preparing your questions, you should meet up with Student b. Make notes on the answers you receive and decide how you are going to invest your money. Student b

- •Role Play 3: Deciding where to invest

- •Introduction

- •1. Look at this list of possible criteria. Work with a partner, and choose what you think are the important criteria. At the same time, eliminate criteria you think are unimportant.

- •Situation

- •You must decide:

- •Worksheet

- •Roles: Role a: The President

- •Role b: The Investment Manager, West Africa

- •Role c: The Investment Manager, South Korea

- •Role d: The Investment Manager, North America

- •Role e: The Financial Research Officer

- •Role f: The Political Research Officer

- •Role g: The Head of Loan Scheduling

- •Role play 4. Selling off a line of business

- •Introduction

- •1. Do this quiz. Begin at number 1, make your choice, and then go to the number indicated in brackets.

- •Situation

- •Role b: The Sales Manager

- •Role c: The Claims Manager

- •Role d: The Investment Manager

- •Role e: The Marketing Manager

- •Role f: The Personnel Manager

- •Role g: The it Manager

- •Role play 5. A big new feature film

- •Introduction

- •1. You are a film producer, with your own company. Work with a partner. Read the questions and choose the best answer.

- •Situation

- •Role b: The Production Manager

- •Role c: The Company Accountant

- •Role d: The Production Assistant

- •Role e: The Head of Casting

- •Role f: The Head of Marketing

- •Role g: The Technical Adviser

- •Role play 6. Servicing a debt

- •Introduction

- •1. Look at this list and put a tick next to those who will suffer because of your company’s closure:

- •4. Will the people who suffer more be those who have the best protection, or those who receive compensation? Situation

- •5. You must decide:

- •Fact sheet

- •Roles: Role a: The Chair of the Consortium of Banks

- •Role b: The Secretary of the Association of Danegelt Shareholders

- •Role c: The Managing Director of Danegelt

- •Role d: The Chief Executive of the Sumitomo Bank

- •Role e: The Secretary of the Federation of Small Shareholders

- •Role f: The Financial Director of Danegelt

- •Role g: The President of the Trust Bank of New York

- •2. Write notes.

- •3. Study the balance sheet items below. Is a bs in your company presented in the same way?

- •2. Fill in the missing vowels in these words and then check the meaning.

- •3. Discuss. Reference list

- •117997, Москва, Стремянный пер., 36.

Situation

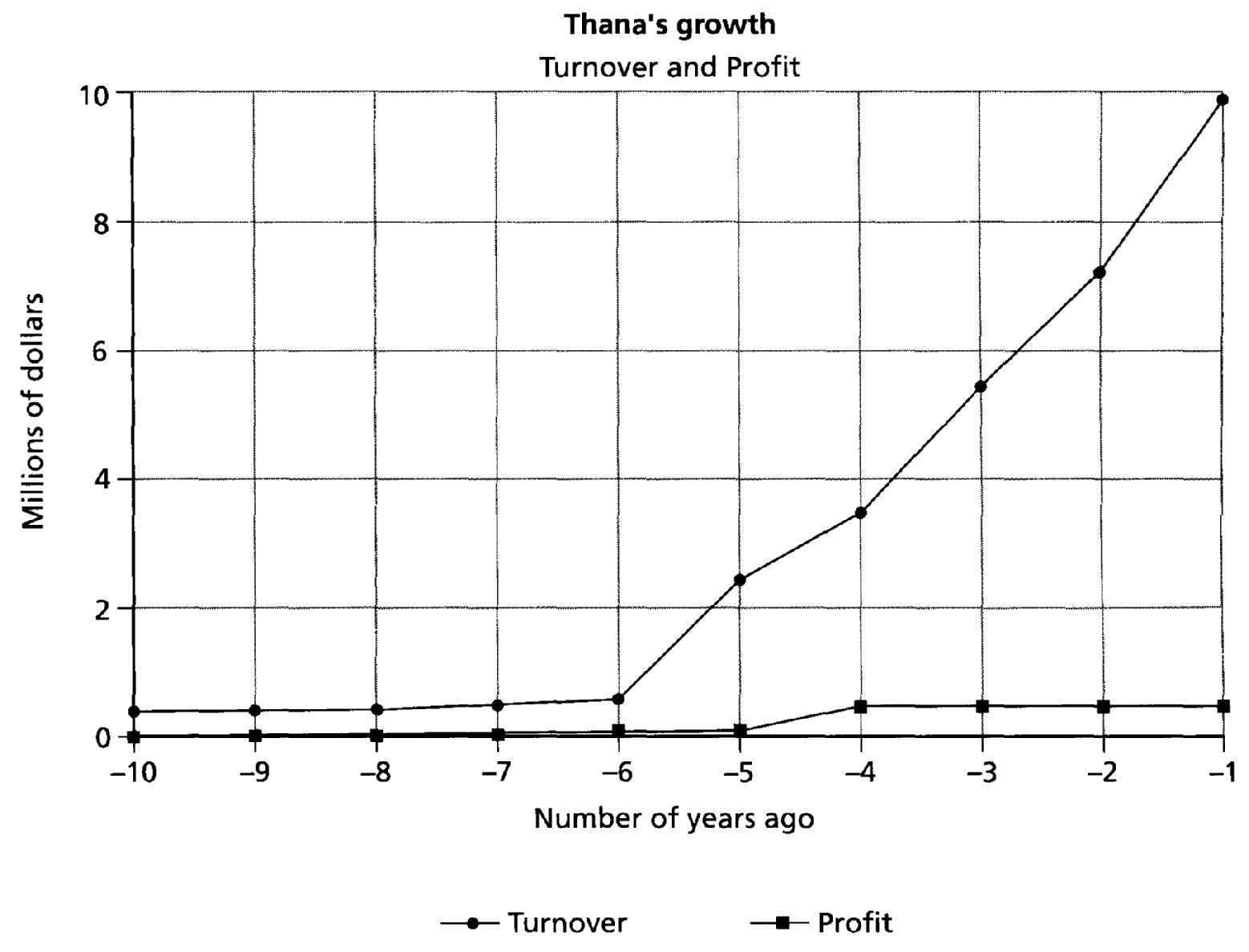

You work for Thana Productions, a small Indian film production company, based in Bombay. Thana makes television films and series, many of which it has sold to countries in Europe, southern Africa, and the Far East. The company has only been in existence for ten years; it has expanded very rapidly in the last five years, since the arrival of a new and very dynamic production manager, who has given an international dimension to the company’s films, casts, directors and sales. Thana makes most of its films and series in Hindi, but has recently started making some in English.

This production manager now wants the company to make a major Hollywood-style feature film in English. The story will be based on the best-selling novel La Cantonaise (The Cantonese Woman) by Shaneyl Bergé, to which Thana owns the film rights. The book has sold over 500,000 copies in French, but has not been translated into English. It is a love story set in China in a context of civil war and revolution in the early part of the twentieth century. It would be a big-budget film, costing at least $50 million if an Indian location, little-known actors, and a little-known film director and screenwriter were chosen; and double that amount otherwise, if a Chinese location, big-name (possibly American) actors, and a well-known film director and screenwriter were chosen.

Preliminary studies, and the experience of other big film production companies, indicate that the financial return on a $100 million investment would be 10%, if the film was a box-office success and if it was distributed worldwide. The same studies show that if a $50 million budget was chosen instead, with distribution in India and in other countries which are regular customers of Thana Productions, the return would only be 5 or 6%. Thana could not possibly make either investment alone (see turnover and profit figures): it would have to find partners to co-produce, finance and distribute the film.

2. You must decide:

• if Thana should find partners and undertake the production of La Cantonaise

• and if so, whether the company should choose the low-budget ($50 million) or high-budget ($100+ million) solution, who the partners could be, and what role those partners should have

Fact sheet

ROLES:

Role A: The President

Chairing the meeting: You chair the meeting and make sure everyone joins in. Organize the meeting in the following way:

1. First, get each participant’s opinion as to whether your company should undertake the production of La Cantonaise, and come to a decision on this question.

2. Then if you do decide to undertake this production, make the choice of a $50 million production or a $ 100+ million production, after careful evaluation of the advantages and disadvantages of each budget.

Your own point of view: Thana is a profitable and growing company, but you think it is absurd to try to undertake an enormous and over- mbitious project of even $50 million, let alone $100+ million. Your colleagues must remember that in its first year of existence ten years ago the company only made three short television films. Even last year turnover was under $10 million, and profits, although healthy, were only $500,000 after tax. If the company continues to expand as rapidly as at present, in five or ten years you will be able to consider a gigantic project like La Cantonaise. But for the moment you should be less ambitious and perhaps plan a major Indian film on a budget of, at most, $20 million.