- •History

- •Products

- •Advantages of international barter

- •Disadvantages of international barter

- •Barter in Russia

- •Modern Countertrade

- •Bases for Countertrade

- •Barter and crisis

- •Barter exchanges

- •Companies in barter

- •Departments

- •Advantages of barter

- •Limitations of barter economy

- •Conclusion

- •Bibliography

Saint-Petersburg State University

Graduate School of Management

Scientific research

PURE BARTER: IS IT POSSIBLE AND ECONOMICALLY REASONABLE TODAY?

Lidia Fedorova

Violetta Pachina

Mikhail Smirnov

Maria Terkina

Irena Timofeeva

Saint- Petersburg

2010

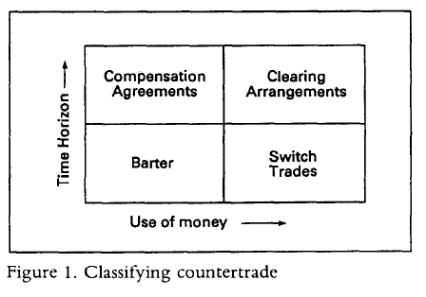

Classifying Countertrade Arrangements

The terminology used in countertrade is unfortunately characterized by a lack of standardization. A number of different expressions are often used to mean the same thing and sometimes the same expression is used with several different meanings. Examples of some terms used are: barter, countertrade, counter purchase, counter sale, clearing agreements, switch trading, bilateral trading, offset trading, reciprocal trading, parallel trading, linked trading, triangular trading, compensation agreements or arrangements, buy-sell, pay-back, back to- back transactions, and other terms too numerous to list

Barter

Barter is a onetime exchange of goods with no direct use of money. There can be many variations of this basic exchange:

Parallel barter or counter purchase or buy-back takes place when goods are exchanged for equal amounts of money.

Offset is parallel barter with a promise to assist in the sale of goods replacing one of the contractual obligations to purchase goods.

Reverse reciprocity is parallel barter for scarce goods such as oil for nuclear power plants.

Multilateral barter is a chain of barter transactions contracted simultaneously among more than two parties.

Parallel barter with co-operation is a set of two offsetting parallel barter arrangements between three organizations.

Barter with co-operation and bank credit allows for a timing difference between the two parts of a parallel barter.

History

Barter Economy may be regarded as the mother of all economic concepts prevalent today. It is the most primitive and very basic economic theory, which does not consider currency as a medium of exchange. Rather, commodities and services are considered to be the means of all exchanges, as money was unknown to man in ancient times.

The beginning of the barter trade originated at the time human societies began to develop, and continues to exist in some societies today. Modern day money developed through the trades and exchanges of bartering with the primary exchange being that of "cattle." Cattle, which included everything from cows to sheep to camels, were the oldest form of modern day money. This developed into the trade of shells and other items, and continued to evolve all the way to the modern form of paper money in use today.

Bartering is traditionally common among people with no access to a cash economy, in societies where no monetary system exists, or in economies suffering from a very unstable currency (as when very high rates of inflation hit) or a lack of currency. In these societies, bartering oftentimes has become a necessary means of survival.

Barter and countertrade were very popular in the 20th century, it played a significant role in the trade between Western countries and countries of Eastern bloc and the third world countries. In the second part of the 20th century barter and countertrade's share of annual world trade volume growed rapidly - from an estimated two percent in 1976 to as much as 30 percent for 1982.1 In East-West trade, barter and countertrade reach about 50 percent, due to hard currency shortages endemic to centrally planned economies. Many third world nations have substantial foreign debts with Western financial institutions, which produce hard currency shortages and exchange controls. Following a tradition established earlier by Eastern bloc economies, these third world countries increasingly rely on the exchange of basic commodities to acquire Western capital goods, and to avoid depleting hard currency reserves. OPEC nations also found barter and countertrade attractive, exchanging oil for sophisticated military and industrial equipment. Additional reliance on barter was stimulated by the desire of Western governments to reduce credits to third world nations on the brink of insolvency, and to Eastern bloc nations, as well, due to their increased indebtedness and for political reasons.

Products

Responding firms produce a wide spectrum of products from food, apparel, industrial chemicals, extractive commodities, transportation equipment and services, industrial machinery, defense related products, to consumer goods and consumer services. The product lines most frequently bartered or countertraded by these firms were industrial equipment and machinery, transportation equipment and parts, and industrial chemicals - product lines previously identified as most subject to barter and countertrade demands.

Compared to conventional international trade, the majority of the products bartered or countertraded were commodities or low technology products. High technology products were more likely obtained by conventional methods of exchange. For firms whose product lines are similar for both types of transactions, simple barter or offset were the most frequently used arrangements. Firms whose product lines are more diversified, however, used more complex trading arrangements, and frequently had a barter or countertrade department or a trading subsidiary. For firms trading a less diversified product line, transactions are generally channeled through existing organizational structures such as the export department or the international division.

The extent of firms' product diversification in barter and countertrade is also associated with the degree of market diversification. Firms with a more diversified product offering for barter/countertrade are active in three or four times as many markets. While Eastern and Southern Europe are the most frequent regions for these firms, a surprising amount of activity occurs in Africa and Latin America. The latter destinations fit the recent movement among commodity exporters toward countertrade as a means to compensate depressed earnings from exports. Firms offering a narrower or similar product line were concentrated in Eastern Europe with minimum participation in all other regions.