- •Failure of Carrefour internationalization strategy in Russia

- •Contents

- •Introduction 3

- •1. 1. Company Overview 4

- •Introduction

- •Chapter 1. Background

- •1. 1. Company Overview

- •1. 2. History of the company Carrefour: hypermarket pioneer.

- •1.3 . Internationalization

- •1.4 . Russian Retail Sector

- •Chapter 2. Theory and Problem

- •Chapter 3. Methodology

- •3. 1. Pest-analysis Political factors (including institutions and infrastructure)

- •Economic factors

- •Technological

- •Retail Trade in Russia

- •3. 2. Swot-analysis

- •Increasing awareness of customers with European Brands

- •Chapter 4. Company figures

- •Chapter 5. Recommendations

Technological

In this industry the technological factors play a great role. At first, the quality of infrastructure is very important. It has to be mentioned that, except St. Petersburg and Moscow regions’ infrastructure in Russia is still very bad, it includes bad railway system, poor quality of roads, etc.

On the other hand, the last technological innovations such as automatic shelf labeling, GPS tracking systems, etc. tend to lower the additional costs of retailers. Also they minimize the time consumption, which also leads to lower costs in the end, despite the first huge investments.

Retail Trade in Russia

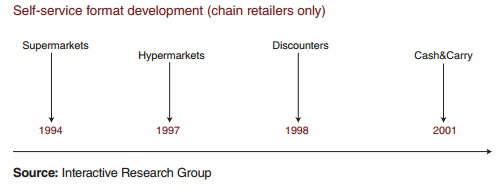

The first recognizable self-service supermarket chain opened in 1994. Subsequently hypermarkets, discounters and cash&carry formats were introduced in quick succession. The 1998 economic crisis was a major influence in the birth and rise of discount chains.

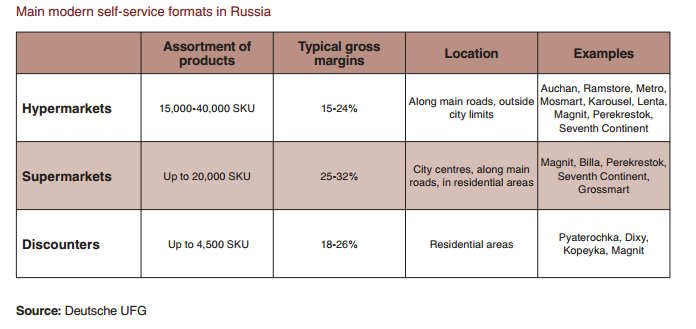

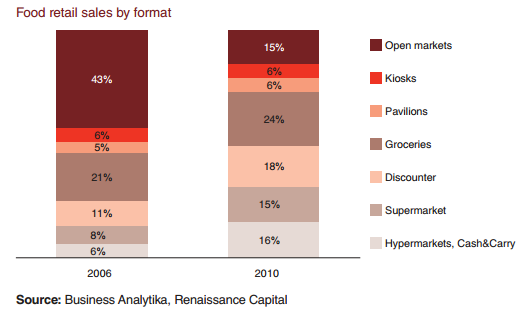

According to estimates, the share of modern self-service formats in Russia is about 50% in 201021, with most of the additional market share being taken from open markets.

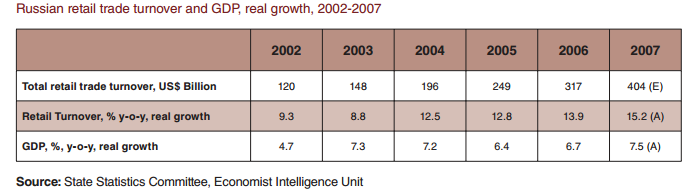

Retail trade has also demonstrated very solid growth rates. Over the last five years, its real growth has significantly surpassed the real growth of the GDP. In 2006 the total retail trade turnover was estimated at US$317 billion by the Russian State Statistics Committee.

The retail growth story was playing out well when the financial crisis struck. The recession, which saw the economy contract by 7.9% in 2009, was particularly bad for consumer-dependent sectors such as retail. The Russian government stepped in at the right time to help the retail sector, though the intervention was limited in scale compared to other major industries such as oil and natural gas, and mining. Russia’s largest food retailer, X5 Retail Group, received a loan from the government to the tune of $255 million to tide over the crisis. Magnit, another food retailer, also availed itself of a $91 million22 credit line from a government-owned bank. Management consultants A.T. Kearney acknowledged the recovery in the industry, when it ranked Russia second in the Global Retail Development Index in 2009.

Though the retail sector does not have any government-owned companies, the segment witnessed some hectic corporate activity, with the country’s biggest food retailer X5 Retail Group taking over smaller rival Kopeika for $1.65 billion. 23The acquisition was a small step in consolidating the country’s highly fragmented retail sector.

3. 2. Swot-analysis

Strengths

|

Weaknesses

|

Opportunities

|

Threats

|

Strengths.

Leading hypermarket retailer in the world

Carrefour operates the largest chain of hypermarket stores in the world. It is the world's second largest retailer and the largest retailer in Europe in terms of revenues. Carrefour operates about 1,302 hypermarkets in 33 countries across the European, Latin American and Asian regions. Further, internationally the average size of a new Carrefour hypermarket stores was around 5,400 sq m in 2008. The larger size of the hypermarket stores enables Carrefour to accommodate a wide selection of food and non-food products. This in turn helps the group promote itself as a destination retailer for household needs. Furthermore, a strong market presence and the large scale of the company's hypermarket operation provide a competitive advantage to the group in terms of economies of scale and business scalability.

- Huge experience in retail industry

Carrefour operates on different markets for a long time. During that time the company gained knowledge background operating such business and adjusted the processes so they could be the optimal ones. Also they have the assets and are capable to widen the range of countries where they operate, without damage to currently running business.

Well-known international brand

The well-known international brand gives the company an opportunity to operate with better conditions. There is no need for the company to prove anything. The power of internationally famous companies is much hires than the ordinary ones. The partners and suppliers are willing to operate with such companies because they are already well-known and it attracts customers with less advertising costs.

Multiple retail format strategy

Carrefour operates its business through a number of retail formats including hypermarkets, supermarkets, hard discount stores, convenience stores, and cash and carry retailing. While the group's hypermarket format offers a wide selection of both food and non-food products, the supermarket and convenience formats target the daily and monthly food needs of customers and are more accessible than the hypermarket stores. Furthermore, Carrefour's hard discount stores offer a range of food and non-food products at a comparatively lesser price points. Carrefour also operates cash and carry stores to meet the demand of small retailers and other business institutions. In addition, Carrefour sells its product through a number of e-commerce websites such as Ooshop, CarrefourOnline.com, and Carrefour.es. having a presence across multiple retail formats enables Carrefour to target different customer segments. Moreover, Carrefour's multiple retail format strategy helps it to set up stores in new markets as per the local requirement with limited barriers.

Weaknesses

Poor supplier and partner system

As we came to the conclusion, that one of the main disadvantages was the poor system of Russian suppliers and partners. The partners, that knew the environment of Russian business in this field, so they could gain more advantages and be more trustworthy in terms of rrelationshipswithotherplayersofthemarket.

Carrefour witnessed a continuous decline in its profit margins.

The group's operating profit margin declined to 3.1% in 2008 as compared to 4.0% and 4.2% in 2007 and 2006, respectively. Similarly, Carrefour's net profit margin decline to 1.4% in 2008 from 2.9% in 2006. Although the decline in profit margins is partly attributed to certain external andinternal factors, a continuous drop in profit margin is certainly a cause of concern for the group. A continuous decline inprofit margins will invariably affect Carrefour's financial position.

Low understanding the ways of doing business in Russia

This weakness comes out from the first one. The company did not hire local managers so it faced the problem with lack of qualified people who are aware with the local business practices and laws. That famous example, when Carrefour did not got the permission to sell alcohol and suffered huge losses, proves this statement.

Low Carrefour Brand awareness in Russia

At that time the company’s strategy was “low cost – low prices”. Unfortunately, the system of Discounters hasn’t appeared in Russia yet and Russian customers are not used to it. They prefer the companies that they already know, although the price plays a great role. So at first the Company had to gain customers awareness and loyalty instead of setting up short-term oriented goals. But the company took the wrong actions because it did not have proper experience on such market.

Opportunities.