- •Chapter 3: The international financial marketplace key chapter concepts

- •Glossary of new terms

- •Financial challenge

- •Introduction

- •The global economy and multinational enterprises

- •Table 3—1

- •Table 3—1

- •Foreign currency markets and exchange rates

- •Direct and Indirect Quotes

- •Table 3 — 2 Spot Foreign Exchange Rates

- •Spot Rates

- •Forward Rates

- •Table 3 — 3. Forward Foreign Exchange Rates

- •Foreign Currency Futures

- •Table 3-4. Futures Contract Quotations

- •Foreign Currency Options

- •The Eurocurrency Market

- •Factors that affect exchange rates

- •Covered Interest Arbitrage and Interest Rate Parity

- •Purchasing Power Parity

- •Expectations Theory and Forward Exchange Rates

- •The International Fisher Effect

- •An Integrative Look at International Parity Relationships

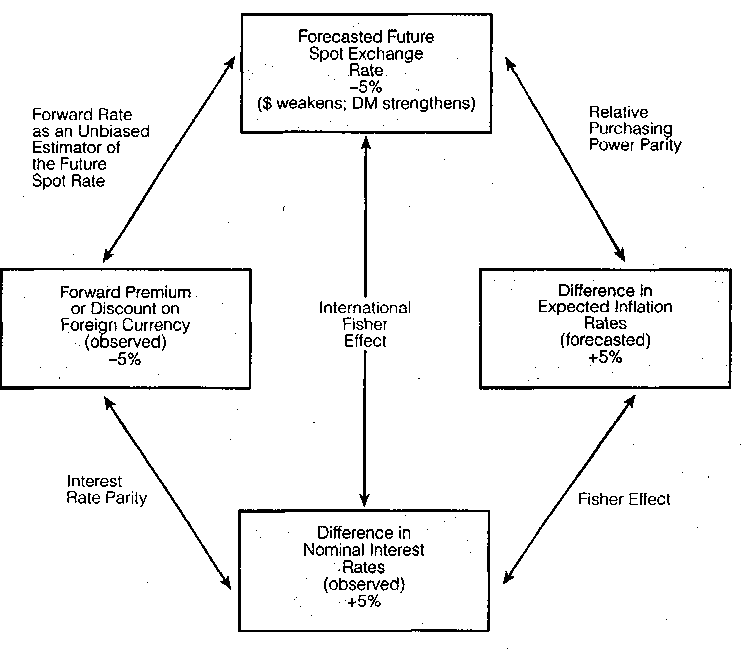

- •Figure 3—1. International Parity Conditions: An Integrative Look

- •Forecasting future exchange rates

- •Using Forward Rates

- •Using Interest Rates

- •Foreign exchange risk

- •Transaction Exposure

- •Table 3-5. Example of Transaction Exchange Rate Risk

- •Economic Exposure

- •Translation Exposure

- •Table 3 – 6. Effect of a Decrease in the Exchange Rate on American Products' Balance Sheet

- •International finance and the practice of financial management

- •Ethical issues: payment of bribes abroad

- •Summary

- •Questions and topics for discussion

- •Self test problems

- •Problems

- •Solutions to self test problems

An Integrative Look at International Parity Relationships

Figure 3-1 provides an integrative look at international parity relationships. Beginning with the lower box in the figure, suppose one observes that the one-year nominal interest rate is 10 percent in the United States and 5 percent in Germany. This implies, according to the Fisher effect, that the difference in expected inflation rates between the United States and Germany is also 5 percent, because real rates of return are assumed to be equal between the United States and Germany. The 5 percent inflation differential means that the one-year future spot rate of exchange between dollars and DM can be expected to change such that the dollar will weaken by 5 percent relative to the DM. This condition is expected from the purchasing power parity relationship.

The 5 percent differential in interest rates also implies that the dollar will sell at a 5 percent discount in the one-year forward market relative to the DM. This expectation arises from the interest rate parity relationship. If the forward rate is an unbiased estimator of future spot rates, then the one-year future spot rate of exchange between dollars and DM can be expected to change such that the dollar will weaken by 5 percent relative to the DM.

Finally, the international Fisher effect implies that if one-year nominal interest rates are 5 percent higher in the United States than in Germany, then the one-year future spot rate of exchange between the dollar and the DM will change such that the dollar will weaken by 5 percent relative to the DM.

Figure 3—1. International Parity Conditions: An Integrative Look

Assume: U.S. nominal interest rate = 10%

Germany nominal interest rate = 5%

Time horizon = 1 year

Forecasting future exchange rates

The equilibrium relationships discussed in the previous sections can be very useful to managers who need forecasts of future spot exchange rates. Although empirical evidence indicates that these relationships are not perfect, the financial markets in developed countries operate in a way that efficiently incorporates the effect of interest rate differentials in the forward market and the future spot exchange market. Therefore managers can use the information contained in forward rates and interest rates to make forecasts of the future spot exchange rates. These forecasts are useful, for example, when pricing products for sale in international markets, when making international capital investment decisions, and when deciding whether to hedge foreign currency risks.

Using Forward Rates

The simplest forecast of future spot exchange rates can be derived from current forward rates. If the one-year forward rate of exchange between dollars and yen is 110 yen/dollar, then this can be used as an unbiased estimate of the expected one-year future spot rate of exchange between dollars and yen. For example, if Boeing were negotiating the sale of a Boeing 737 airliner to Japan Air with delivery and payment to take place in one year, and if Japan Air insisted on a price quoted in yen, then Boeing could use this forward rate to convert its desired dollar proceeds from the transaction into yen. As we will see below, Boeing may want to hedge against the risk of a change in this exchange rate between the time the contract is signed and the time the plane is delivered and payment is received.