- •International Trade

- •International Trade

- •Read and learn the following words and word combinations. Translate the examples:

- •Read and learn the following words and word combinations. Translate the examples:

- •Read and learn the following words and word combinations. Translate the examples:

- •Read and learn the following words and word combinations. Translate the examples:

- •Read and learn the following words and word combinations. Translate the examples:

- •Read and learn the following words and word combinations. Translate the examples:

- •Incoterms

- •I. Read and learn the following words and word combinations. Translate the examples:

- •Incoterms

- •Read and learn the following words and word combinations. Translate the examples:

- •Insurance

- •Read and learn the following words and word combinations. Translate the examples:

- •I. Read and learn the following words and word combinations. Translate the examples:

- •International Money Transfer. Western Union

- •I. Read and learn the following words and word combinations. Translate the examples:

- •I. Read and learn the following words and word combinations. Translate the examples:

- •International Trade Organisations

- •I. Read and learn the following words and word combinations. Translate the examples:

- •International Trade Organisations

- •International Business

- •I. Read and learn the following words and word combinations. Translate the examples:

- •International Business

- •Infrastructure, industries, the global regime, host-countries, investments, environment

- •Read and learn the following words and word combinations. Translate the examples:

- •Read and learn the following words and word combinations. Translate the examples:

- •I. Read and learn the following words and word combinations. Translate the examples:

- •International Financial institutions

- •Read and learn the following words and word combinations. Translate the examples:

- •International Financial Institutions

- •Investment opportunities, unit of account, should focus, to settle, contributed

- •International Trade 2

International Money Transfer. Western Union

Through Western Union, anyone can send or receive money internationally for any reason – and no credit card, bank account or membership is needed. More people use Western Union than any other money transfer service to support family back home, rescue travelers in emergencies, aid students in foreign countries, and keep businesses operating smoothly.

Receivers can pick up their money just minutes after it is sent. Western Union uses modern electronic technology and its own worldwide computer network to issue immediate payout authorization in more than 100 countries.

Western Union has been safely transferring money since 1871. Every transfer is protected by our world-class security system. This ensures that your money will be paid out only to the right person.

Western Union is the world’s largest money transfer network, with more than 28,000 agent locations dedicated to the highest levels of customer service. Many are in banks, post offices, pharmacies, stores, railway stations, airports, and other convenient places, and are open for early and late hours and on weekends.

The sender brings the money to any Western Union agent, fills out a short form, pays the service fee and receives a receipt with a Control Number. The sender then informs the receiver of the transfer. The receiver goes to any Western Union agent, provides identification (knowing the Control Number will help, but is not necessary), and immediately gets the full amount in cash.

Friendly Western Union operators in every country we serve can answer your questions and help you locate the most convenient agents. All operators speak English as well as their national language.

Unit Twelve

Methods of payment in foreign trade

I. Read and learn the following words and word combinations. Translate the examples:

security n – 1) безпека; 2) захист, охорона; 3) забезпечення, гарантія; syn. safety, safeguard; securities – цінні папери; syn. stock; stock exchange – фондова біржа; біржа цінних паперів; to provide security – забезпечувати захист; as a safeguard (against) – в якості гарантії (на випадок)

secure adj – захищений, безпечний, гарантований; syn. safe

e.g. Basic methods of payment provide various degrees of security for the importer and the exporter.

e.g. Securities are traded at the Stock Exchange.

payment in advance – оплата авансом; передоплата; syn. cash with order – готівка з замовленням

e.g. Our only term is payment in advance.

credit n – 1) довіра; 2) кредит; opp. debit 3) акредитив; to extend credit – надавати кредит; Documentary Letter of Credit (L/C) – документарний акредитив; debit and credit – дебет і кредит; credit card – кредитна картка; debit card – дебетна картка

e.g. The documentary letter of credit is a reliable and safe method of payment.

release v – 1) звільняти; 2) дозволяти (випуск, видачу, відвантаження, публікацію); 3) випускати нову продукцію; 4) випускати в продаж; 5) публікувати

e.g. Goods will be released only after payment of the invoice

account n -1) рахунок; 2) фінансовий звіт; 3)pl. звітність, бухгалтерські рахунки; bank/banking account – банківський рахунок; current/checking (A.E.) account – поточний рахунок; open account – відкритий рахунок; to account for – 1) пояснювати; 2) звітувати;відповідати; нести відповідальність

e.g. Payment on open account offers the least security to an exporter.

recover v – 1) повертати; 2) відшкодовувати, покривати; 3) збирати (борги), інкасувати; to recover money – отримати назад гроші; recovery – 1) повернення, відшкодування; full recovery – повне відшкодування; 2) economic recovery – економічний підйом

e.g. There exist legal procedures for recovering money against bill of exchange.

collection n – 1) збір, збирання; 2) грошовий збір; 3) інкасо; 4) отримання грошей (по векселю, чеку); for collection – на (через) інкасо

e.g. We shall send the documents to our bank for collection in 3 days.

revoke v – 1) скасовувати, анулювати; 2) відкликати, повертати

revocable adj – відкличний, поворотний; opp. irrevocable – безвідкличний, безповоротний; той, що не підлягає скасуванню

e.g. Documentary Letter of Credit may be revocable or irrevocable.

in somebody’s favour – на чиюсь користь, на чиєсь ім’я

issue v – 1) випускати в обіг; емітувати; 2) виписувати, видавати, виставляти; the issuing bank – банк-емітент

issue n – предмет обговорення, дискусійне питання

e.g. The importer asks his bank to issue a documentary credit in the exporter’s favour.

advise v – 1) радити, рекомендувати; 2) консультувати; 3) повідомляти, авізувати; “advise fate” – „інформуйте про долю” (форма звертання одного банку до іншого щодо оплати рахунку)

adviser n – радник, консультант; economic/financial/trade adviser ; the advising bank – авізуючий банк

e.g. The issuing bank arranges with the advising bank to pay the exporter after the examination of the documents.

II. Read and translate the text

Methods of Payment in Foreign Trade

Compared to selling in the domestic market, selling abroad can create extra problems. Delivery generally takes longer and payment for goods can take more time. So exporters need to take extra care in ensuring that prospective customers are reliable payers and payment is received as quickly as possible. Payment for export depends on the conditions outlined in the commercial contract with a foreign buyer. There are internationally accepted terms designed to avoid confusion about costs and price (Incoterms). The way exporters choose to be paid depends on a number of factors: the usual contract terms adopted in the buyer's country; what competitors may be offering; how quickly funds are needed; the availability of foreign currency to the buyer and, of course, whether the cost of any credit can be afforded by the importer (the buyer) or the exporter (the seller).

There are several basic methods of payment providing various degrees of security for the exporter and the importer.

Payment in advance (Cash with order)

The best possible method of payment for the exporter is payment in advance. Cash with order (CWO) avoids any risks on small orders with new buyers and may even be asked before the production begins. However this form is rare since it means that the buyer is extending credit to an exporter. In addition the importer may run a risk that the goods will not be despatched in accordance with the contract terms. Nevertheless, provision for partial advance payment in the form of deposits (normally between 10 per cent and 20 per cent of the contract price) or progress payments at various stages of manufacture is often included in the contract terms.

Variation of this form is cash on delivery (COD), where small value goods are sent by Post Office parcel post and are released only after payment of the invoice plus COD charges.

Open account

Payment on open account offers the least security to an exporter. The goods and accompanying documents are sent directly to the importer who has agreed to pay within a certain period after the invoice date – usually not more than 180 days. There are various ways in which the importer can send money to his supplier under open account and he may wish to choose the means to be used, for example payment by cheque, by telegraphic transfer (TT), by International Money Order, etc.

The open account method is increasingly popular within the EEC because it is simple and straightforward.

Documentary Bill of Exchange

This is a popular method as it offers benefits for both the exporter and the importer. The main advantage for the importer is that he does not need to make payment until his exporter has dispatched the goods. The advantage for the exporter is that there are legal procedures for recovering money against bill of exchange and, if the goods are sent by sea, he is able to control them through the documents of title to the goods until the importer has agreed to make payment. Documentary bill of exchange is a demand for payment from the exporter. He will draw it up on a special printed form and forward it to his bank together with the documents relating to the transaction. These may include the transport document proving that the goods have been dispatched. The exporter’s bank will send the bill and documents to the importer’s bank “for collection”. The importer’s bank will notify him of the arrival of the documents and will release them to the importer provided that: a) he pays the amount of the bill in full if it is the sight draft, or b) if the bill is a term draft, the importer “accepts” it, i.e. signs across the bill his agreement to pay the amount in full on the due date.

Documentary Letter of Credit (L/C)

The Irrevocable Letter of Credit is the most commonly used method of payment for imports. The exporter can be sure that he will be paid when he dispatches the goods and the importer has proof that the goods have been dispatched according to his instructions.

The “letter” is an inter-bank communication. The two banks take full responsibility that both shipment and payment are in order. The banks deal only in documents and are not obliged to inspect the actual goods. This is how the system works.

The importer and exporter agree a sales contract and the terms of the Documentary Credit.

The importer asks his bank to open a Documentary Credit in the exporter’s favour.

The importer's bank (the issuing bank) issues a L/C saying, “We, the bank, promise that we will pay you when you submit certain documents that prove that you have shipped the goods as agreed upon in the sales contract”. The L/C specifies the documents to be submitted, the shipping requirements and the expiry date. The issuing bank sends a L/C to a bank in the exporter's country (the advising bank). The issuing bank arranges with the advising bank to pay the exporter after the documents have been presented.

The exporter prepares the documents, usually an invoice, a bill of lading, an insurance policy, a packing list and a certificate of origin, then makes a shipment. Then the exporter draws a draft (Bill of Exchange), attaches the documents to it and presents everything to the advising bank for payment.

The advising bank examines the documents. If everything is in order the bank pays the draft presented by the exporter and sends the documents to the issuing bank.

The issuing bank notifies the importer that the documents are at his disposal. The bank releases the documents as soon as the importer has paid and the importer may receive the goods.

There is a great variety of international trade relations, so there are different kinds of L/C. But all have the same function: to provide a safe and trusted method of payment between importer and exporter.

III. Answer the following questions:

What factors influence the choice of the methods of payment in foreign trade?

How do basic methods of payment differ?

Which of the methods of payment is the most secure for the exporter?

Why is CWO rarely used?

Which of the methods of payment is the least secure for the exporter?

What benefits does payment by documentary bill of exchange offer to the exporter? to the importer?

What is the role of the bank in dealing with the documentary bill of exchange?

What method of payment is the most commonly used in foreign trade and why?

How are banks involved in payment by documentary L/C?

What are the obligations of the importer/exporter in this kind of payment transaction?

IV. Give Ukrainian equivalents of the following:

prospective customer; conditions outlined in … contract; to afford the cost of credit; nevertheless; to be increasingly popular; simple and straightforward; documents of title to the goods; to forward; to notify; on the due date; actual goods; at his disposal.

V. Give English equivalents of the following:

внутрішній ринок; вжити додаткових заходів безпеки; щоб уникнути непорозумінь; поетапна оплата; супроводжуючі документи; юридична процедура; друкований бланк; за умови, що ...; сплатити суму повністю; міжбанківський обмін інформацією; конкурент

V. Learn the following phrases with the word “account”. Use them to translate the following sentences:

to establish/to open an account with the bank – відкрити рахунок в банку

to have/to keep an account with the bank – мати рахунок в банку

to draw money from an account – знімати гроші з рахунку

to overdraw an account – зняти більше грошей, ніж є на рахунку; перевищити залишок на рахунку

to pay into/to enter to an account – зараховувати (суму) на рахунок

to transfer to an account – перерахувати (суму) на рахунок

to settle an account – 1) оплачувати рахунок; 2) узгоджувати суму на рахунку

to close an account – закривати рахунок

Кожна особа може відкрити рахунок в банку.

Нам потрібно перерахувати гроші на вказаний рахунок.

Будьте уважні не перевищуйте залишок на поточному рахунку, інакше банк може анулювати ваші чеки.

В якому банку ти маєш рахунок?

Перш ніж закрити рахунок, ви повинні узгодити суму на ньому.

Це дуже дорога річ. Щоб купити її, тобі доведеться зняти гроші з рахунку.

Будь ласка, зарахуйте цю суму на мій рахунок.

VII. Match the definition on the right with the word on the left. Learn the definitions:

credit account |

|

advance |

|

recover |

|

advantage |

|

draft |

|

VIII. Fill in the blanks with the words from the list below:

forward, arrangements, draw, irrevocable, advance

The … L/C cannot be cancelled, so the exporter can be sure to collect his money.

On receipt of your documents we shall … your order.

The suppliers asked the importer for 20% ….

You may … on us at 90 days from the date of dispatch.

Please, inform what … you have made for payment.

IX. Match the synonyms. Use any 5 words in the sentences of your own:

|

|

|

|

|

|

|

|

|

|

|

|

X. Match the words with the opposite meaning. Use any 5 words in the sentences of your own:

|

|

|

|

|

|

|

|

|

|

XI. Translate into Ukrainian:

Постачання закордон та оплата товару займають більше часу, ніж операції на внутрішньому ринку.

Перш ніж надати кредит переконайтесь, що ваш партнер – надійний платник.

Які супроводжуючі документи я повинен надати банку?

Ви отримаєте гроші по векселю при умові, що всі документи в порядку.

Умови транспортування уточнені в акредитиві.

Оскільки він був новим клієнтом, фірма попросила часткову передоплату замовлення.

XII. Topics for discussion:

Speak about the degrees of security offered by payment in advance, payment on open account; by B/E; by L/C.

Explain the essence of payment by B/E.

Explain the essence of payment by L/C.

XIII. Skills practice:

Assignment 1. Complete the scheme, showing the relations between the participants.

-

Sales Contract

Exporter/Seller |

Importer/Buyer |

The advising bank |

B/E L/C |

The issuing bank |

Assignment 2. Explain the scheme, the movement of goods and money.

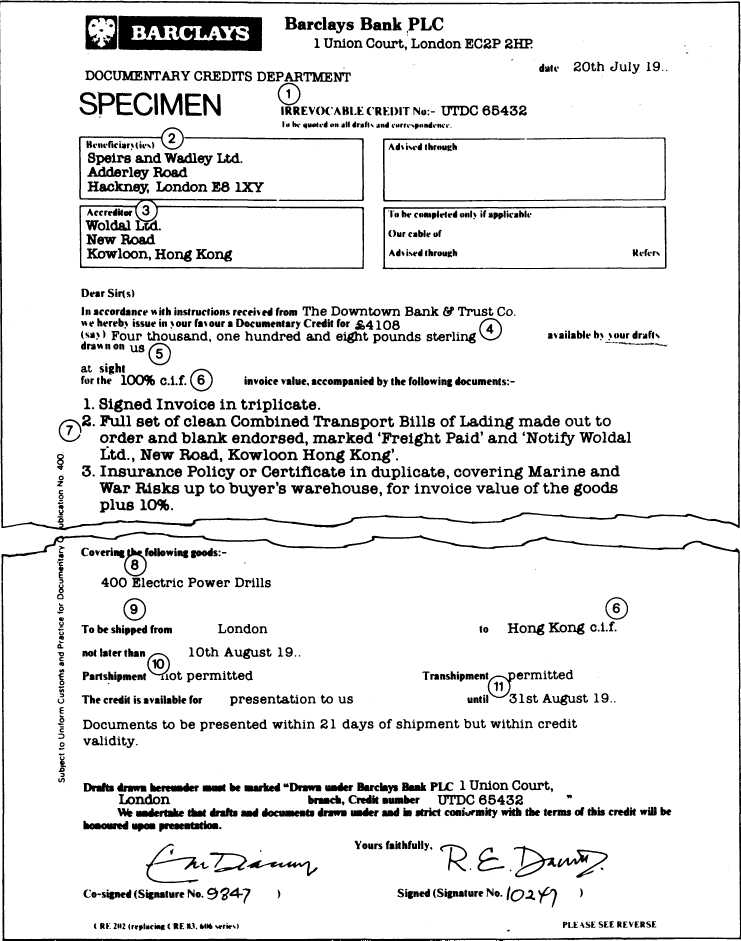

Assignment 3. Look at the following document - a copy of a letter of credit. Read the explanation of the various sections on the next page and decide which explanation goes with which number.

Most Credits are fairly similar in appearance and contain the following details:

The terms of contract and shipment (i.e. whether ‘ex-works’, ‘FOB’, ‘CIF’, etc).

The name and address of the importer (accreditor).

Whether the Credit is available for one or several shipments.

The amount of the Credit in sterling or a foreign currency.

The expiry date.

A brief description of the goods covered by the Credit (too much detail should be avoided as it may give rise to errors which can cause delay).

The name and address of the exporter (beneficiary).

Precise instructions as to the documents against which payment is to be made.

The type of Credit (Revocable or Irrevocable).

Shipping details, including whether transhipments are allowed.

Also recorded should be the latest date for shipment and the names of the ports of shipment and discharge. (It may be in the best interest of the exporter for shipment to be allowed 'from any UK port’ so that he has a choice if, for example, some ports are affected by strikes. The same applies for the port of discharge.)

The name of the party on whom the bills of exchange are to be drawn, and whether they are to be at sight or of a particular tenor.

Assignment 4. Describe the exporter’s/importer’s obligations under the contract.

Unit Thirteen

Barriers to international trade