- •International Trade

- •International Trade

- •Read and learn the following words and word combinations. Translate the examples:

- •Read and learn the following words and word combinations. Translate the examples:

- •Read and learn the following words and word combinations. Translate the examples:

- •Read and learn the following words and word combinations. Translate the examples:

- •Read and learn the following words and word combinations. Translate the examples:

- •Read and learn the following words and word combinations. Translate the examples:

- •Incoterms

- •I. Read and learn the following words and word combinations. Translate the examples:

- •Incoterms

- •Read and learn the following words and word combinations. Translate the examples:

- •Insurance

- •Read and learn the following words and word combinations. Translate the examples:

- •I. Read and learn the following words and word combinations. Translate the examples:

- •International Money Transfer. Western Union

- •I. Read and learn the following words and word combinations. Translate the examples:

- •I. Read and learn the following words and word combinations. Translate the examples:

- •International Trade Organisations

- •I. Read and learn the following words and word combinations. Translate the examples:

- •International Trade Organisations

- •International Business

- •I. Read and learn the following words and word combinations. Translate the examples:

- •International Business

- •Infrastructure, industries, the global regime, host-countries, investments, environment

- •Read and learn the following words and word combinations. Translate the examples:

- •Read and learn the following words and word combinations. Translate the examples:

- •I. Read and learn the following words and word combinations. Translate the examples:

- •International Financial institutions

- •Read and learn the following words and word combinations. Translate the examples:

- •International Financial Institutions

- •Investment opportunities, unit of account, should focus, to settle, contributed

- •International Trade 2

I. Read and learn the following words and word combinations. Translate the examples:

payment n – 1) платіж, оплата; 2) погашення (боргу); 3) внесок; 4) винагорода; means of payment – засіб платежу; syn. instrument of payment – платіжний інструмент; method of settlement – форма оплати/розрахунку/ погашення боргу

payer n – платник

payee n – одержувач грошей, ремітент

payable adj – той, що підлягає оплаті; оплачуваний; payable on demand – оплачуваний по вимозі, на пред’явника

e.g. Means of payment is the instrument of payment where certain instructions are written.

сash n – 1) готівка, готівкові гроші; 2) банкноти, монети та ін. активи, що прирівнюються до готівки; 3) готівкові угоди

e.g. Cash in the form of coins and notes is rarely used in foreign trade.

cheque n (A.E. check) – чек; to cash a cheque – отримати готівку по чеку; to negotiate a cheque – переуступити чек; open cheque –відкритий чек; negotiable cheque – обіговий/оборотний, передатний чек; cheque book – чекова книжка

e.g. Payments of large sums of money are usually made by cheque.

draw v – виписувати/виставляти тратту, чек;

drawer n – особа, що виписує чек/виставляє тратту; трасант

drawee n – особа, на яку виписано чек/виставлена тратта; трасат

to draw on (smb) for – виставити вексель (на когось) на (суму)

e.g. A person drawing the cheque is called a drawer.

сross v – перекреслювати, кроссувати; cross/crossed cheque – кроссований чек; crossing n – кроссування чека; general crossing – загальне кроссування; special crossing – особливе кроссування

e.g. The crossing is two parallel lines placed across the cheque.

due date – строк оплати, термін погашення

Bill of Exchange – перевідний вексель, тратта; syn. draft, transfer note; documentary Bill of Exchange – документований вексель; the face of the bill – лицьова сторона чека; sight draft/bill – вексель/тратта на пред’явника; term draft/bill – терміновий, строковий вексель/тратта

e.g. Bill of Exchange is often called a draft, especially if payment is made from one bank to another.

аccept v – 1) приймати, погоджуватись; 2) акцептувати (вексель); accepted – акцептований; accepted cheque – акцептований чек

acceptor n – акцептант

acceptance n – акцептований вексель, тратта

e.g. The drawee becomes acceptor after he has accepted the bill.

II. Read and translate the text:

Means of Payment in Foreign Trade

Means of payment (also called method of settlement) is the instrument by which payment is made. Among numerous instruments we distinguish between payment in cash, by cheque (A.E. check), bank transfer, SWIFT, draft, bank money order, telegraphic transfer (TT), mail transfer (MT), Bill of Exchange. Generally speaking, means of payment is the instrument of payment where certain instructions are written.

The simplest way is to pay in cash that is money in coins or notes. This, however, is very rarely used in foreign trade. A cheque is a written order by a person (a drawer) to a bank (a drawee) to pay a certain sum of money from the person's bank account to another person (a payee). Payments of large sums of money are usually made by cheque rather than cash and the drawer of the cheque will wish to make sure the cheque does not fall into wrong hands.

A cheque made out as payable on demand (an open cheque) can be cashed or negotiated by any person who holds it. To minimize such a possible loss it is usual to cross the cheque. A crossed cheque can only be paid into a bank account. The crossing is two parallel lines placed across the cheque with or without the words “not negotiable” or “a.c.” – “payee only” or “and company”. This is called a general crossing. A special crossing is the one where the words are added to general crossing specifying the bank at which the cheque is to be presented.

A Bill of Exchange is an unconditional order in writing addressed by one person to another and signed by the person giving it, requiring the person to whom it is addressed to pay on demand (a sight draft) or at a fixed or determined future date (a term draft) a certain amount of money to a specified person or to the bearer. A Bill of Exchange is sometimes called a draft, especially if payment is made from one bank to another. It is often used in foreign trade. The buyer signs an agreement to pay on the due date by writing across the face of the bill the word “accepted” together with his name and the name of his bank, where the amount will be paid. The terms of payment of the bill may be 50, 60, 90 days after sight (D/S). In some countries three extra days are allowed for payment. They are called “days of grace”.

The person drawing the bill is called the drawer, the person upon whom it is drawn (to whom it is addressed) is called the drawee, who becomes acceptor after he has accepted the bill. Here is an example of the Bill of Exchange.

$ 580.57 Due 11th May, 2003 London 8th February, 2003

STAMP

Three months after date, pay to our order the sum of five hundred and eighty dollars and fifty seven cents for value received.

To Messrs. A. White & Co For and behalf of Smith & Co., Ltd.

(Signatures)_________________

|

If the drawee is willing to pay, he signs across the face of the bill:

Accepted

Payable at

The Sheffield City Bank

A.White & Co.

When payment is made through a post office (which does not very often happens in international trade) money orders are used, either TT or MT.

The credit card is becoming a very important means of payment in consumer transactions and is replacing the cheque in the everyday payments. It first appeared in the USA and is now spreading throughout the world. The best known credit cards in use are Barclay Cards, Access Cards, Diners Club Cards;, American Express Cards, Eurocard/Mastercard, Visa Cards. A special kind of credit card is the cheque card.

III. Answer the following questions:

What means of payment are used in trade transactions?

Why is cash rarely used in foreign trade?

What is a cheque?

How are cheques protected against possible loss?

What do we call ‘crossing’?

What is a Bill of Exchange?

Who is the drawer?

What is the difference between a sight draft and a term draft?

What should the drawee do if he agrees to pay?

What are the usual terms of payment of the bill?

What means of payment replaces cash in everyday payments?

IV. Give Ukrainian equivalents of the following:

a certain sum of money; to fall into wrong hands; a cheque… can be cashed or negotiated; a determined future date; after sight; for and behalf of; consumer transactions; by cheque rather than cash; extra days

V. Give English equivalents of the following:

засіб розрахунків; письмове розпорядження;оплачуваний на пред’явника; безумовне розпорядження; вказана особа; строк платежу; виставити тратту; акцептувати; пільгові дні; 30 днів після пред’явлення; угоди споживачів

VI. Study the following expressions. Use them in the sentences of your own:

to draw/ to issue/ to make out/ to write out a cheque – виписувати чек

to cash/ to collect/ a cheque – отримувати гроші по чеку

Use the given expressions to define the following:

A drawer is a person who…

A payee is …

VII. Match the definition on the right with the word on the left. Learn the definitions:

bearer |

|

bill |

|

cash |

|

to draw |

|

to negotiate |

|

VIII. Fill in the gaps with the words from the list below:

on demand, to cross, cash, means of payment, due, at sight

You may draw on them for Hr 1000 … through the Eximbank.

You may … your traveller’s cheques at any bank.

The bill is called a sight draft if it is made out payable ….

To avoid possible loss it is usual … the cheques.

This Bill of Exchange is … on March, 20th.

Nowadays credit cards have become a convenient ….

IX. Match the synonyms. Use any 5 words in the sentences of your own:

|

|

|

|

|

|

|

|

|

|

X. Match the words with opposite meaning. Use any 5 in the sentences of your own:

|

|

|

|

|

|

|

|

|

|

XI. Translate into English:

Форма оплати залежить від умов, які були узгоджені в контракті.

Термін сплати цього векселя наступає 15 вересня, враховуючи пільгові дні.

Ми проводимо цю зустріч від імені та за дорученням голови банку.

Чек підлягає оплаті протягом 3 днів.

Оплата готівкою все рідше застосовується в повсякденних фінансових операціях.

Ми можемо перерахувати (перевести) гроші тільки на ваш банківський рахунок.

XII. Topics for discussion:

Speak about means of payment used in everyday consumer transactions.

Cheque, its essence and the ways to safeguard it.

Bill of Exchange, its essence, the terms of its payment.

XIII. Skills practice:

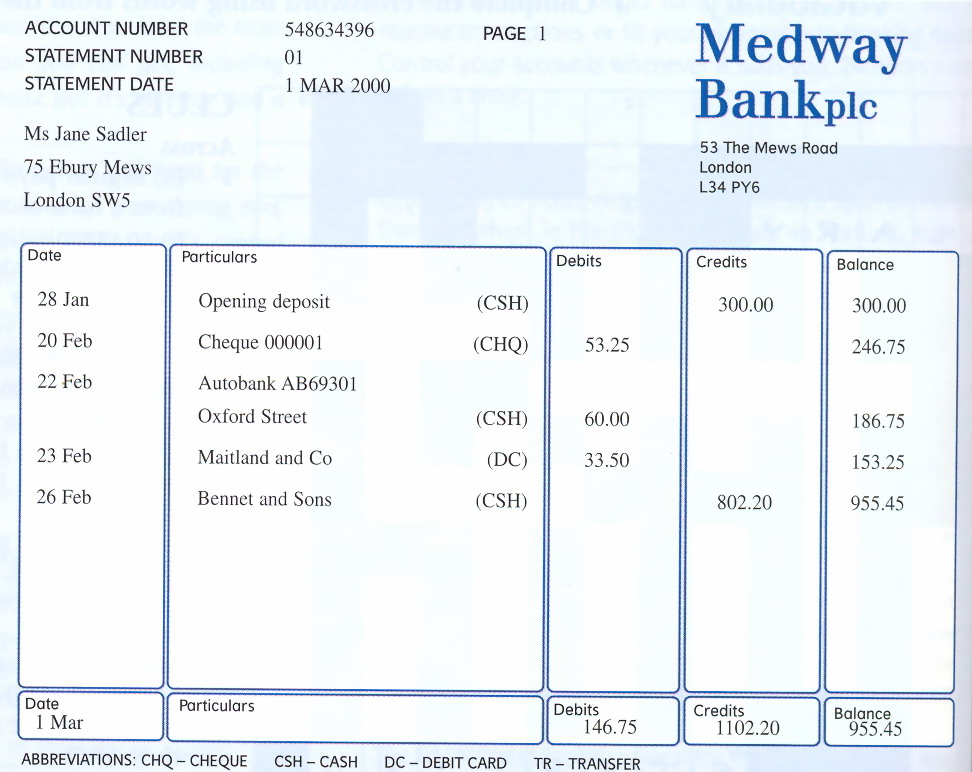

Assignment 1. Complete the passage using words from the box and the information in the bank statement below.

credit account cash transactions payment balance deposit cheque debit debit card |

|

Jane Sadler opened her _____ with the Medway Bank on 28th January with a cash ______ of £300. On 15th February she wrote a ______ for £53.25 and this appeared as a ______ on the bank statement on 20th February. On 22nd February she took out £60 in ______ from a cashpoint machine. On the following day the bank debited £33.50 from her account for a ______ she had made using her ______. Her monthly salary was paid directly into her account and this appeared as a ______ of £802.20 on 26th February. There were no further ______ on her account and she finished the month with a ______ of £955.45.

|

|

|---|---|---|

|

||

Assignment 2. Look through the text about Western Union. Find information concerning: - location; - working hours; - reliability; - system operation.