- •FOCUS 1. Read and discuss the following

- •Jenifer Jason

- •George Brown

- •George Brown

- •Donald Vance

- •Donald Vance

- •Мы обращаемся к Вам в связи с…

- •Мы заинтересованы в… и хотели бы узнать…

- •В ответ на Ваше письмо (запрос), мы…

- •Подтверждаем получение Вашего письма от…

- •THEY’VE = THEY HAVE

- •Letter 1

- •L.Crane

- •Jann v Oos

- •Kate

- •Jack Smithson

- •Jack Smithson

- •Tim Daldon

- •Ivanov

- •FOCUS 3. Study the notes, written patterns and vocabulary

- •EXHIBITIONS AND CONFERENCES

- •FOCUS 1. Read and discuss the letters

- •Sophie Bolan

- •Brian Hayden

- •Sophie Bolan

- •Sally Turner

- •Mandy Lim

- •WRITTEN PATTERNS

- •INTERNATIONAL COMPUTING SERVICES PLC

- •Peter Keyser

- •INTERNATIONAL COMPUTING SERVICES PLC

- •Peter Keyser

- •ELmVHiggins

- •Michael Doom

- •NOTES

- •WRITTEN PATTERNS

- •LETTER 1.2

- •LETTER 1.3

- •LETTER 2.1

- •LETTER 2.2

- •GETTING THROUGH

- •Repetition of telephone numbers to avoid misunderstanding

- •ICAO PHONETIC ALPHABET

- •BRITISH TELEPHONE ALPHABET

- •THE INTERNATIONAL SPELLING ANALOGY

- •FOCUS 3. Study the vocabulary

- •Time:

- •Time:

- •Time:

- •Time:

- •Memo

- •Caller’s number is

- •Oh, hello, Bill. How are you keeping?

- •EASTLAND BANK

- •OCTOBER

- •Tape 7 – Changing an appointment

- •What day was the appointment fixed on?

- •Why is Miss Simpson calling Mr. Raven?

- •What about 6.00 on Friday. Is that suitable?

- •WEATHERPROOF LTD.

- •Newtown Liverpool L30 7KE

- •James Brown

- •AO TECHNOSERVICE

- •A.Gomonov

- •AO ELECTRONICA-TRADE

- •119511 Moscow Lesnaya st., 8, Russia

- •A.Mishin

- •J.White & Co. Ltd.

- •ENQUIRIES AND REPLIES TO ENQUIRIES 2

- •1951 Benson Street Bronx, New York 10465

- •H.Rosen

- •R.Levine

- •10 Ichiban-cho Tokyo 102, Japan

- •D.R.Dove

- •Delivery

- •S. King

- •Samuel Long

- •Anita Broderick

- •C.Marlow

- •Mr. N. Woods

- •A.Nikitin

- •LEAD-IN 1

- •LEAD-IN 2

- •LEAD-IN 1

- •AO INTERSPORT

- •AO INTERSPORT

- •Maria Kiseljeva

- •ORDER No. IS 2815

- •AO INTERSPORT

- •129511 Russia, Moscow, Universitetsky Prospect, 21

- •Item description

- •Samuel Long

- •842 Seventh Avenue, New York, NY 10018

- •Samuel Long

- •AO TECHNOSERVICE

- •Russia, 126523, Moscow, Leningradsky Prospect, 98

- •A.Gomonov

- •Graham Blunkett

- •AO ELECTRONICA-TRADE

- •P.Adler

- •P.Adler

- •H.Rosen

- •SANDMANN OFFICE SUPPLIES

- •S.Olssen

- •M.York

- •AO MOSKVA-PRESTIGE

- •Russia 109004, Moscow, Volgogradsky Prospect, 8

- •AO INTERSPORT

- •AO INTERSPORT

- •Maria Kiseljeva

- •ORDER No. IS 2815

- •AO INTERSPORT

- •129511 Russia, Moscow, Universitetsky Prospect, 21

- •Item description

- •Samuel Long

- •842 Seventh Avenue, New York, NY 10018

- •Samuel Long

- •AO TECHNOSERVICE

- •Russia, 126523, Moscow, Leningradsky Prospect, 98

- •A.Gomonov

- •Graham Blunkett

- •AO ELECTRONICA-TRADE

- •P.Adler

- •P.Adler

- •H.Rosen

- •SANDMANN OFFICE SUPPLIES

- •S.Olssen

- •M.York

- •AO MOSKVA-PRESTIGE

- •Russia 109004, Moscow, Volgogradsky Prospect, 8

- •AO INTERSPORT

- •AO INTERSPORT

- •Maria Kiseljeva

- •ORDER No. IS 2815

- •AO INTERSPORT

- •129511 Russia, Moscow, Universitetsky Prospect, 21

- •Item description

- •Samuel Long

- •842 Seventh Avenue, New York, NY 10018

- •Samuel Long

- •AO TECHNOSERVICE

- •Russia, 126523, Moscow, Leningradsky Prospect, 98

- •A.Gomonov

- •Graham Blunkett

- •AO ELECTRONICA-TRADE

- •P.Adler

- •P.Adler

- •H.Rosen

- •SANDMANN OFFICE SUPPLIES

- •S.Olssen

- •M.York

- •AO MOSKVA-PRESTIGE

- •Russia 109004, Moscow, Volgogradsky Prospect, 8

- •REVISION OF PRICES.

- •ACCEPTING & DECLINING

- •OFFERS & ORDERS

- •Russia, 341 124, Kaliningrad, Lenin st., 12

- •Victor Pankov

- •INFOGRAFICA

- •LEE PHOTOGRAPHICS

- •Sheila Chin

- •Serge Arzaev

- •K.Hikkleer

- •LETTER 1

- •LETTER 2

- •LETTER 3

- •AO DACHA

- •G.Goncharovsky

- •Regio Scipelli

- •Transportmaschinen

- •Alfred Kroll

- •Transportmaschinen

- •Order No. 789-RF

- •V.Maximov

- •ElBullfinch

- •Continuation sheet No. 2

- •Jacques Piemont

- •Alan Parker

- •James Aniston

- •Mary Canningham

- •M.Pushkina

- •ПРОТОКОЛ ПЕРЕГОВОРОВ

- •M.Wang

- •Sommersby Kuala Lumpur

- •S.Dudko

- •Continuation sheet No. 2

- •LETTER 1.1

- •We operate on additional 3% … commission if required.

- •Hendon Middlesex L13

- •Marina Black

- •Hendon Middlesex L13

- •Marina Black

- •Hendon Middlesex L13

- •STATEMENT

- •Account Rendered

- •M.Proud

- •PAYMENT METHODS

- •Clayfield, Burney GG10 TQ

- •New Terms of Payment –

- •Lola Brown

- •T.Raspletina

- •T.Raspletina

- •SETTLING ACCOUNTS

- •E-69 Ester str. Vienna Austria

- •Longland House 20-25 Hunt str.

- •London EC3P 2BE UK

- •Queens B-78 Cathays Park Cardiff

- •CF1 9UJ Verbaarten

- •REISDEN ING

- •CF1 9UJ Verbaarten Amsterdam

- •Diputación 235, Asuncion, Paraguay

- •78 Jaakaren Katu, HH 8 BBB, Helsinki

- •78 Jaakaren Katu, HH 8 BBB, Helsinki

- •78 Jaakaren Katu, HH 8 BBB, Helsinki

- •EXPORTING COMMODITIES.

- •CRUDE OIL

- •EXPORTING MACHINERY

- •ROSEXPORTNEFT

- •Russia, Moscow, Mytnaya, 11

- •V.Klinov

- •SuperOil Inc.

- •1740 WestEnd Avenue, Chicago, Illinois 60624, USA

- •Ellen Morgan

- •ROSMASHEXPORT

- •13 Suschevskij val Moscow

- •ZAO ELKOM-UNA

- •GENERAL CONDITIONS OF DELIVERY

- •HANDLE WITH CARE

- •ОСТОРОЖНО

- •IMPORTING HARDWARE AND SOFTWARE

- •OLIVER GREEN & Co. Ltd.

- •J.Stevens

- •A.Burtsev

- •STAR DREAMS

- •T.White

- •RODRIGUES y CÍA

- •Los Madrazo, 8 y 10 Madrid Espňa

- •INTERVEHICLE LTD.

- •INTERVEHICLE LTD.

- •BRITISH FILMS LTD.

- •G.Virbocoli

- •CLAIMS 2

- •BEERGHAM PLC.

- •BEERGHAM PLC

- •Continuation Sheet No. 2

- •M.C.Hammer

- •ZAO Rusexport

- •Serge Serov

- •Botch TLD

- •A.B.Spruggen

- •GLOBAL PERFECTION

- •GLOBAL PERFECTION

- •Continuation Sheet No. 2

- •ELECTROOBORUDOVANIE

- •Continuation Sheet No. 2

- •Semen Sidorov

- •Messrs. W.H.Strong and Co.

- •Steven King

- •J.K.Bhatta

- •ZAO ROSMACHINY

- •MOSCOW Chistye Prudy 17 tel. (095) 117 01 02

- •28-30, Totford Avenue,

- •Warmley, Bristol BS1 52X

- •MARUCHAN DESIGNERS Ltd

- •Continuation Sheet No. 2

- •Hafiz Parcham

- •IRASOFT

- •Russia, Moscow, Zeleny pr., 3/10-24

- •A.Konkin

- •Zukerstrauss

- •Olga Vertkova

- •ZOOM ENERGY CORP.

- •Russia, Moscow, Suschevski val, 64-32

- •Garbuzov Alexey

- •Bedix Oil Ltd.

- •Bedix House Richmond Surrey TW9 1DW

- •WEMBELY SHOPFITTERS LTD.

- •J.Tritten

- •DELTA COMPUTERS

- •AMOS PARAN

- •Item

- •Via Matichelli 67-HYT-65 Palermo

- •J.Dupont

- •Transhipment allowed

- •D.Adair

- •Dear Sirs

- •D.Adair

- •23 July 20__

- •Barnley’s Bank Ltd.

- •PART II

- •DOCUMENTARY COLLECTION.

- •STAGE 1

- •STAGE 2

- •STAGE 3

- •BANCA COMMERCIALE ITALIANA

- •16 Via di Pietra Papa 00146 Roma Italy

- •BANCA COMMERCIALE ITALIANA

- •16 Via di Pietra Papa 00146 Roma Italy

- •UNION BANK OF SWITZERLAND

- •Haldenstrasse 118 3000 Bern 22 Switzerland

- •S..Schiller

- •Putney & Raven Merchants Ltd.

- •T.Shurgold

- •UNION BANK OF SWITZERLAND

- •J.Guttenberg

- •J.Guttenberg

- •Messrs. Nolestru & Nolestru

- •Messrs. Nolestru & Nolestru

- •SOUTH BANK

- •PART I

- •PART II

739

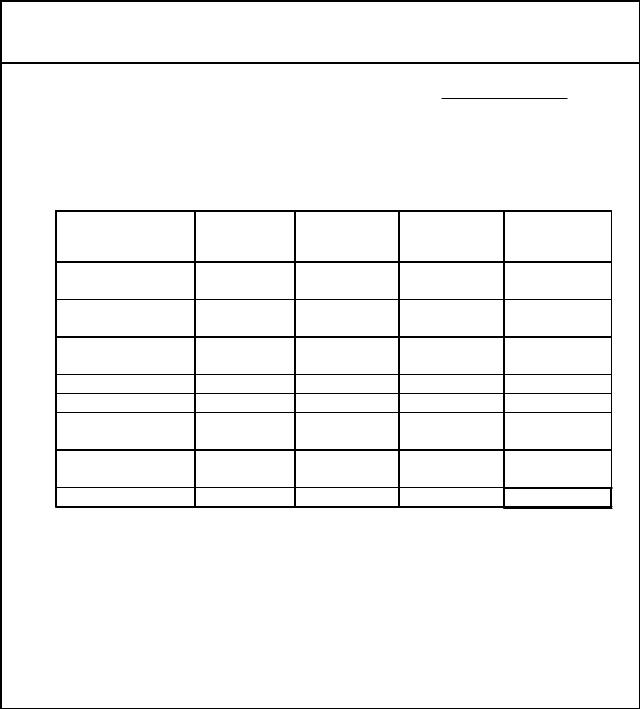

4.1 COMPANY-TO-COMPANY STATEMENT OF ACCOUNT

AMOS PARAN

48-A, KKGU Parklane Road, Brisville

Our ref. |

|

Your ref. |

September 29, 20__

Prunerdi Gatta SRL,

Via Matichelli 67-HYT-65,

Palermo

|

Date |

Item |

|

Debit $ |

Credit $ |

Balance $ |

31 |

August |

Account |

|

|

|

560,000.00 |

|

|

Rendered |

|

|

|

|

5 September |

Invoice |

48- |

80,000.00 |

|

640,000.00 |

|

|

|

35 |

|

|

|

|

8 September |

Invoice |

48- |

50,000.00 |

|

690,000.00 |

|

|

|

37 |

|

|

|

|

9 September |

D/N 56 |

|

20,000.00 |

|

710,000.00 |

|

12 |

September |

Cash |

|

|

120,000.00 |

590,000.00 |

15 |

September |

Invoice |

48- |

270,000.00 |

|

860,000.00 |

|

|

38 |

|

|

|

|

17 |

September |

Invoice |

48- |

80,000.00 |

|

940,000.00 |

|

|

35 |

|

|

|

840,000.00 |

20 |

September |

C/N 13-E |

|

|

100,000.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE PAY THE |

|

|

|

|

|

|

|

LAST AMOUNT |

|

|

|

|

|

|

SHOWN HERE |

E.&O.E. |

|

|

|

|

|

|

740

4.2 COMPLAINT OF ACCOUNTING ERRORS

Prunerdi Gatta SRL

Via Matichelli 67-HYT-65 Palermo

Our ref. |

Your ref. |

||

|

|

October 1, 20__ |

|

AMOS PARAN |

|||

|

|||

48-A, KKGU |

|

||

Parklane Road |

|

||

Brisville |

|

||

Dear Mrs Zifka, |

|

||

We have received your statement as at September 29 for $840,000.00 but we should draw your attention to a number of errors in it:

1.Invoice 48-35 for $80,000.00 has been debited twice.

2.No credit has been listed for the Valves ERM-3000 which were found defective and still are not replaced by you.

3.You have charged our account for a delivery of Pumps RG-560, which were neither ordered, nor received. We would be obliged if you could check your delivery book.

Therefore, a total of $250,000.00 has been deducted from your statement and we will accept your draft for $590,000.00, once we have your confirmation of this amount.

Yours sincerely,

J.Dupont

J.Dupont

Commercial Manager

741

FOCUS 2. Comprehension questions. LETTER 1.1

?Which party to the contract has written the letter?

?What is the key message of the letter? Is this letter a claim?

?Which problem did the Sellers have to cope with?

?What were the Buyers’ contract obligations for chartering a vessel?

?What steps do the Sellers expect the Buyers to take?

LETTER 1.2

?What do the Buyers apologize for?

?What explanation is given by the Buyers?

?What prompt measures did the Sellers have to take?

LETTER 2

?On what ground is the claim made?

?What do the Sellers demand?

LETTER 3

?What caused the complaint?

?Why is the deduction from the invoice amount justified?

?What do the Sellers ask the Buyers to do?

LETTER 4.2

?What are the reasons for the complaint?

?What errors are mentioned?

?Do the Buyers put forward the reasons for referring the case to the Arbitration or do they expect the Sellers to put things right by due adjustments?

FOCUS 3. Study the notes, writing patterns and vocabulary.

NOTES

1.Error vs mistake – в ситуации, когда в выражении имеется в виду «ошибка в расчетах» или «ошибка в документах», как правило, употребляется слово error.

2.E. & O.E. (errors and omissions are excepted) – данное указание в конце выписки или счета указывает на то, что, если в счете допущена ошибка, возможно повторное выставление счета или возврат сумм.

|

|

|

|

742 |

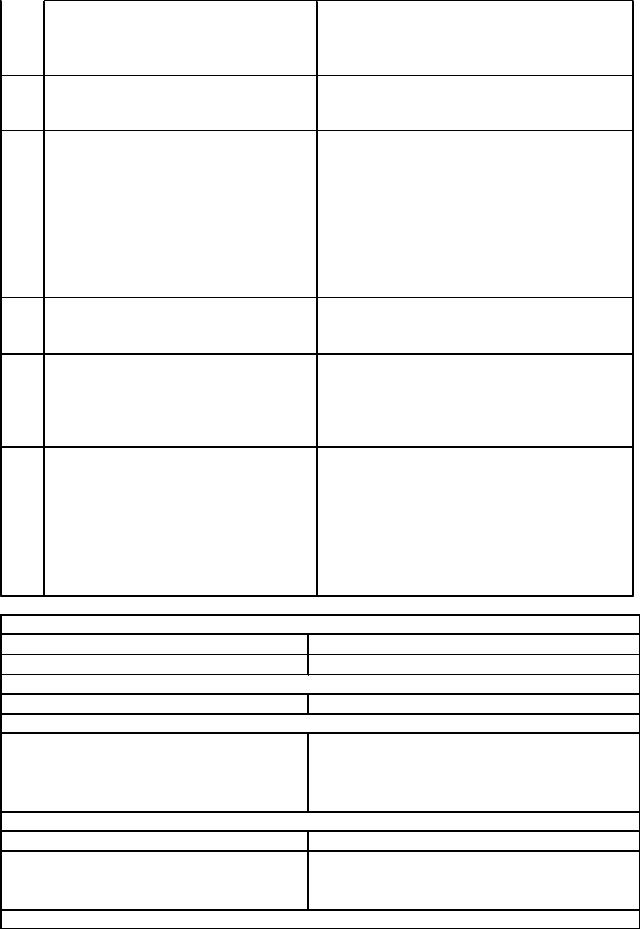

WRITING PATTERNS |

|

|

|

|

1. |

The unexpected arrival of the tanker |

Неожиданное |

прибытие |

танкера |

|

(s/s, m.v.) … at … has put us in |

(парохода, теплохода) «…» в … |

||

|

a difficult position as far as loading |

значительно |

усложнило организацию |

|

|

arrangements are concerned. |

погрузки товара. |

|

|

2.We have taken steps to ensure that Мы предприняли меры для обеспечения

|

|

loading of the vessel should be |

немедленной погрузки товара на судно. |

||||||||

|

|

effected without delay. |

|

|

|

|

|

|

|

|

|

|

3. |

You should inform us of the names of |

Вы должны сообщать нам названия |

|

|||||||

|

|

the vessels chartered by you as well as |

зафрахтованных |

|

судов, |

а |

также |

||||

|

|

their approximate loading dates/ |

приблизительные |

|

|

|

даты |

||||

|

|

positions at least … weeks before their |

погрузки/позицию |

судна |

по |

крайней |

|||||

|

|

expected arrival at the port of loading. |

мере за … недель до ожидаемого |

||||||||

|

|

|

прибытия судна в порт погрузки. |

|

|

||||||

|

4. |

We apologize for failing to give you |

Мы |

приносим |

извинения |

за |

|

||||

|

|

the due notice of chartering the |

несвоевременное |

(позднее) |

уведомление |

||||||

|

|

vessel. |

Вас о том, что судно было зафрахтовано. |

||||||||

|

5. |

We thank you for taking measures to |

Благодарим |

Вас |

за |

обеспечение |

|

||||

|

|

start loading the vessel without delay. |

своевременной |

|

погрузки |

товара |

на |

||||

|

|

|

судно. |

|

|

|

|

|

|

|

|

6.It would seem that the difference/the Мы полагаем, что разница/ остаток в

balance $… has been mistakenly |

размере $… была ошибочно вычтена в |

deducted as agreed and liquidated |

качестве согласованных и заранее |

damages for delay in delivery of … |

оцененных убытков за задержку в |

weeks. |

поставке товара на … недель |

7.May we respectfully remind you that Мы хотим обратить Ваше внимание на

|

|

we have clearly met our contractual |

то, что мы полностью выполнили наши |

|

|

|

commitments. |

обязательства по контракту. |

|

|

8. |

We would/should appreciate it if you |

Мы были бы признательны, если бы Вы |

|

|

|

would pay discrepant $… into our |

как можно скорее перечислили на наш |

|

|

|

account as soon as possible. |

счет разницу в размере $… |

|

|

9. |

Please check your delivery book. |

Просим Вас проверить книгу учета |

|

|

|

|

(регистр) поставок. |

|

VOCABULARY

LETTER 1.1

LETTER 1.1

to lift |

− |

зд. погружать наливные грузы |

|

advice of chartering a vessel |

− |

уведомление о фрахтовании судна |

|

LETTER 1.2 |

|

|

|

oversight |

− |

недосмотр, оплошность, упущение |

|

LETTER 2 |

|

|

|

to reimburse |

− |

возмещать, компенсировать, |

|

|

|

|

рамбурсировать, возвращать, |

∙ |

reimbursement |

|

покрывать, оплачивать |

− |

компенсация, возмещение, рамбурс |

||

LETTER 3 |

|

|

|

late penalties |

− |

штрафы за просрочку в поставке |

|

discrepancy |

− |

расхождение в чем-либо, несоответствие |

|

∙ |

discrepant |

− |

несоответствующий, отличный от |

|

|

||

LETTER 4.1 |

|

|

|

743

E. & O.E. – errors and omissions are |

− |

исключая возможные ошибки |

||

excepted |

|

и пропуски |

||

LETTER 4.2 |

|

|

|

|

undercharge |

− |

начисление меньшей (заниженной) |

|

|

∙ |

to undercharge |

|

суммы |

|

− начислять к оплате меньшую |

||||

|

|

|

(заниженную) сумму |

|

overcharge |

− |

начисление большей (завышенной) |

|

|

∙ |

to overcharge |

|

суммы |

|

− начислять к оплате большую |

||||

|

|

|

(завышенную) сумму |

|

estimate |

− |

зд. смета, калькуляция |

|

|

delivery book |

− регистр (книга учета) поставок |

|

||

FOCUS 4. Fill in the gaps with one of the following words or word combinations. Use the appropriate tense form.

agreed and liquidated damages |

chartering |

|

discrepant |

|

positions |

to charge |

to charter |

|

delivery book |

to order |

Release Note |

due notice |

prompt settlement |

|

to maintain |

contractual commitment |

account |

in full |

|

1.It would seem that the balance has been mistakenly deducted as … for delay in delivery of 4 weeks.

2.May we respectfully remind you that our prices were quoted on the basis of C&F

Singapore |

and |

with |

the |

… |

having |

been |

signed |

on |

14th September 20__, we have clearly met our …. |

|

|

|

|||||

3.We fail to understand why you have not paid this invoice ….

4.We must apologize for failing to give you the … of chartering the tanker “SIBIR”.

5.We must insist that in future you should inform us of the names of the vessels … by you as well as of their approximate … at least two weeks before the expected arrival of each vessel at the port of loading.

6.We must stress the point that … of our invoices on your part is essential if we are … mutually beneficial relations.

7.We should therefore appreciate it if you would pay the … $13,098.00 into our … as soon as possible.

8.We would be obliged if you could check your ….

9.We would like to state that up to the present moment we have not had from you any advice of … this vessel.

10.You … our account for a delivery of Pumps RG-560, which were neither …, nor received.

FOCUS 5. |

Fill |

in |

the |

gaps |

with |

prepositions/particles |

where |

|

necessary. |

|

|

|

|

|

|

1.Thank you ... your fax informing us ... the arrival … the vessel “Volga” ... lifting the cargo

... the contract.

2. ... the moment we are not ... possession ... your advice ... chartering the vessel. This puts us ... a difficult position.

3.This amount was omitted ... the invoice ... an oversight.

4.As we have pointed ... ... you, prompt settlement ... accounts ... your part is essential.

5.All expenses ... connection ... arbitration proceedings will be charged ... your account.

6.Your Invoice No. L987.98 is undercharged. The balance will be credited ... your account.

7.We would appreciate your paying $678.99 ... our account.

744

8.We fail to understand why the invoice was not paid ... full.

9.No credit has been listed … the wallpaper which was returned ... July.

10.You have charged me ... a delivery … paint brushes but I have never ordered or received them.

11.I have deducted a total … $5,678.98 ... your statement ... account as ... 31 August 20__.

FOCUS 6. Translate into English.

LETTER 1.1

1.Мы хотели бы привлечь Ваше внимание к тому, что мы до сих пор не получили уведомление о фрахтовании судна.

2.Мы вынуждены настаивать на том, чтобы Вы в дальнейшем вовремя информировали нас о названии и позиции зафрахтованного судна.

LETTER 1.2

3.Кредитовое авизо не было выслано Вам по недосмотру с нашей стороны.

4.Приносим извинения за то, что мы вовремя не уведомили Вас о фрахтовании танкера и дате его ожидаемого прибытия в порт погрузки.

5.Вы забыли включить счет-фактуру № 45-97 в выписку из нашего счета у Вас.

LETTER 2

6.Для поддержания взаимовыгодных деловых отношений необходимо своевременно оплачивать счета.

7.На настоящий момент мы не имеем информации от банка о зачислении на наш счет суммы в уплату за поставленный товар.

8.Нам необходима безусловная гарантия с Вашей стороны, что Вы возместите сумму долга до 23 сентября.

9.Если сумма задолженности не поступит на наш счет в течение 5 дней, мы будем вынуждены передать дело в Арбитражный суд при ТПП России.

LETTER 3

10.Просим незамедлительно перевести требуемую сумму счета в полном объеме.

11.Разница была вычтена как штраф за просрочку в поставке.

12.Просим зачислить на наш счет сумму в 456,98 долларов США, вызвавшую некоторые разногласия.

13.Мы должны сличить все расхождения по выпискам из счетов и выставить на

разницу либо дебетовые, либо кредитовые авизо. Необходимо быть точным в выставлении счетов, чтобы избегать начислений завышенных или заниженных сумм.

LETTER 4.2

14.Вы переплатили по счету № 678-65. Разница в сумме 345 долларов США будет переведена и зачислена на Ваш счет.

15.Мы полагаем, что в Вашей выписке из счета от 31.08.20__ допущены некоторые ошибки.

16.Сумма за поставку запасных частей начислена к оплате (взимается) дважды.

17.Просим выставить кредитовое авизо на сумму непоставленного Вами оборудования.

745

18.Уважаемые господа!

Настоящим подтверждаем получение Вашего рекламационного письма касательно несвоевременного уведомления о прибытии судна под погрузку.

Приносим свои извинения за то, что поставили Вас в затруднительное положение. Мы не проинформировали Вас в должные сроки из-за того, что по недосмотру это сообщение было пропущено в файле электронной почты. Надеемся, что данное недоразумение не приведет к ухудшению наших деловых отношений.

Еще раз приносим извинения. С уважением,

FOCUS 7. Letters to make up.

1.You think that the balance of the statement of account received by you is stated incorrectly. In your opinion there are some discrepancies in the calculations of the sums payable for insurance and transportation of the goods. You think that the sums were overcharged. Write a letter to your partner and state the necessity of deducting these amounts and ask for a Credit Note. Give reasons.

2.Your customer regularly delays payment. Make up a letter stating that these delays cause inconvenience and losses to you. Insist on due payments. Inform that otherwise you will have to take legal actions.

FOCUS 8. Role play.

Hold negotiations on the raised in Letters 1.1 and 1.2, Focus 1.

FOCUS 9. Act as an interpreter.

DIALOGUE 1

DIALOGUE 2

–Mr Rusanov, I feel compelled to revert to the matter of payment again. As I have repeatedly pointed out to you prompt settlement of our account with you is essential for maintaining fruitful cooperation.

–Мне нечего возразить Вам, г-н Маркс. Однако я тоже неоднократно говорил Вам, что наша бухгалтерия задерживает к оплате только те счета, суммы по которым начислены неправильно.

–What errors are you talking about?

–Я имею в виду, что суммы к оплате иногда завышены, т.к. в счета включены незаконтрактованные позиции, а мы оплачиваем счета только за товары, оговоренные контрактом.

–I think that sometimes we elivered the goods, which a not specified in the contract. But we did it at your request.

–Я не отрицаю поставки неспецифицированных товаров. Но все должно быть отражено в контракте, иначе нет оснований для оплаты счетов. Давайте подпишем дополнение к контракту.

–If you guarantee that it will settle the problem of payment in due time I have no objections.

746

BANKING 1

DOCUMENTAR

Y CREDIT

747

FOCUS 1. Read and discuss the lead-in and the letters.

The banks’ main functions in foreign trade are:

∙Handling of shipping documents;

∙Collection of payments;

∙Observance of buyers’ conditions of purchase;

∙Discounting bills of exchange;

∙Loans to exporters;

∙Acting as agents for foreign banks and their customers.

PAYMENT INSTRUMENTS IN FOREIGN TRADE

The two principal instruments offered by the banks for executing and securing payments in international trade are documentary credits and documentary collections.

DOCUMENTARY CREDIT

PART I

Documentary credit is an undertaking made by a bank at the request of the applicant for the credit to pay a specified amount in an agreed currency to a beneficiary, on condition that the beneficiary presents stipulated documents within a prescribed time limit.

The buyer asks his bank to “issue” or open a letter of credit. The issuing bank asks its corresponding bank – usually in the seller’s country – to advise (and confirm) the credit. The advising bank informs the seller that the credit has been issued. As soon as the seller receives the credit, he checks it and if he can meet its requirements, the seller ships the goods. At the same time the seller sends the documents, which prove shipment of the goods to the bank where the credit is available. The bank checks the documents against credit. If the documents comply with the requirements of the credit, then the bank will make payment. The bank, which made payment to the seller, sends the documents to the issuing bank for reimbursement. The issuing bank after checking the documents reimburses the bank that has paid. The documents are then released to the buyer upon payment.

748

- 2 -

Thus the bank acts as an intermediary between the buyer and the seller. Settlement is effected through the bank by means of a direct exchange: the beneficiary presents the required documents to the bank and receives in return the amount specified in the credit (in the form of cash, an accepted bill of exchange or an undertaking to pay, depending on the terms of the credit). With a documentary credit, the beneficiary is no longer dependent on the buyer’s ability or willingness to pay. Moreover, he can obtain liquid funds shortly after dispatching the goods.

It is not essential that a letter of credit (L/C) be paid to the seller immediately upon execution of the order. If agreed between the seller and the buyer, the arrangement could be for the agent bank (the corresponding bank) to accept a bill of exchange (B/E) drawn by the seller on the agent bank. This gives the buyer credit and is, of course, absolutely safe for the seller, who can discount the bill for ready cash if he needs it.

Documentary credits go a long way towards reconciling the conflicting interests of the buyer and the seller:

∙The seller wants to be sure that the price of the goods will be paid in the correct currency and as soon as possible.

∙The buyer does not want to pay for the goods before they have actually been dispatched.

749

- 3 -

Specific advantages of documentary credits:

∙Can be used in transactions with virtually every country in the world;

∙Rapid access to funds for the seller;

∙Flexible terms of payment with no impairment of security;

∙Suitable as an instrument for short-term financing;

∙Rapid and convenient settlement, often enabling the seller to offer attractive discounts;

∙High degree of legal security throughout the world.

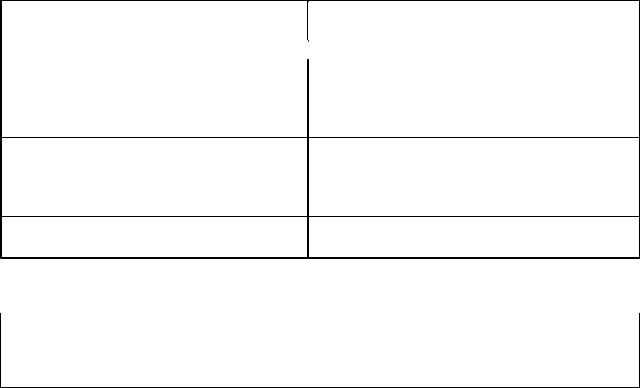

Here is the scheme of the documentary credit procedure:

ISSUING |

ADVISINGBANK |

BENEFICIARY |

(CONFIRMING |

||

BANK |

BANK) |

(EXPORTER) |

There are two types of documentary credits: revocable, i.e. those that can be cancelled, and irrevocable, i.e. those that cannot be cancelled. Irrevocable credits can be confirmed and unconfirmed.

APPLICANT (IMPORTER)

|

|

|

750 |

|

|

- 4 - |

|

|

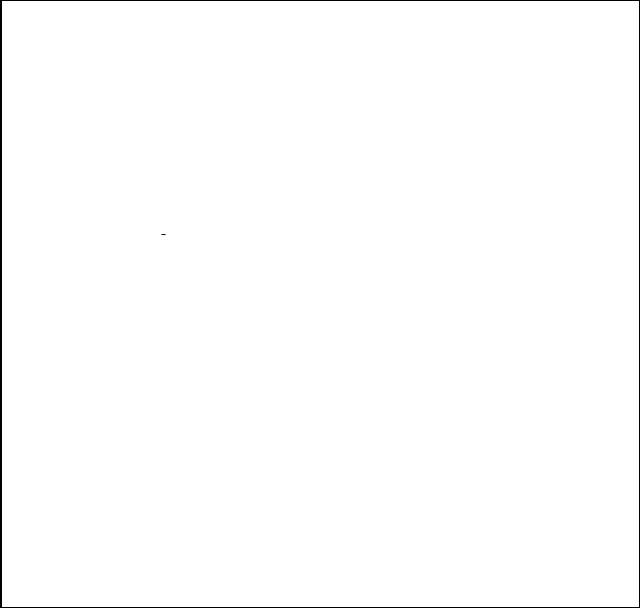

LEGAL RELATIONS IN THE CASE OF |

||

A CONFIRMED IRREVOCABLE CREDIT |

|||

|

WITH PAYMENT AT SIGHT |

|

|

Importer |

|

|

Exporter |

(Applicant) |

|

Payment |

(Beneficiary) |

|

Contract |

|

|

|

under- |

|

|

|

of sale |

taking |

|

Instruction to |

Payment |

|

|

open credit |

undertaking based |

|

|

|

|

on documentary |

|

|

|

credit |

Confirming bank |

|

|

|

|

|

Instruction to |

(exporter's bank) |

|

|

|

||

|

advise the credit |

|

|

|

with the request |

|

|

|

|

to add |

|

Issuing bank |

confirmation |

|

|

|

|

|

|

(importer's |

|

|

|

bank) |

|

|

|

|

|

- 5 - |

|

Example of an irrevocable letter of credit.

Barclays Bank PLC |

International division |

|

23, High Street |

|

London C.W. 25 |

Date of issue… |

Date of expiry |

|

|

Applicant |

Beneficiary |