- •Ministry of finance of ukraine

- •Dnipropetrovsk state finance academy

- •What is a business?

- •The diverse nature of business (Part I)

- •The diverse nature of business (Part II)

- •The resources of business

- •The functions of business

- •Business classifications

- •Classification by size

- •Classification by ownership

- •Public sector of the economy

- •Problems of production

- •Capacity constraints

- •Marginal Physical Product

- •Law of diminishing returns

- •Costs of production

- •Average costs

- •Marginal cost

- •The relationship of marginal cost to average total cost

- •Economic vs. Accounting costs

- •Inputs cost

- •Supply horizon

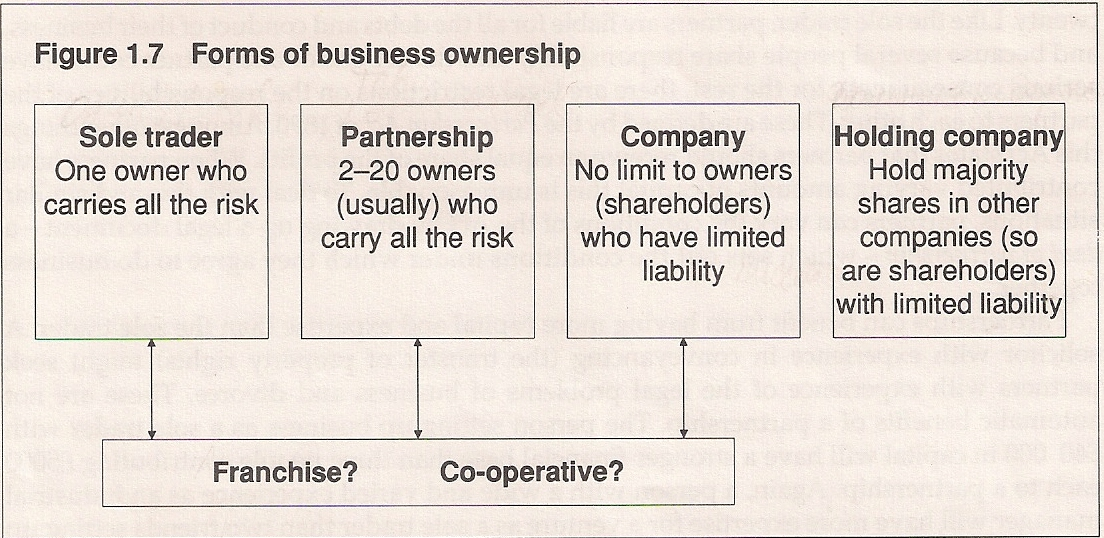

Classification by ownership

The major distinction is between businesses owned by central or local government, i.e. the public sector of the economy, and businesses owned by individuals or groups of individuals, i.e. the private sector of the economy. This classification is useful when speaking in general terms.

‘The Government has set a limit of 3 per cent on all wage increases for public sector employees.’

‘It is difficult to estimate the effect of the cutback in Government spending on the private sector.’

Neither the public nor the private sectors are homogeneous (that is of identical structure) in terms of ownership, and when discussing the problems associated with different types of ownership it is important that we specify which type we are talking about. These are outlined in Figure 4.

Forms of private ownership – the sole trader

This term is used to describe a business wholly owned by one person, although there may be a number of people employed in running the business. Businesses owned by one person are often, but not necessarily, small. Their growth is limited by the amount of capital available and this in turn is limited by the personal resources of the founders and their success in trading.

Sole traders are accountable only to themselves and this can make this form of business ownership very attractive to people who have strong ideas on the way in which they want their business to be run. Added to this there are very few legal restrictions on the formation of a one person business, which increases its flexibility. The owner of the business does not have to consult other people before making decisions which can improve the speed with which the business responds to changing conditions.

The lack of specific business skills on the part of the owner is often considered a drawback but this can be overcome by employing people with these skills or by using the professional services offered by other businesses, e.g. accountants, solicitors, and marketing and advertising agencies.

The sole trader is entirely responsible for the debts of the business. Should it fail and there is insufficient money to pay the debts of the business the owner can be declared bankrupt through legal process. All the property of the business and the personal property of the owner will then be sold to pay the debts and, should the money realized by the sale prove to be insufficient for this purpose, the court will have a claim on the income of the bankrupt until all debts have been paid. The sole trader is thus said to have unlimited liability for the debts and conduct of the business.

Partnerships

Partnerships are groups of people who contribute capital and management expertise to the same business enterprise and accept joint responsibility for the operation of the business. The minimum number of partners is, of course, two. The maximum number in most cases is twenty. Like the sole trader, partners are liable for all debts and conduct of their business, and because several people share responsibility and the actions of one partner could have serious consequences for the rest, there are legal restrictions on the responsibilities of the partners to each other. These are defined by the Partnership Act of 1890. Amongst other things this Act states that partners should receive an equal share of the profits. When partners have contributed varying amounts of capital this is unreasonable. To deal with this and similar situations, partners can vary the conditions of the Act by drawing up a legal document – a deed of partnership – which sets out the conditions under which they agree to do business together.

Partnerships can benefit from having more capital and expertise than the sole trader. A solicitor with experience in conveyancing (the transfer of property rights) might seek partners with experience of the legal problems of business and divorce. These are not automatic benefits of a partnership. The person setting up business as a sole trader with £40000 in capital will have a stronger financial base than three people contributing £5000 each to a partnership. Again, a person with a wide and varied experience as an industrial manager will have more expertise for a venture as a sole trader than two friends setting up as partners in their first business venture.

Limited companies

As the size of business enterprises increased in the nineteenth century, the amount of capital required increased and the ability of sole traders and partners to accumulate the necessary finance declined. Many people were willing to lend small amounts of money to a business but they had no control over the way in which it was used. They were at the mercy of the owners of the business. The solution to this problem was sought in law.

1 Companies – that is groups of people who collectively own a business under certain legal conditions – were established as separate legal entities from the people who owned them. This meant that the company would be treated as a separate person in law from its owners. The company could sue and be sued, own property and survive the death of its owners.

2 The company was granted limited liability. This can be seen as a logical extension of the fact that the company is a separate legal entity. The company is responsible for its own debts and conduct of business. If, at any time, the company cannot pay its debts it may be forced to sell all its assets in order to do so. The company goes into involuntary liquidation. This process is also known as winding up. Shareholders will lose the money they have invested in the business but other assets they possess cannot be touched.

3 Legal restrictions were placed on the formation of companies to ensure that the privileges given above were not abused.

The first instance of limited liability being granted to a restricted range of businesses was in 1662. General limited liability was extended to all registered companies by the Limited Liability Act of 1885. The conditions under which a company can register with the registrar of companies (a civil service function) are defined by the Companies Acts. The first of these Acts was passed in 1844.

1. Formulate the main idea of the text.

2. Find in the text English equivalents of these words and phrases.

|

28.сплатити борги |

55. компанія з обмеженою відповідальністю |

|

29.бути проголошеним банкрутом |

56. накопичувати |

|

30. за допомогою юридичного процесу |

57. схильний, готовий щось зробити |

|

31. власність бізнесу |

58. позичити незначну кількість грошей |

|

32. особиста власність |

59. бути у владі власників бізнесу |

|

33. суд |

60.вирішення проблеми |

|

34. вимагати |

61. трактуватися як |

|

35.необмежена відповідальність по боргам |

62.переслідувати судовим порядком |

|

36. поведінка бізнесу |

63.бути переслідуваним судовим порядком |

|

37. товариство |

64. володіти власністю |

|

38. вкладати капітал |

65. виживати |

|

39. брати спільну відповідальність |

66.отримувати дотацію, субсидію |

|

40.бути відповідальним за борги бізнесу |

67.обмежена відповідальність |

|

41.поділяти відповідальність |

68. бути змушеним продати власні активи |

|

42. серйозні наслідки |

69. недобровільна ліквідація |

|

43.юридичні обмеження |

70. закінчення |

|

44. відповідальність партнерів один до одного |

71. втратити гроші |

|

45. отримувати рівну частку прибутку |

72.гарантувати, забезпечувати |

|

46. нерозсудливий, нерозумний |

73. привілеї |

|

47. договір про партнерство |

74. зловживати |

|

48. мати користь (вигоду) |

75. перший випадок |

|

49. перевезення, транспортування |

76. погоджений |

|

50. передача права власності |

77. умови |

|

51. шукати партнерів |

78. реєструватися |

|

52.юридичні проблеми бізнесу |

79.зареєструвати компанію |

|

53. фінансова основа |

80. компанія з обмеженою відповідальністю |

|

54. великий і різноманітний досвід |

|

3. Are these statements true or false? Correct the false ones.

One can easily estimate the effect of the cutback in Government spending.

A sole proprietorship is an individual in business for himself or herself.

The proprietor owns or obtains the materials and equipment needed by the business and personally supervises its operation.

A sole proprietorship is easy to organize.

A proprietor must take decisions concerning buying, selling, and the hiring and training of the personnel.

In terms of ownership both the public and the private sectors of economy are homogeneous.

Businesses owned by one person are always small.

Sole trader is personally liable for all business debts.

Sole trader carries an unlimited liability.

It is easy to start a sole trader’s business at any time.

In a partnership there are two or more partners.

If an entrepreneur has debts, he ought to sell his business in order to pay the debts.

The owner of a business can be declared bankrupt through legal process.

Sole traders and partnerships are dominant forms in the small business segment.

The partnership is a firm where there are a few partners.

Partnership is easy to organize.

All partners are liable for debts and they share in the profit.

Partners jointly own a business and each partner is personally liable for the firm’s debt.

To prevent possible future discord among partners, it is usual practice to draw up an agreement.

Limited companies are separate legal entities.

Shareholders of limited companies don’t enjoy limited liability.

4. Answer the questions.

What are the major legal forms of business organisation?

What is the major distinction between the public and the private sectors of the economy?

What is a sole trader?

What does the term ‘unlimited liability’ mean?

What two types of business organisation does it apply to?

What is a partnership?

5. Write key words and phrases to each paragraph of the text.

Text 9