contactusa

.pdf

184 Taxes, Taxes, and More Taxes

ft

React

Look at the reading again. Choose one sentence from it which surprised you. Write down the sentence and then explain to your classmates why it surprised you.

D. Scanning/Vocabulary

PART 1

DIRECTIONS: |

Scan |

the |

reading for |

these words. |

Write |

the |

number of the line where you |

||||||||

|

|

|

find them. |

Then compare its |

meaning in the sentence to the meaning of the |

||||||||||

|

|

|

word(s) on the right. Are the |

words |

similar or |

different? Write similar or dif- |

|||||||||

|

|

|

ferent |

on |

the |

line. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

LINE |

|

|

|

|

|

SIMILAR OR DIFFERENT |

|

|

|

|

|

|

|

|

|

NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

are made oi |

|

|

|

|

|

1., consist of |

|

|

|

|

|

|

|

|

|

|||||

|

2. |

spend |

|

|

|

|

|

|

|

|

saves |

|

|

|

|

|

3. |

complain |

|

|

|

|

|

|

|

|

enjoy |

|

|

|

|

|

4. |

conflicting |

|

|

|

|

|

|

|

similar |

|

|

|

||

|

5. |

include |

|

|

|

|

|

|

|

|

keep out |

|

|

|

|

|

6. |

tend to |

|

|

|

|

|

|

|

|

seem to |

|

|

|

|

|

7. |

repairs |

|

|

|

|

|

|

|

|

rebuilding |

|

|

|

|

|

8. |

misuse |

|

|

|

|

|

|

|

|

use well |

|

|

|

|

|

9. |

subject |

|

|

|

|

|

|

|

|

opinion |

|

|

|

|

|

10. |

due |

|

|

|

|

|

|

|

|

payable |

|

|

|

|

|

PART 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DIRECTIONS: |

Find |

a word |

in the |

reading |

which |

has a |

meaning similar to the following. |

||||||||

|

|

|

The line number is given. |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

1. |

national (7) |

|

|

|

|

|

|

|

||||

|

|

|

2. |

kinds (8) |

|

|

|

|

|

|

|

|

|||

A First Look |

|

185 |

E. Reading Comprehension

DIRECTIONS: Circle the letter of the choice that best completes each sentence.

1. In the United States, there are generally _ a. two b. three

2.A person must pay federal taxes if that person a. has a part-time job

basic types of taxes. с four

3. |

There are |

basic types of city taxes, |

|

|

|

|

|

|

|

|

|||||

|

a. three |

|

|

|

b. two |

|

с |

four |

|||||||

4. |

Some states tax items that a person buys. This is a(n) |

|

|

|

tax. |

||||||||||

|

a. income |

|

|

|

b. |

sales |

|

с |

excise |

||||||

|

|

|

|

|

|

|

|

|

|||||||

5. |

State sales taxes |

|

in different states. |

|

|

|

|

|

|

|

|

||||

|

a. are fixed |

|

|

|

b. are based on income |

|

с |

vary greatly |

|||||||

6. |

Cities get tax money from two different sources: homeowners and |

|

|

||||||||||||

|

a. property |

|

|

|

b. |

municipal employees |

|

c.drivers |

|||||||

7. |

Americans think that they have to work one day out of every five to |

|

|

||||||||||||

|

a. pay the |

|

|

|

b. relax |

с |

misuse their taxes |

||||||||

|

government |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Each of the |

|

|

states probably has individual tax laws. |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||||

a. forty-seven |

|

|

|

b. |

three |

с |

fifty |

||||||||

186 Taxes, Taxes, and More Taxes

9. If a person who earns $17,000 pays 15 percent of it in federal taxes, a person who earns $30,000 pays

a. 15 percent also |

b. a lower percentage |

с more than $8,000 |

10. The author thinks that we can be certain about two things:

a. useless and |

b. taxes and death |

с sales tax and |

impractical programs |

|

income tax |

"*V *

A First Look 187

section 2

Look Again

A. Vocabulary

DIRECTIONS: Circle the letter of the choice that best completes each sentence.

1. Taxes must be paid on a certain day. They are |

|

on that day. |

|

|

|

|

||||||||||||||||||

|

a. sure |

|

|

b. due |

|

|

|

|

|

|

|

|

|

|

с |

raised |

|

|

|

|

||||

2. A(n) |

person earns an income. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. impractical |

b. salaried |

|

|

|

|

|

|

с |

resident |

|

|

|

|

||||||||||

3. The amount of income tax a person pays |

|

|

|

|

|

his or her salary. |

|

|

|

|

||||||||||||||

|

a. depends on |

b. earns |

|

|

|

|

|

|

|

с |

increases |

|

|

|

|

|||||||||

4. |

People today are often careless, and we |

|

|

our national resources. |

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

a. spend |

|

|

b. complain about |

|

|

с |

misuse |

|

|

|

|

||||||||||||

5. You cannot agree. He has his |

|

and you have yours. |

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. aspect |

|

|

b. view |

|

|

|

|

|

|

|

|

|

|

с |

protest |

|

|

|

|

||||

6. The United States is a country of immigrants. There are many |

of Ameri |

|||||||||||||||||||||||

|

cans. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. percentages |

b. types |

|

|

|

|

|

|

с |

issues |

|

|

|

|

||||||||||

7. When Americans don't like what the government is doing, they usually |

||||||||||||||||||||||||

|

a. include |

|

|

b. protest |

|

|

|

|

|

|

с |

reinforce |

|

|

|

|

||||||||

8. When people from warm countries visit cold areas, they usually '. |

about the |

|||||||||||||||||||||||

|

weather. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. vary |

|

|

b. complain |

|

|

|

|

|

|

с |

tend |

|

|

|

|

||||||||

9. |

It is |

|

|

for a person who doesn't drive to buy a car. |

|

|

|

|

|

|

|

|||||||||||||

|

a. conflicting |

b. impractical |

|

|

|

|

|

|

с |

confusing |

|

|

|

|

||||||||||

10. |

Energy is one of the most important |

|

of this century. |

|

|

|

|

|

|

|

||||||||||||||

|

a. issues |

|

|

b. views |

|

|

|

|

|

|

|

с solutions |

|

|

|

|

||||||||

188

Americans generally agree **$*• c^ &^~* •»«-.(>- -> v.^y ^ * .

C. Think About It

In the United States, as in many countries, the citizens do not enjoy paying taxes so collecting taxes can be a problem. The Swedish government has an interesting solution. Each year it publishes a book with a list of all individual taxpayers who earn the equivalent of $15,000 or more and each married couple who earns $20,000 or more. The book is similar to the telephone book. In this way, everyone knows how much money you make and how much you pay in taxes.

This system would not be useful in the United States. Americans are very private about many things, especially how much money they make. This would not be a good system of keeping track of taxes. Are salaries private in your country? Is it impolite to ask a person how much money he or she makes?

Look Again |

189 |

D. Reading

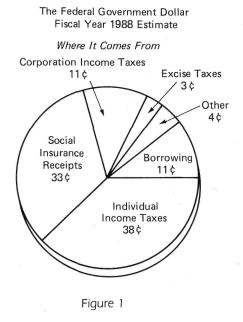

Running a government is very expensive. In the United States, most of the money comes from taxes—both from individuals and from corporations. Another part comes from social security payments (about 7 percent of an individual's salary). Other money comes from borrowing. But what happens to this money? Figure 1 indicates where the 1987-1988 budget came from and Figure 2, how the money was spent.

1.What percentage of the U.S. budget comes from income taxes?

2.Who contributes more to the federal government—corporations or individuals?

3.How much of the federal budget comes from excise taxes?

4.What percentage comes from borrowing (taking money now and paying it back later)?

190 Taxes, Taxes, and More Taxes

Where It Goes

Other Federal

Operations

Grants to States and Localities 50 100

Figure 2

1.Where does the largest part of the federal budget go?

2.How much of the federal budget is used for the protection of the country?

3.How much support does the federal government give to states and cities or towns?

4.Which area does the president's salary come from?

5.What percentage of the federal budget supports retired people and people who are poor or have health problems?

Look Again |

191 |

section З

Contact a Point of View

A. Background Building

Figure 3 illustrates part of a page from the U.S. tax forms. Imagine that you are a single person who earns $26,125 in taxable income. What do you have to pay the federal government? Scan the table to find out. What percentage of your income is that figure?

Figure 3

192

Timed Reading

DIRECTIONS: Read the following point of view and answer the questions in four minutes.

Some people have all the luck. Here I am, a family man with three small children. I work hard for everything I have: a nice car, a house in the suburbs, and other conveniences. Lately on TV, I've seen groups of people on welfare who complain that they can't get by on their incomes. How do you think I feel? People on welfare never work and have seven or eight children. Who pays the bills? I do. About 25 percent of my salary goes to taxes: the federal and the state taxes. Then, of course, there is the property tax on the house and the excise tax on the car. I've had it with taxes. Besides, the rate of inflation is increasing daily. It really angers me that I can't have the kind of life I deserve—the kind of life that I have worked for.

The president says that these are hard times and that we should not spend so much money, and then the defense budget goes up. The local politicians say that they need more money for highway repairs, and then they vote a salary increase for themselves. The town selectmen say we need a new elementary school. We just can't afford it. Who helps me when the kids need new sneakers? No one. People used to say that the rich get richer and the poor get poorer. Now I am beginning to think that the people in the middle class are the real losers.

DIRECTIONS: Read each of the following statements carefully to determine whether each is true (Tj, false (Fj, or impossible to know (ITK).

1.This man lives in the city.

2.Twenty-five percent of his salary goes to taxes.

3.He has three older children.

4.He pays taxes on his home.

5.Money for education comes from the state.

6.He is on welfare.

7.He is from the upper class.

8.He thinks that the middle class is lucky.

9.Local politicians have high salaries.

10.The president wants people to conserve.

Contact a Point of View |

193 |