- •Предисловие

- •Unit 1. Economic environment a. Text what is economics all about?

- •B. Dialogue business climate in russia

- •Vocabulary list

- •Exercises

- •Discussion

- •In order to get prepared for participation in the class discussion of the above questions, write several paragraphs on the following:

- •Reading practice

- •Unit 2. Public finance a. Text finance and financial system

- •B. Dialogue budget organization and budget process

- •Vocabulary list

- •Exercises

- •Discussion

- •A) The Budget Message of the Mayor

- •April 27, 1995

- •In order to get prepared for participation in the class discussion of these questions, write several paragraphs on the following:

- •Reading practice

- •Unit 3. Fiscal management a. Text financial policy. Fiscal sphere

- •B. Dialogue effective fiscal policy

- •Vocabulary list

- •Exercises

- •A) Financial Policy

- •B) Fiscal Policy in the uk

- •Discussion

- •A) Multiyear Budgeting

- •B) Types of Budget Classification

- •A) Fiscal Policy in Transition Economies: a Major Challenge

- •B) On Macro- and Microeconomics

- •In order to get prepared for participation in the discussion of the questions, write a short essay on the following:

- •Reading practice

- •Transition Economies Need to Reform Social Safety Nets

- •Unit 4. Central banking. Monetary policy a. Text central banking system

- •B. Dialogue banking system in russia

- •Vocabulary list

- •Exercises

- •Us Activities of Foreign Banking Organizations

- •Discussion

- •A) Is Monetary Policy Needed?

- •B) Payment Systems

- •In order to get prepared for participation in the class discussion of the questions, write a summary of the interview in Ex. 13. Follow the plan suggested below:

- •Reading pra ctice

- •Unit 5. Banking system a. Text commercial banks

- •B. Dialogue

- •Interview With a Bank Manager

- •Vocabulary list

- •Exercises

- •B) Bank Accounts

- •B) The Nature of Banking

- •Discussion

- •A) Bank Loans and Overdrafts

- •In order to get prepared for participation in the class discussion of the questions, write a short essay on:

- •Reading practice

- •Unit 6. Taxation a. Text what are taxes?

- •B. Dialogue taxation in russia

- •Vocabulary list

- •Exercises

- •What Is an Excise Duty?

- •Tax Reform in Developing Countries

- •Discussion

- •In order to get prepared for participation in the class discussion of the questions, write a short essay on the following:

- •Reading practice

- •Unit 7. International monetary system a. Text

- •International monetary institutions

- •B. Dialogue

- •Imf's support for russian reforms

- •Vocabulary list

- •Exercises

- •International Monetary Fund

- •Your Partner ebrd

- •World Bank – International Bank for Reconstruction and Development (ibrd)

- •Discussion

- •In order to get prepared for participation in the class discussion of the questions, write a short essay on:

- •Reading practice

- •Unit 8. Financial markets. The bond market a. Text trading in the bond market

- •B. Dialogue the bond market

- •Vocabulary list

- •Exercises

- •Discussion

- •In order to get prepared for participation in the class discussion of the above questions, write a short essay on the following:

- •Reading practice

- •Unit 9. Financial markets. The stock market a. Text stocks and markets

- •B. Dialogue the corporate securities market in russia

- •Vocabulary list

- •Exercises

- •Discussion

- •A) Bulls, Bears and Stags

- •B) Options and Short Selling

- •In order to get prepared for participation in the class discussion of the questions, write a short essay on the following:

- •Reading practice

- •The New Issue Market

- •Unit 10. Investment activity a. Text

- •Investments

- •B. Dialogue

- •Investment climate

- •Vocabulary list

- •Exercises

- •Investment Companies

- •3 Food Giants Build Local Yogurt Plants

- •Discussion

- •B) Brazil Attracts Foreign Investors

- •C) Investment in the uk

- •In order to get prepared for participation in the class discussion of the questions, write a short essay on the following:

- •Reading practice

- •Investment Skill Is a Rare Commodity

- •Investment Trusts

- •Unit 11. Foreign exchange market. Global financial markets a. Text trading in the foreign exchange market

- •B. Dialogue cornerstone of the global financial market

- •Vocabulary list

- •Exercises

- •The Eurocurrency Market

- •Discussion

- •In order to get prepared for participation in the class discussion of the questions, write several short paragraphs about:

- •Reading practice

- •Unit 12. Financial management a. Text finance function

- •B. Text financial ratios

- •C. Dialogue ratio analysis

- •Vocabulary list

- •Exercises

- •Discussion

- •A) Corporate Governance

- •B) Investment Management

- •A) Investment Decision Making

- •B) Investment Project Appraisal

- •In order to get prepared for participation in the class discussion of these questions, write a short paragraph on the following:

- •Reading practice

- •Unit 13. Accounting a. Text accounting principles and concepts

- •B. Dialogue accountancy in a free-market economy

- •C. Dialogue public and private accountants

- •Vocabulary list

- •Exercises

- •Discussion

- •In order to get prepared for participation in the class discussion of the questions, write a short paragraph, explaining:

- •Reading practice

- •Balance Sheet

- •A. Balance sheet

- •Unit 14. Auditing a. Text performing an audit

- •B. Dialogue auditing in russia

- •Vocabulary list

- •Exercises

- •Ex. 4. Say in a few words what the main text is about. Use the opening phrases from

- •Sweden.

- •Independent Auditors' Report to the Board of Directors and Stockholders of_______Company

- •Discussion

- •In order to get prepared for participation in the class discussion of the questions, write several paragraphs on the following:

- •Reading practice

- •Banking correspondence

- •Dictionary of key words

- •Contents

In order to get prepared for participation in the class discussion of the above questions, write a short essay on the following:

a) A bond as a financial instrument.

b) Financial markets.

(Use: to classify, to divide, to create, to develop, to emerge)

c) Bond market.

(Use: global, domestic, internal, external, national, foreign, to consist of, to decompose, issuer, to domicile)

Ex. 15. Prepare a short talk on the following:

a) Future of the Russian debt market.

b) Prospects of restructuring Russia's treasury bill debt and GKOs.

c) Your opinion about the role of Russian government bonds as an instrument of monetary policy and a means to finance the budget deficit.

Ex. 16. Scan the available financial papers and summarize the attitude of foreign investors towards Russian bonds placed abroad.

Reading practice

Ex. 17. a) Look through the text below to say what types of securities are described in it.

b) Reread the text more carefully and explain how the US government uses debt instruments.

US Government Securities

The US government relies heavily on debt financing. Since the 1960s, revenues have seldom covered expenses, and the differences have been financed primarily by issuing debt instruments. Moreover, new debt must be issued in order to get the necessary funds to pay off old debt that comes due.

About two-thirds of the public debt is marketable, meaning that it is represented by securities that can be sold at any time by the original purchaser through government security dealers.

Marketable issues include Treasury bills, notes, and bonds.

US Treasury Bonds have maturities greater than ten years at the time .of issuance, with denominations ranging from $1,000 upward. Some Treasury bond issues have call provisions under which the Treasury has the right to force the investor to sell the bonds back to the government at par value.

US Savings Bonds are nonmarketable securities, offered only to individuals and selected organizations. There is a limit to the amount that may be purchased by any person in a single year. Two types are available: pure discount bonds and bonds that pay interest semiannually but can be redeemed for par value at any time.

To support credit for home purchase, the government has authorized the issuance of participation certificates. The most important certificates of this type are those issued by the Government National Mortgage Association (GNMA or "Ginnie Mae"), they are known as GNMA Modified Pass-Through Securities. Unlike most bonds, GNMA pass-through securities pay investors on a monthly basis an amount of money that represents both a pro rata return of principal and interest on the underlying mortgages.

US Corporate bonds. Corporate bonds are similar to other kinds of fixed-income securities. An issue of bonds is generally covered by an indenture, in which the issuing corporation promises a specified trustee that it will comply with a number of stated provisions, like the timely payment of required coupons and principal on the issue. The major types are as follows:

Mortgage bonds are debt that is secured by the pledge of specific property. In the event of default, the bondholders are entitled to obtain the property in question.

Collateral trust bonds are debt-backed by other securities that are usually held by the trustee.

Debentures are general obligations of the issuing corporation representing unsecured debt. A bond indenture will often require the issuing corporation to make annual payments into a sinking fund.

Words you may need:

treasury bond долгосрочные казначейские обязательства (облигации)

call provision условие займа, предусматривающее право эмитента досрочно выкупить ценные бумаги

par value паритет, номинал

participation certificate сертификат участия

Government National Mortgage Association (GNMA) Правительственная национальная ипотечная ассоциация

pass-through security ценная бумага, выпущенная на базе пула ипотек

pro rata adj, adv пропорциональный, пропорционально

fixed-income security ценная бумага с фиксированным доходом

indenture n письменное соглашение об эмиссии облигаций

trustee n доверенное лицо, опекун

mortgage bond облигация, обеспеченная закладной под недвижимость

pledge n залог

collateral trust bond облигация, обеспеченная другими ценными бумагами, хранящимися на условиях траста

unsecured debt необеспеченный долг

sinking fund выкупной фонд, фонд погашения задолженности

Ух. 18. a) Read the text below quickly to find the developments in the US bond market that occurred in the early 90s.

b) Reread the text more carefully to describe the changes in the Yankee offerings and the interests of US investors.

Borrowers Pile Up the Yankees

During the past six years, according to the Federal Reserve, foreign non-financial borrowers placed $170 billion of public and private bonds in the US – nearly four times the volume issued during all of the 1980s and taking the total amount outstanding to $264 billion last September.

Until recently, only the most creditworthy foreign names were able to tap the US bond market, the largest pool of capital in the world. Yankee offerings were mainly limited to Canadian provinces, supranationals such as the World Bank and triple-A-rated governments and corporations. But as long-term US rates have fallen, and some barriers to entry were removed, many more borrowers have entered the market. By some estimates, single-A and lesser credits accounted for 60% of last year's issues (of which 80% were for 10 years or longer).

The introduction of Rule 144a in April 1990 really opened the door, allowing issuers to offer bonds to large US institutional investors without registering the offering with the Securities and Exchange Commission (SEC). This exemption greatly reduces the time, expense and disclosure required, while extending the benefits of underwriting and secondary-market trading to these placements.

The adoption of Rule 144a also helped increase awareness among foreign issuers of the US bond market's unique attractions. "Many can tap 20-, 30- and even 100-year maturities at costs not achievable anywhere else in the world".

On the demand side, US investors are becoming increasingly receptive to foreign names. In a recent survey of the 400 most active US institutional investors, JP Morgan found that foreign bonds now account for between 9% and 10% of the average portfolio, compared with 4% to 5% just three years ago. One reason for this interest is a relative decline in the volume of domestic bond issues, especially by US industrials. In these circumstances investors are looking for new ways to diversify their credit exposure and they have looked overseas.

But the most powerful force behind increased demand has been an attempt by US fund managers to boost returns in hopes of outperforming the benchmark indices.

Why Yankees? Since they don't come to the market often, their yield spreads may not be priced efficiently; it is not uncommon to see a 50 bp difference in spreads between apparently similar issues. Sophisticated managers are looking for "inefficiencies which the market will eventually recognize", resulting in higher bond prices.

Not surprisingly, these investors are focusing on Asia, expect more Yankee issues from Indonesia, India, Thailand and the Middle East.

Words you may need:

pile up v накапливать

creditworthy adj кредитоспособный, платежеспособный

to tap the market выпускать ценные бумаги на рынок, использовать ресурсы финансового рынка

triple-A-rated имеющий рейтинг ААА (высший кредитный рейтинг по системе Стэндард Энд Пур)

single-A credit кредит, имеющий рейтинг А (низкий рейтинг)

Rule 144а правило 144а (правило Нью-йоркской фондовой биржи)

disclosure n представление компанией информации о своей деятельности

awareness n (зд.) осведомленность

receptive adj восприимчивый

exposure n риск потенциальных убытков

benchmark index отправной индекс, базовый индекс

spread n спред

bp (basis points) базовые пункты

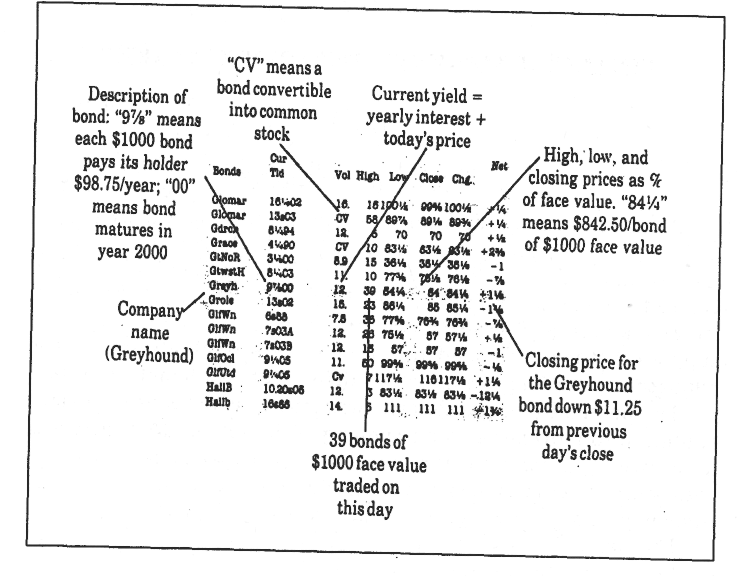

Ex. 19. Study the financial section from a newspaper, which includes information about the bond prices of different companies, and explain how to read bond quotations: